Please sir, tell me accrual concept.

Question

company is in the business of event management.. and also rent food stall at the place of event. what is the rate of GST for renting food stall.?

Accounts Tax GST

Nov. 27, 2017, 8:53 a.m.

Answer

Nov. 27, 2017, 8:53 a.m.

Answer

Which entries to be passed in Journal in tally?

Those entries which do not have Purchase ,Sales or Bank or Cash are Journal Entries

An electrical heater supplies heat to a system at the rate of 100 watt. If the system performs work at the rate of 75 joules per second. At what rate is the internal energy increasing?

In changing the state of the gas adiabatically from equilibrium state to another equilibrium state, amount of work is equal to 22.3J is done on the system. if the gas is taken from state A to state B via a process in which the net heat absorbed by the system is 9.35cal, how much is the net work done by the system in the later case?

Sir kya hum ek tally me 2 gstr3b prepair kr sakte hai spose meri company hai or ek work delhi me ho rha hai or ek work rajasthan me to kya mujhe tally bhi State wise Krna hoga gstr3b k liye

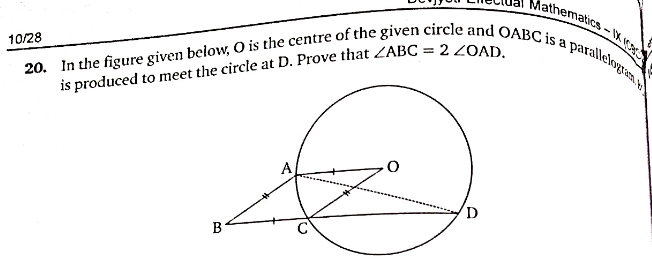

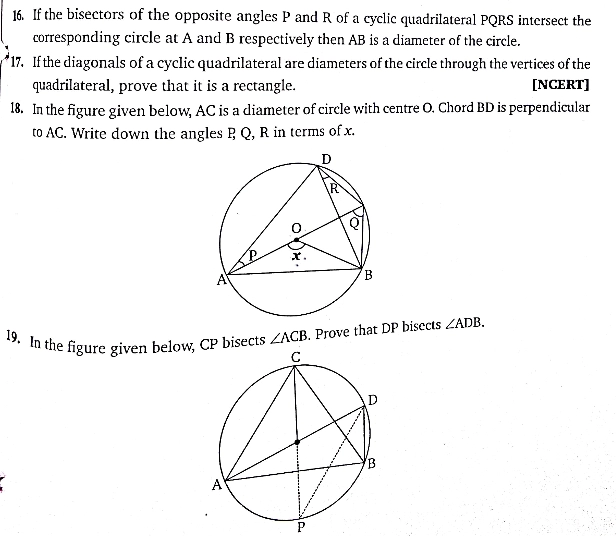

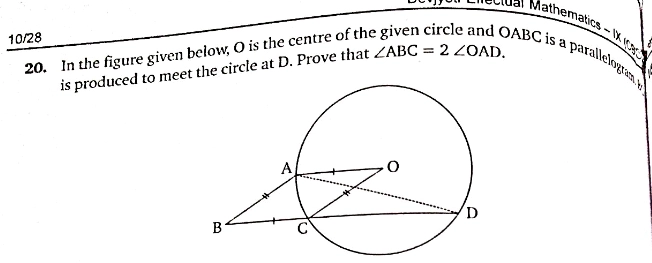

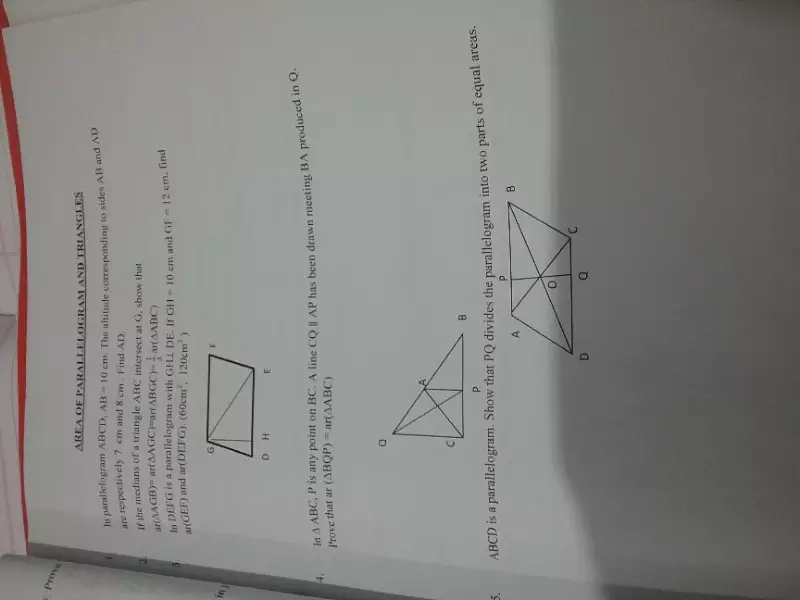

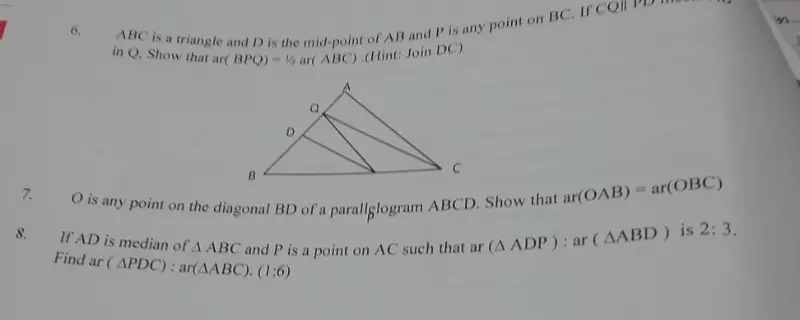

pls solve all these 8 questions

pls solve all these 8 questions