chap 7 miscallaneous class12

Question

a flower floral design on a floor is made up of 16 tiles which are triangular the side of a triangle being 9 CM 28 cm and 35 cm find the cost of polishing the tiles 50 Paisa per centimetre square

a flower floral design on a floor is made up of 16 tiles which are triangular the side of a triangle being 9 CM 28 cm and 35 cm find the cost of polishing the tiles 50 Paisa per centimetre square

Dst diploma of gulathi institute is eligible for being GST practitioner according to rule 83

Dst examination of gulathi institute is eligible for being GST practitioner

Below 2crore anual registered person can file which GST manual return

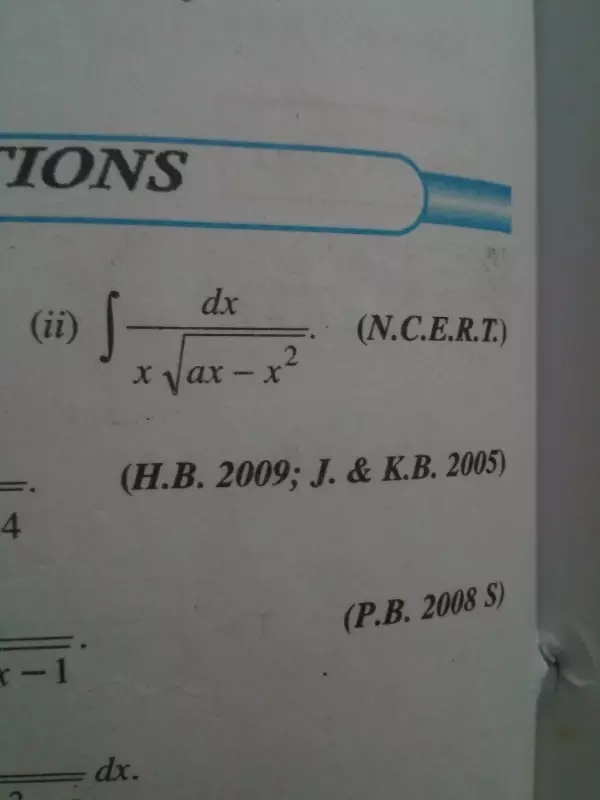

Maths

Nov. 16, 2018, 6:46 p.m.

Answer

Nov. 16, 2018, 6:46 p.m.

Answer

At what distance does a man 11/2ft in height , subtend an angle of 15 second

Verify Mean Value Theorem for the function x3-5x2-3x ,x ∈[1,3]. Find all c∈(1,3) for which f(c)=0