(5+root3)(5-root3)

Question

Hi danveet singh sir, idont know hindi so in your app there is explanation in english or not .i hope that you will explai. thanyou .have a nice day!

where we have to show our reverse charges tax credit in gst return form gstr-2?and in 3b form?

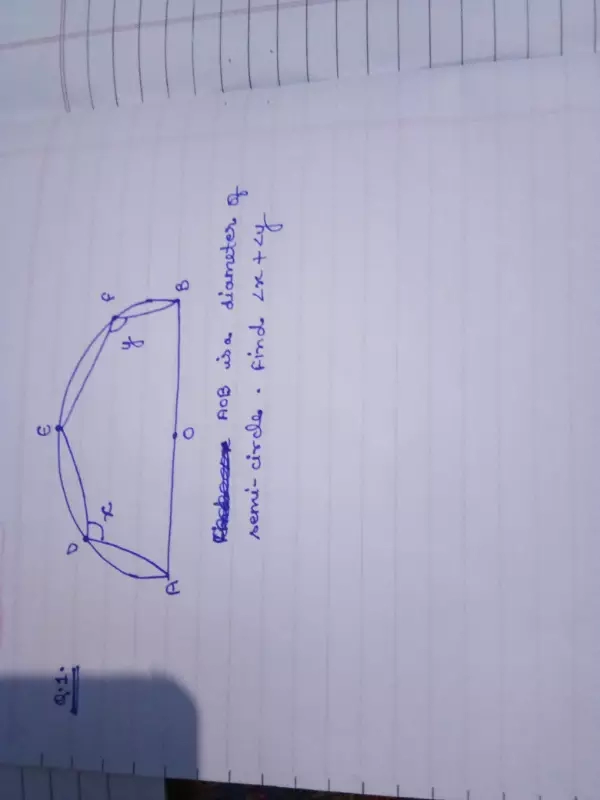

Maths

Sept. 15, 2017, 4:52 p.m.

Answer

Sept. 15, 2017, 4:52 p.m.

Answer

find the points on the x axis whose distance from the line x/3 y/3 are 4 units

Maths

Sept. 15, 2017, 3:17 p.m.

Answer

Sept. 15, 2017, 3:17 p.m.

Answer

m,n,&p,the terms of A.P.&G.P. are equal and these terms are x.y.&z.prove that x^y-z.y^z-x.z^x-y=1

what is the interest rate for late filing of vat return in karnataka

Is there any penalty in addition to interest for late filing?

Whether vat return can be revised ?

IF I SALE IN OTHER STATE ON IGST AND TRANSPORT CHARGES ALSO PAID THEN HOW CAN I GET BENEFIT OF TRANSPORTATION CHARGES ?