- .e

Question

I want to know if i complete whole course can i get job in ca firm & how much salary i can get

Dear Sir I want to know Calculation(on CTC) and Accounting Entries of PF and ESI Please tell me with illustration.

what is Bank Overdraft?

what is profit?

Difference between Finance and Accounts

Accounting standards from AS1 to till now.

Accounts Tax GST

May 25, 2017, 4:19 p.m.

Answer

May 25, 2017, 4:19 p.m.

Answer

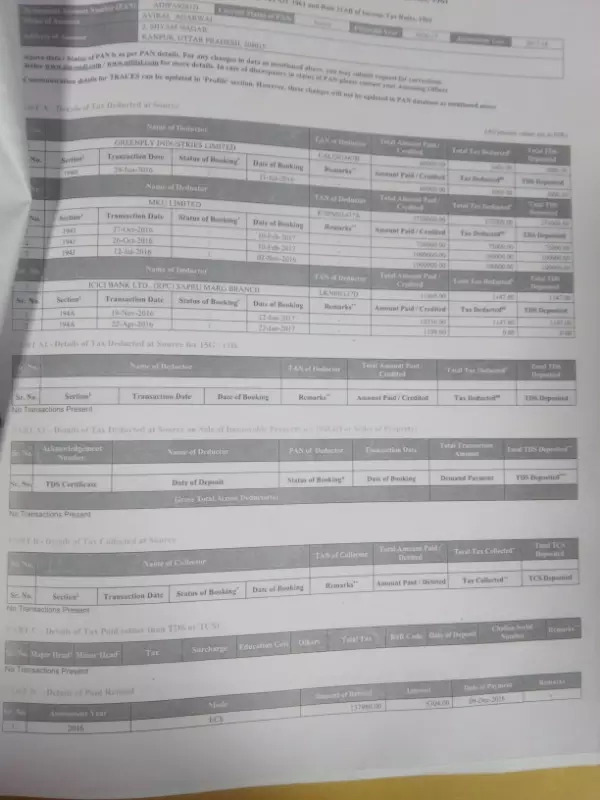

Actually sir I have summited the TDs but I have to the non company o21 but I summited the company 020. How can correct plz reply me

what will be done if debtors show credit balance and creditors show debit balance while finalisation of balance sheet

If a manger is admitted as a partner with effect from 1st April 2012. Will anything be done to the profit for the year ending 31st March 2012?

Sir ji, if we applied for TIN number but there is not any visit by inspector at business site for last one month, then in this condition,,, what should we do to get RC

A Government Servant has to deposit three months salary in lieu of three months notice, if he takes Voluntary Retirement by giving 24 hours notice. Can he deduct this amount from his income for the purpose of calculating taxable income for the year? What is the section of income tax under which he can claim this deduction?

how to enter in tally 26 as?

how to enter in tally 26 as?