What is the meaning of major arc and minor arc

Question

Accounts Tax GST

Nov. 26, 2017, 12:45 a.m.

Answer

Nov. 26, 2017, 12:45 a.m.

Answer

Why is GST registration compulsory for taking certain government contacts.?

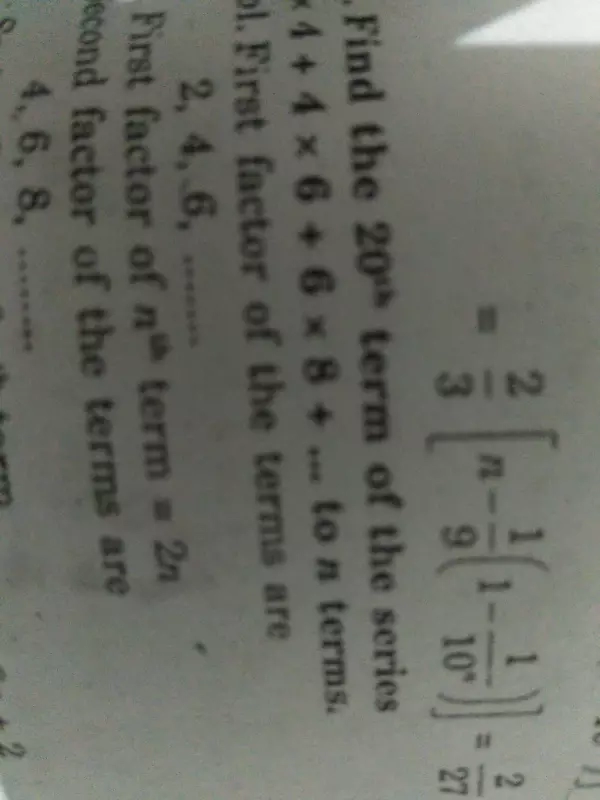

Show that the time taken to complete 75% of a first order reaction is double the half time .

Maths

Nov. 25, 2017, 9:07 p.m.

Answer

Nov. 25, 2017, 9:07 p.m.

Answer

Are the points A(3,6,9) and B(10,20,30)C(25,-41,5) the vertices of a right angled triangle.

The radii of two circles are 8cm and 6cm respectively . Find the radius of the circle having area equal to the sum of the areas of the two circles

Class 9

Nov. 25, 2017, 8 p.m.

Answer

Nov. 25, 2017, 8 p.m.

Answer

ABCD Is a rhombus and P, Q, R and S are the mid points of the sides AB, BC, CO, and DA respectively. Show that the quadrilateral PQRS is a rectangle

Maths

Nov. 25, 2017, 1:49 p.m.

Answer

Nov. 25, 2017, 1:49 p.m.

Answer

During squre root, you add 00 but you added only one decimal point in quotient why? I know tha this question is stuff but we topper sometime stuck on small problems it is a basis because we are human..

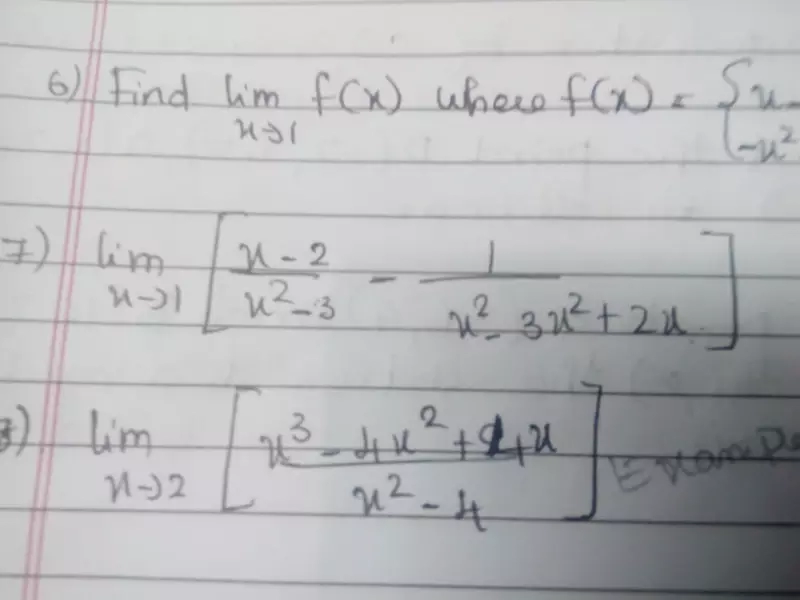

7 th question answer

7 th question answer