Question

GST RATE SLAB OF BLANKET HSN CODE 6301 BIFRICATE CGST & SGST DIFFERNCIATE

My client has changed its a trade name "abc", as xyz, and it is duly amended in Ap vat portal, but after migration in into GST PORTAL, it is still showin old name I.e."abc". What is the form to be used to do correction in trade name in GST portal ?Whom to contact ? Please tell me?

What is fee to get new gst registration for individual to open propertier bussiness? How can register?

Thanks

Thanks

Hello

I like this alp very much and this is very useful.

I found some problems in app.

Whenever i save some sums in app and try to refer that ofline after saving that, any other saved sum is open.

For Example

Whenever i save example no. 10 to 20 and try to open example no 12 ofline, then example no. 15 is opened.

Please solve this problem ASAP.

Thank you.

I like this alp very much and this is very useful.

I found some problems in app.

Whenever i save some sums in app and try to refer that ofline after saving that, any other saved sum is open.

For Example

Whenever i save example no. 10 to 20 and try to open example no 12 ofline, then example no. 15 is opened.

Please solve this problem ASAP.

Thank you.

We are living in manipur and we are purchases of goods to otherstate and sale of goods in manipur state so telling about me gst tax calculation

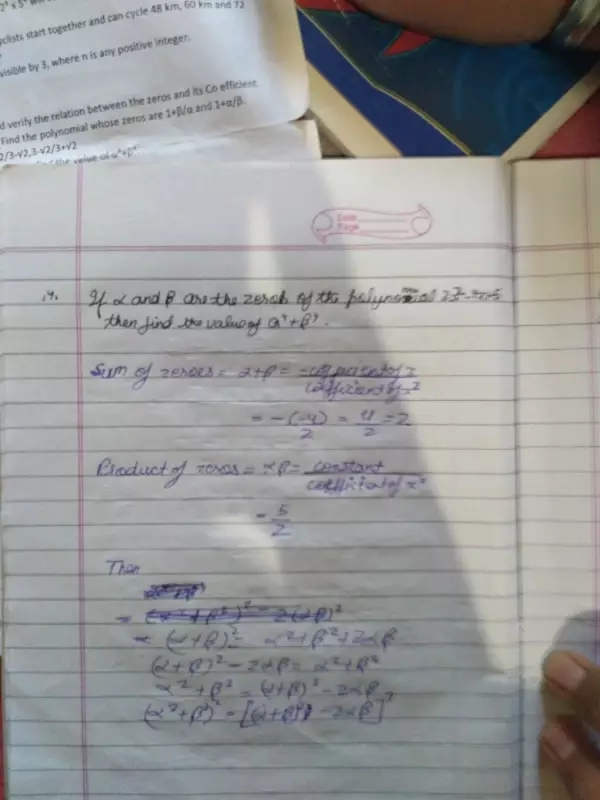

triangle abc is an equilateral triangle ad is height of the triangle bc perpendicular to ad then show that 3 absquare=4 ad square

D,E,F are the mid points of the sides of BC,CA,AB.prove that BDEF is a parallelogram whose area is half that of triangle ABC and area of triangle DEF =1/4 of area of triangle ABC

I get cotton fabrics for plastic lamination.I purchase plastic raw material at 18% GST now and return cloth after lamination.Will this be providing service or manufacture? Thanks.

I am smal worker , why should i need to register pan no. with adhar efiling