Question

Maths

Jan. 5, 2018, 10:47 a.m.

Answer

Jan. 5, 2018, 10:47 a.m.

Answer

The perimeter of a triangle is50cm. One side is 4cm longer than the smaller side and the third side is 6cm less than twice the smaller side. Find the area of the triangle.

Accounts Tax GST

Jan. 5, 2018, 9:26 a.m.

Answer

Jan. 5, 2018, 9:26 a.m.

Answer

Can you help me In case of tax treatment of amounts involved in keyman insurance policy:

1.In the hands of person taking the policy? &

2.In the hands of keyman?

Please explain the provisions and what is the difference between them?

1.In the hands of person taking the policy? &

2.In the hands of keyman?

Please explain the provisions and what is the difference between them?

In given in bracket I think should writte 3 non collinear point or 2 collinear

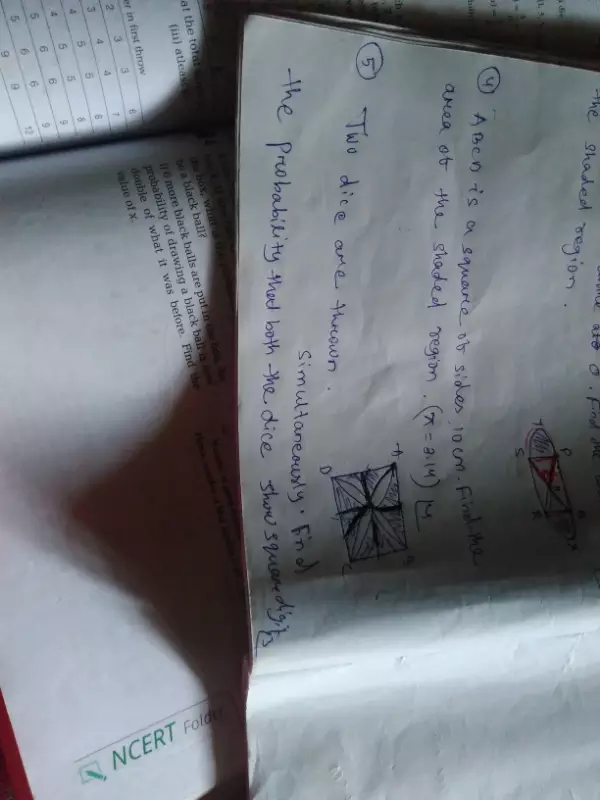

Maths

Jan. 5, 2018, 6:05 a.m.

Answer

Jan. 5, 2018, 6:05 a.m.

Answer

- Of any two chords of a circle show that the the one which is larger is nearer to the centre.

A sphere and a right circular cylinder of the same radius have equal volumes. By what percentage does the diameter of the cylinder exceeds its diameter?