Question

A man travel 370km partly bytrain and partly by car.if the cover 250km by train and test by car it take him 4hr but if he travel 130kmby train and restby car it take 18mins longer find the speed of car and that of train

Find the slope of the normal to the curve x=1_asinx ,y=bcos^2x at x= π/2

Service tax journal entry

Give a journal entry of cash received in advance

Give a journal entry of cash received in advance

Find the perimeter of sector of angle of 45 of a circle with radius 7cm

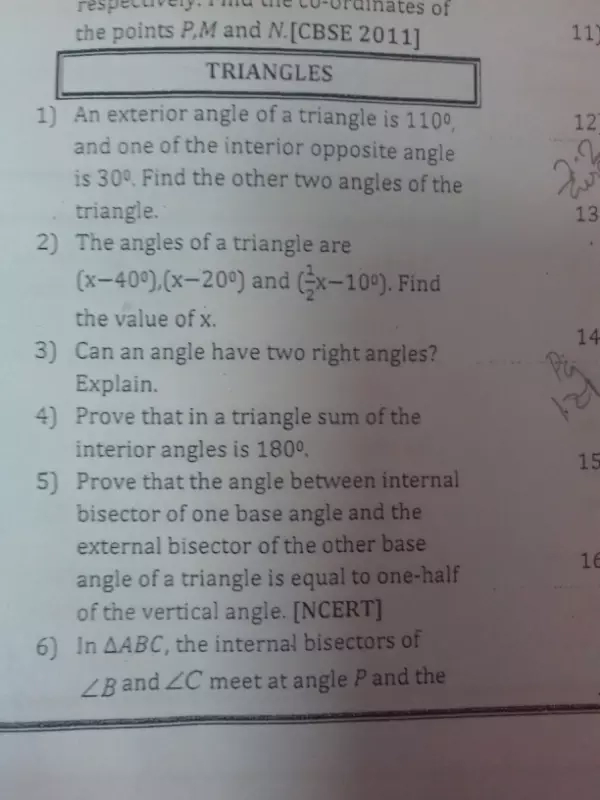

Maths

Sept. 11, 2017, 6:44 p.m.

Answer

Sept. 11, 2017, 6:44 p.m.

Answer

Sir, I Thank you for providing such a great platform of learning for students like us

I hated Mathematics before i knew that there is something called as www.teachoo.com

Thank you, very much sir now I feel that Maths is beautiful

The radius of a. spherical ballon increase from 3.5 cm to 4.2 cm as area is being pumped into it, find the ratio of surface area of the ballon in two cases

SGST & CGST Ret in 2.5% isn't accept in your bill formet in Excel, Please Help me !!!!

how to find the angel with the value if it is given to us like value is 0.75 how do we know that it angle is tan 36 degree 52 ??????????????

If cash withdrawn Rs. 10,000 by Mr. X, managing director of the company from company's bank A/c for his personal use.

Then director's loan (Mr. X) comes under which (Tally) ledger head & why??