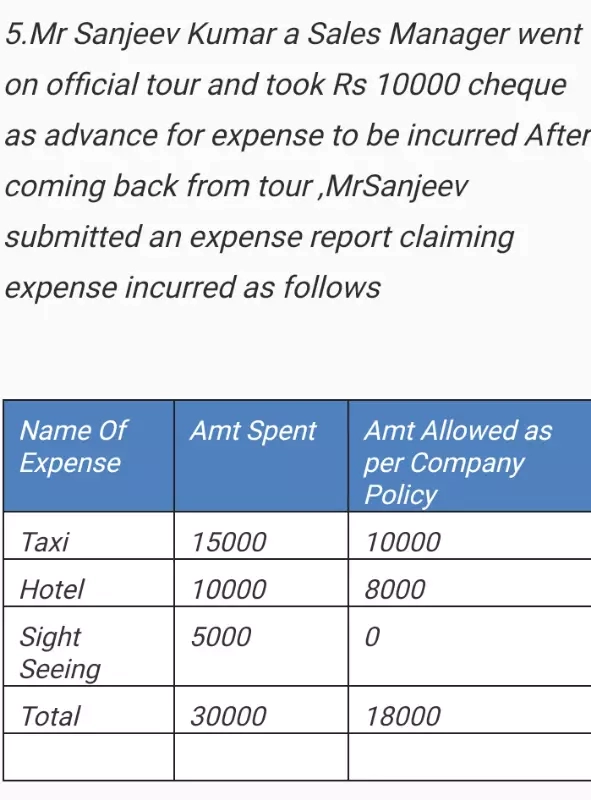

Question

A person’s 1Q is given by the formula

1Q =100

Where MA is mental age and CA is chronological age. If 80 < 1Q < 140 for a group of 12 year old children. Find range of their mental age.

In Balance sheet, workstation in office shown under which head, Office Equipments or Furniture& Fittings? suggest me for proper treatment of assets.

(k 1)xsquare-2(k-1)x 1=o

Determine the value of k by quadratic formula in it has two equal real roots

Determine the value of k by quadratic formula in it has two equal real roots

If my client is not deducting my tds properly so I'm receiving extra money more than the money what i should get now how can I pass the entries in tally

Accounts Tax GST

April 24, 2017, 2:57 p.m.

Answer

April 24, 2017, 2:57 p.m.

Answer

I could not understand the 2nd and 3rd journal Entries. Please Help

I could not understand the 2nd and 3rd journal Entries. Please Help

In excel and MIS, you provide info only for excel not for MIS. Can you provide info about MIS?

Design seven mechanisms that can be used to reduce the government expenditure in developing countries like Tanzania

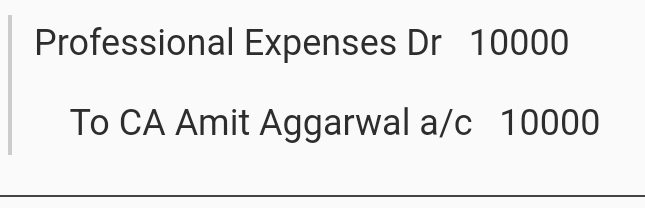

why a/c not written after Proffessuinal Expenses ?

why a/c not written after Proffessuinal Expenses ?