Question

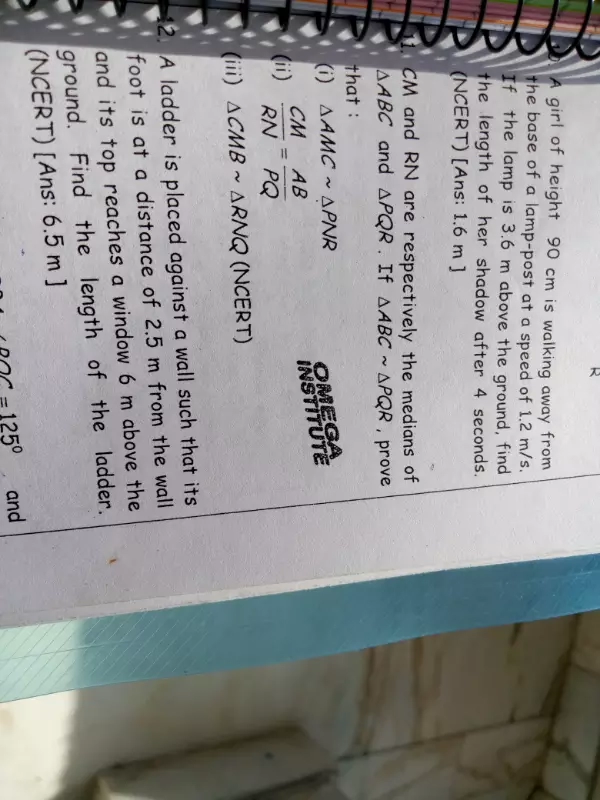

A ladder 17m long reaches a window which is 8 m above the ground on the side on the street keeping it's foot at the same point , the ladder is turned to the other side of the street to reach a roof at a height of 15 m find the width of the street

Accounts Tax GST

Dec. 27, 2017, 12:52 p.m.

Answer

Dec. 27, 2017, 12:52 p.m.

Answer

good morning

whether general insurance agent liable to charge GST on bill raised to insurance company.?

Accounts Tax GST

Dec. 27, 2017, 11:30 a.m.

Answer

Dec. 27, 2017, 11:30 a.m.

Answer

How to enter purchase entry in tally

Of vat invoice

--Regards--

PRAVIN PRAJAPAT

#7725988701

Of vat invoice

--Regards--

PRAVIN PRAJAPAT

#7725988701