If an angle is 28 degree less than its complement, find its measure

Question

Can you show any other fraction between 0 And 1. Write five more fraction and show and depict from them

The diagrams show the plans for a sun room. It will be built onto the wall of a house. The four walls of

the sunroom are square clear glass panels. The roof is made using

• Four clear glass panels, trapezium in shape, all the same size

• One tinted glass panel, half a regular octagon in shape

A

B

Not to scale

A B

Y

C D

J H

G E

F

A

B

P R S

1 cm

Q

Top view

Front view

O X

I

Scale 1 cm = 1 m

(i) Refer to Top View

Find the mid-point of the segment joining the points J (6, 17) and I (9, 16).

(a) 33 15 , 2 2 (b) 3 1,

2 2 (c) 15 33 , 2 2 (d) 1 3,

2 2

(ii) Refer to Top View

The distance of the point P from the y-axis is

(a) 4 (b) 15 (c) 19 (d) 25

(iii) Refer to Front View

The distance between the points A and S is

(a) 4 (b) 8 (c) 16 (d) 20

(iv) Refer to Front View

Find the co-ordinates of the point which divides the line segment joining the points A and B in the ratio

1:3 internally.

(a) (8.5, 2.0) (b) (2.0, 9.5) (c) (3.0, 7.5) (d) (2.0, 8.5)

(v) Refer to Front View

If a point (x, y) is equidistant from the Q(9, 8) and S(17, 8), then

(a) x y = 13 (b) x – 13 = 0 (c) y – 13 = 0 (d) x – y = 13

18. Case Study Based- 2

SCALE FACTOR AND SIMILARITY

SCALE FACTOR

A scale drawing of an object is the same shape as the object but a different size.

The scale of a drawing is a comparison of the length used on a drawing to the length it represent

the sunroom are square clear glass panels. The roof is made using

• Four clear glass panels, trapezium in shape, all the same size

• One tinted glass panel, half a regular octagon in shape

A

B

Not to scale

A B

Y

C D

J H

G E

F

A

B

P R S

1 cm

Q

Top view

Front view

O X

I

Scale 1 cm = 1 m

(i) Refer to Top View

Find the mid-point of the segment joining the points J (6, 17) and I (9, 16).

(a) 33 15 , 2 2 (b) 3 1,

2 2 (c) 15 33 , 2 2 (d) 1 3,

2 2

(ii) Refer to Top View

The distance of the point P from the y-axis is

(a) 4 (b) 15 (c) 19 (d) 25

(iii) Refer to Front View

The distance between the points A and S is

(a) 4 (b) 8 (c) 16 (d) 20

(iv) Refer to Front View

Find the co-ordinates of the point which divides the line segment joining the points A and B in the ratio

1:3 internally.

(a) (8.5, 2.0) (b) (2.0, 9.5) (c) (3.0, 7.5) (d) (2.0, 8.5)

(v) Refer to Front View

If a point (x, y) is equidistant from the Q(9, 8) and S(17, 8), then

(a) x y = 13 (b) x – 13 = 0 (c) y – 13 = 0 (d) x – y = 13

18. Case Study Based- 2

SCALE FACTOR AND SIMILARITY

SCALE FACTOR

A scale drawing of an object is the same shape as the object but a different size.

The scale of a drawing is a comparison of the length used on a drawing to the length it represent

The curved surface area of a right circular cylinder of height 14cm is 88cm square find diameter of the base of the cylinder

From numbers 4,-2,2,0,3 find the zeroes of the polynomials p(x) =xpower 2 -2x

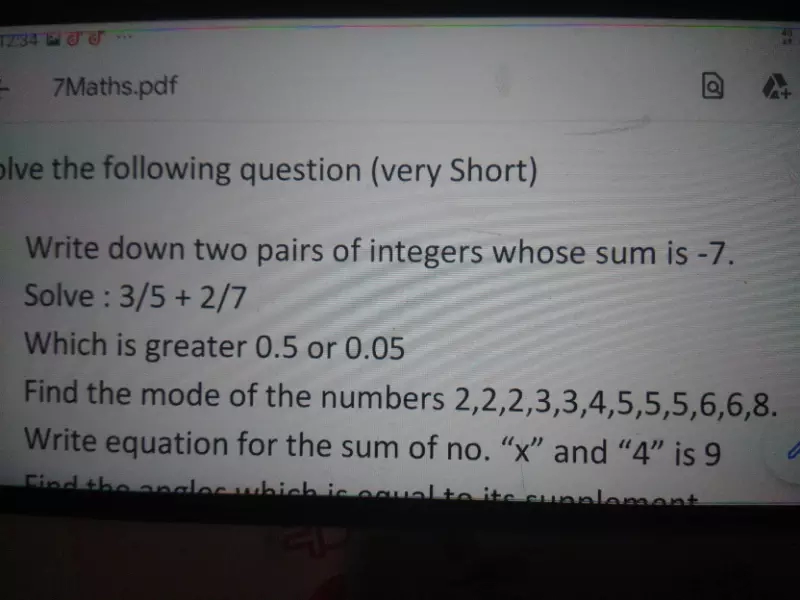

Solve the following pairs of equation by substitution method

7x - 15y = 2

x 2y = 3

7x - 15y = 2

x 2y = 3

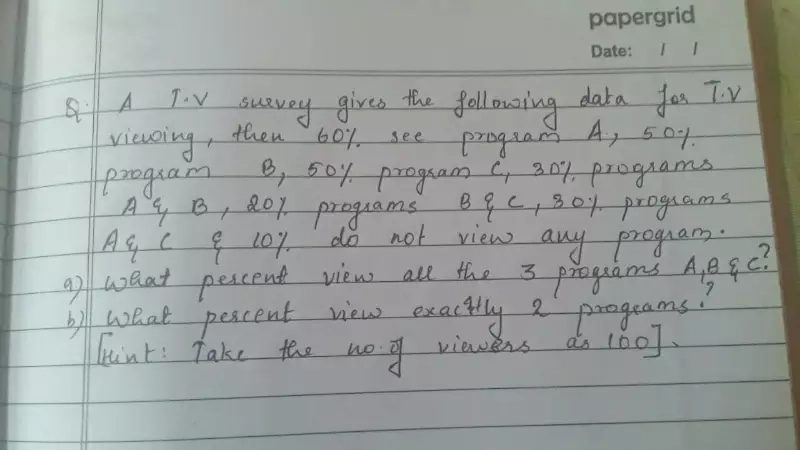

A tv survey gives the following data for tv viewing, then 60% see program A, 50% see program B, 50% sees program C. 30% people see program A and B, 20% see program B and C, 30% see program A and B and 10% do not view any program.

1) what percentage view all the 3 programs A, B and C?

1) what percentage view exactly 2 programs

1) what percentage view all the 3 programs A, B and C?

1) what percentage view exactly 2 programs

Accounts Tax GST

Nov. 26, 2020, 10:46 a.m.

Answer

Nov. 26, 2020, 10:46 a.m.

Answer

Reema a consultant, during the financial year 2015-16 earned Rs8,00,000 out of which received only Rs7,20,000. He incurred an expense of Rs2,20,000 out of which Rs50,000 are outstanding. He also received consultancy fee relating to the previous year Rs45,000 , paid Rs25,000 expenses of last year and received Rs35,000 as fee for the next year. You are required to calculate her income for the year 2015-16 if (i) she follows cash basis of accounting (ii) she follows accrual basis of accounting.

Maths

Nov. 26, 2020, 10:42 a.m.

Answer

Nov. 26, 2020, 10:42 a.m.

Answer

If triangel ABC =FED Under the corrOspOndence ABC write all the corresponding Congruent Parts of the triangle