Chapter -2

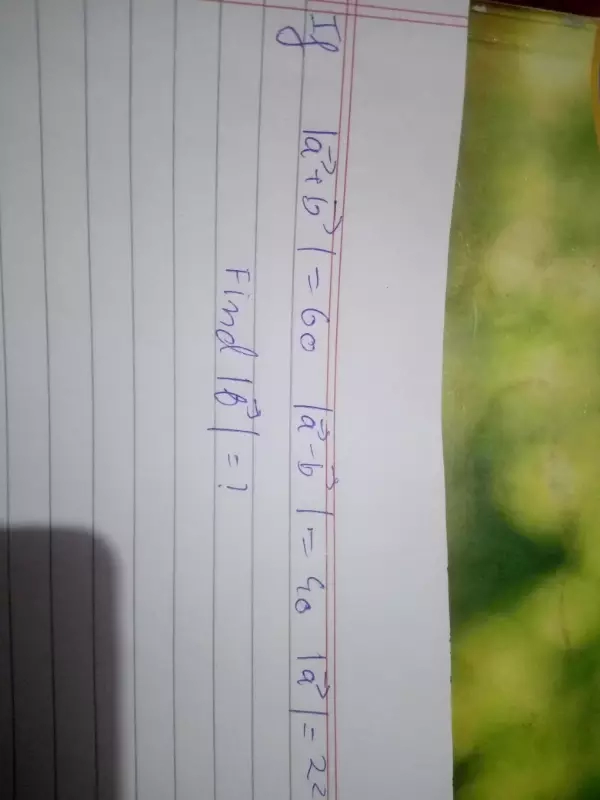

Question

Maths

Feb. 9, 2018, 9:14 p.m.

Answer

Feb. 9, 2018, 9:14 p.m.

Answer

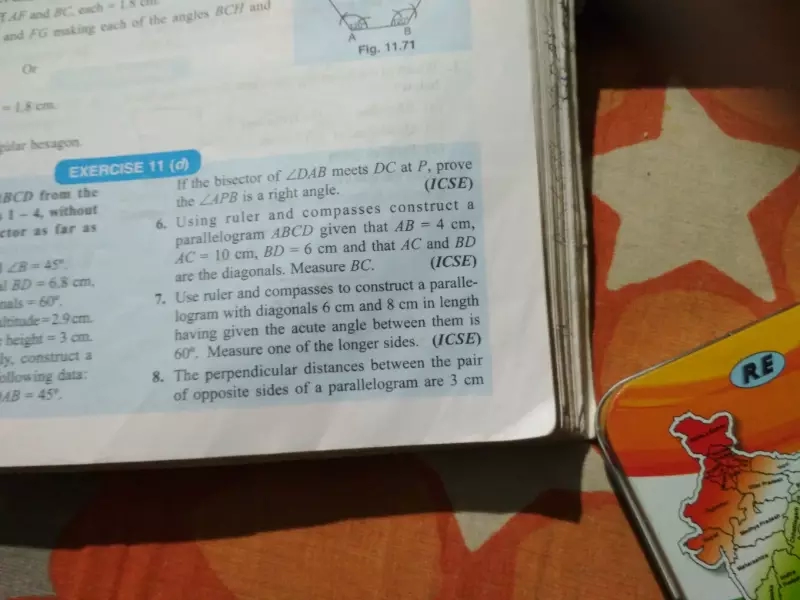

In the given figure angle100 dgree where p,q&r are points on a circle with centre O.find angle OPR.

Accounts Tax GST

Feb. 9, 2018, 5:09 p.m.

Answer

Feb. 9, 2018, 5:09 p.m.

Answer

HOW TO CALCULATE TAXABLE INCOME OF A PROPRIETOR WHO HAS OPTED COMPOSITION SCHEME UNDER GST

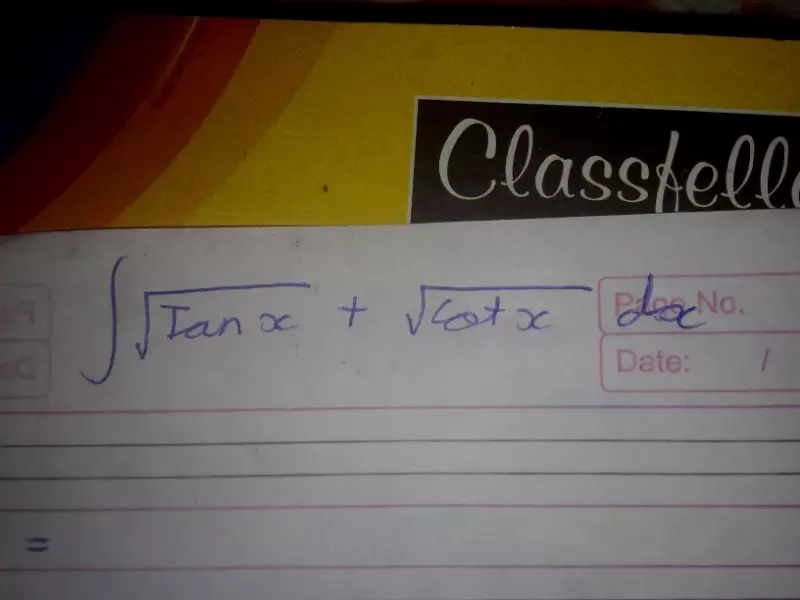

How to solve? ?

How to solve? ?

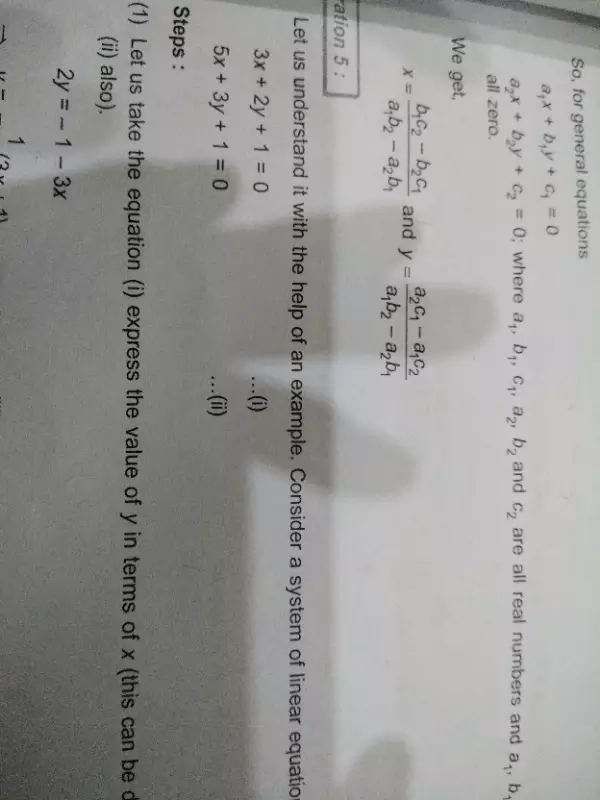

plz solve this by substitution method

plz solve this by substitution method