a problem is given to three students whose chances of solving it 1/3,1/5,1/6 what is probability that excatly one of them may solve it

Question

If purchase a car for above 10 lakh value including GST tcs calculations will be?

if the numbers (x-2), (4x-1) and (5x+2) are in A.P. find the value of x

A die was rolled 100 times and the number of times 6 came up was noted .If experimental probabilitycalculated from this information is 2/5 .Then how many times 6came up . Sir please help me in solving this question. 🙏🙏

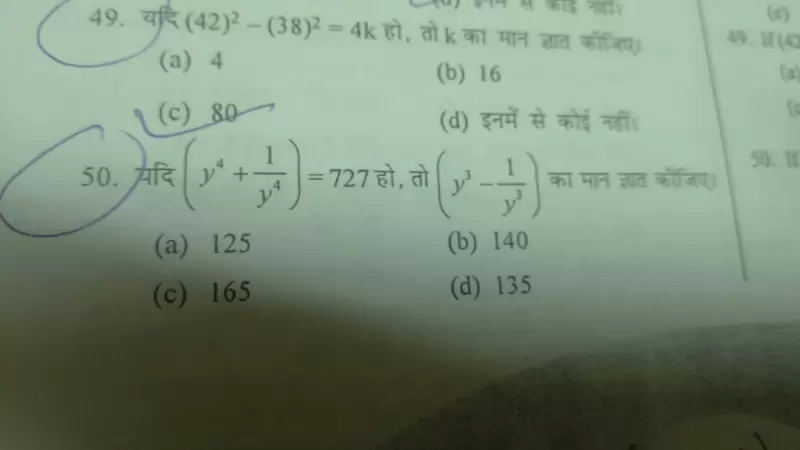

Maths

Dec. 11, 2017, 10 a.m.

Answer

Dec. 11, 2017, 10 a.m.

Answer

Sir why? we plus the curved surface area of two hemisphere to curved surface of cylindrical part. But they are subtracted why? we added.

in 13.1,9

in 13.1,9

Sir under composition scheme assesse also eligible for claiming cess. This is mejor advantage of composition scheme

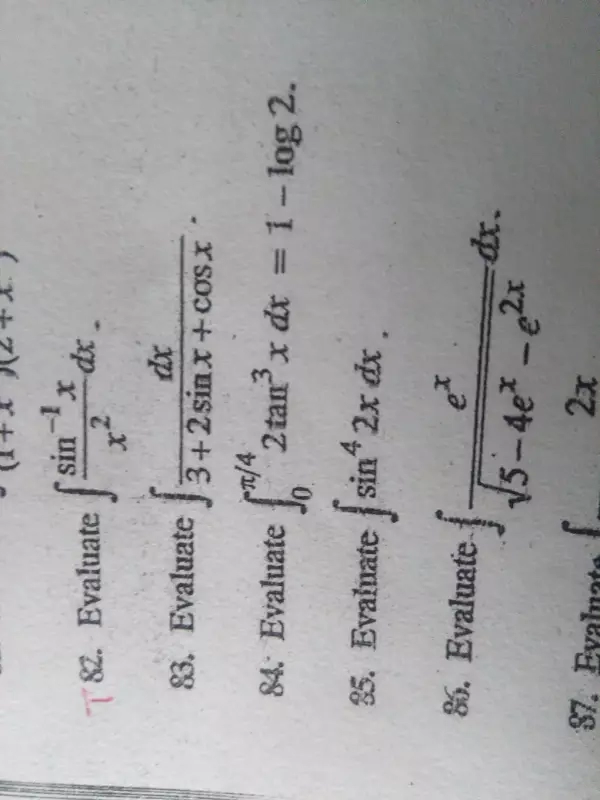

question no 84. VERY IMPORTANT.....??????? 💯

question no 84. VERY IMPORTANT.....??????? 💯