Question

Maths

Sept. 3, 2020, 1:44 p.m.

Answer

Sept. 3, 2020, 1:44 p.m.

Answer

Let A={1,2,{3,4}} then an incorrect statements are

A)3belongs to A

B) {1} is power set of A

C){2} belongs to A

D) 1is subset of A

[The answer is more than one correct answer type]

A)3belongs to A

B) {1} is power set of A

C){2} belongs to A

D) 1is subset of A

[The answer is more than one correct answer type]

You idiot nonsense 😂😂😂 🤔🤔🤔 I think that you came in mental hospital

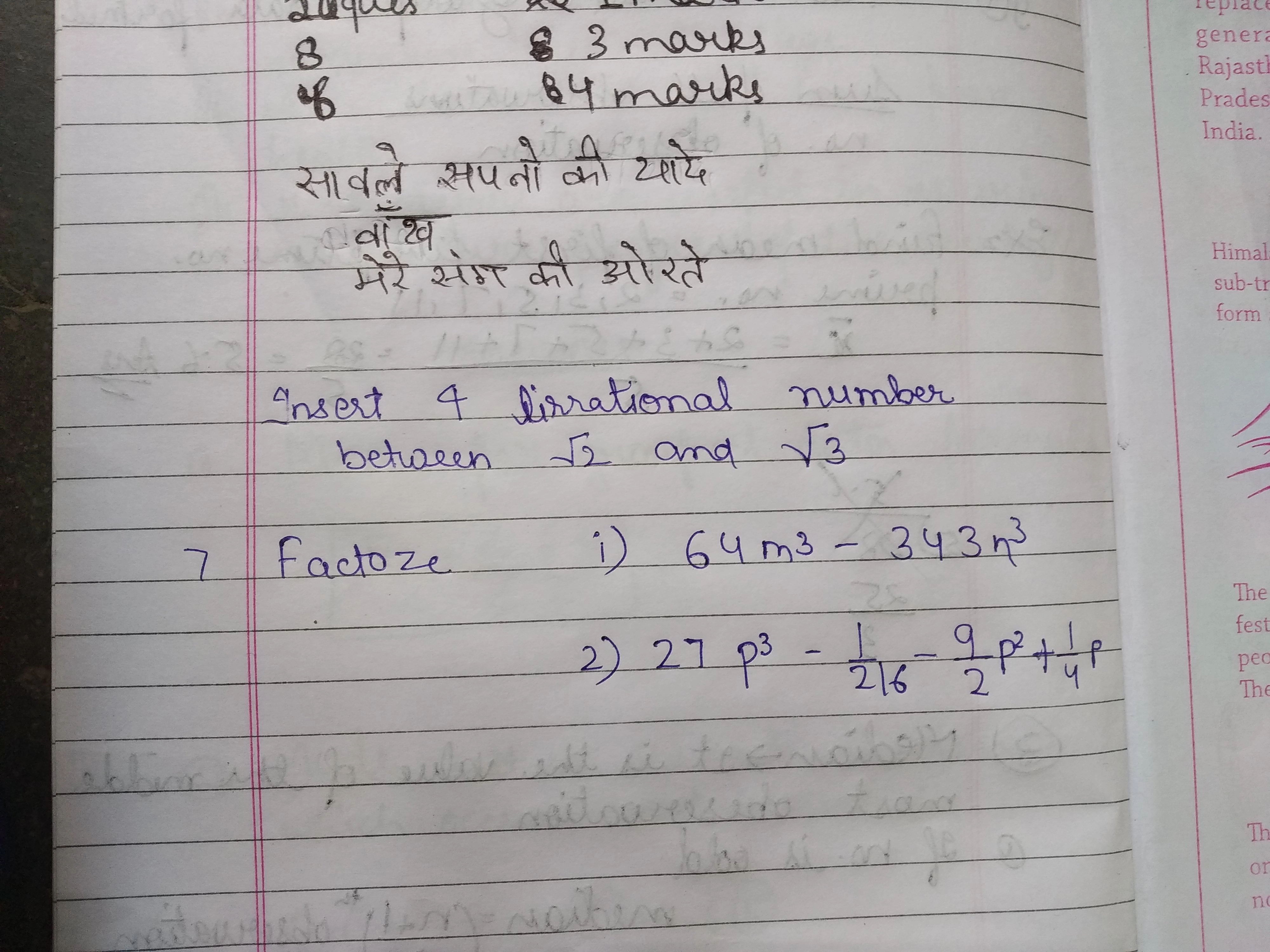

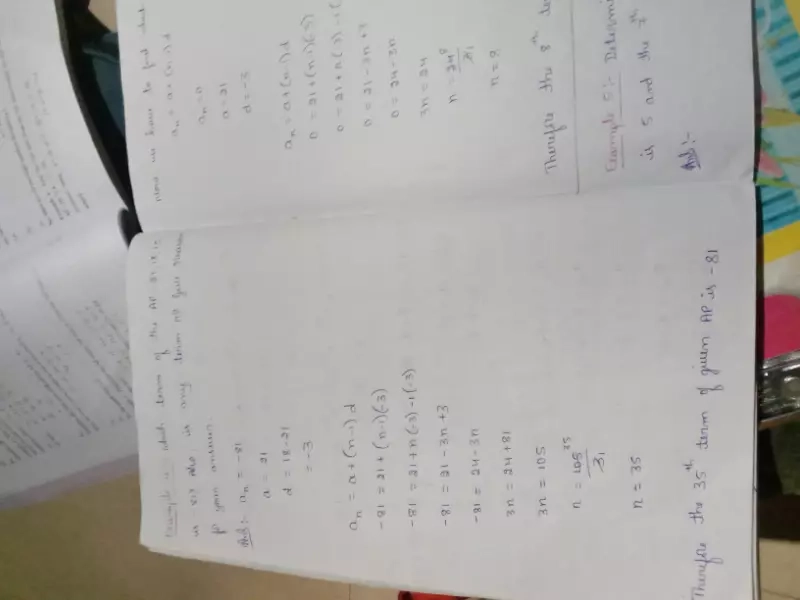

Maths

Sept. 3, 2020, 10:46 a.m.

Answer

Sept. 3, 2020, 10:46 a.m.

Answer

Find time when: principal = ₹1000; rate of interest = 8% p.a.; simple interest =₹200

At srinagar temperature was -5°c on Monday and then it dropped by 2°c on Tuesday. What was the temperature of srinagar on Tuesday? On Wednesday, it rose by 4°c. What was the temperature on this day?

Accounts Tax GST

Sept. 3, 2020, 7:55 a.m.

Answer

Sept. 3, 2020, 7:55 a.m.

Answer

videos would you telling in English? Because I'm not understanding of hindi language