Question

Find the image of the position vector i + 3j + 4k in plane r.(2i - j + k) + 3

Place of supply? Supplier carry goods from one state to another by bus or by their own vehicle?

- a manufacturer reckons that the value of a machine , which costs him rs 15625, will depreciate each year by 20percant . find the estimated value at the end of 5 years

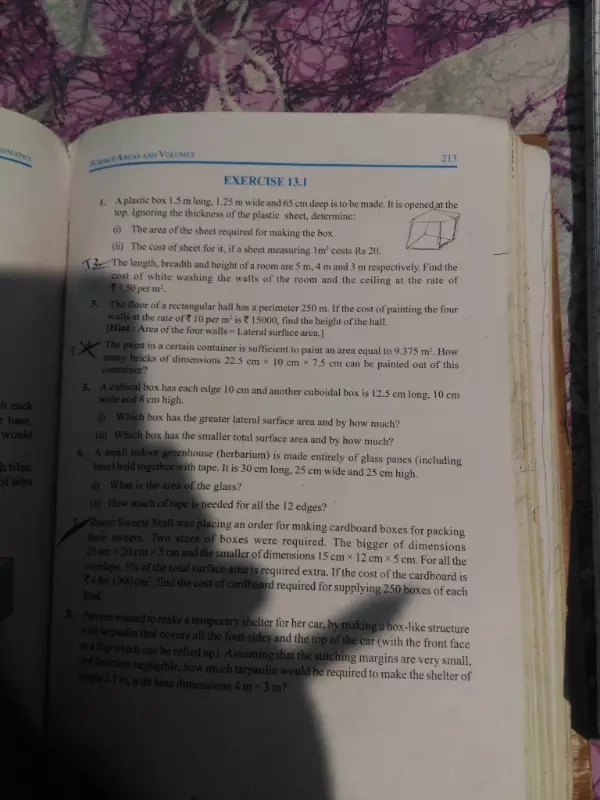

Maths

Nov. 12, 2017, 8 p.m.

Answer

Nov. 12, 2017, 8 p.m.

Answer

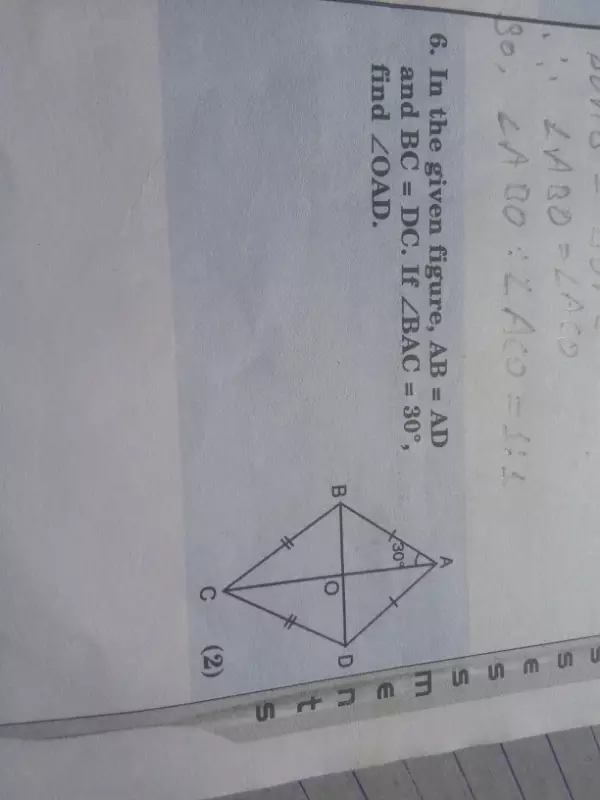

Can't we prove theorem 8.5 using theorem 8.1 that states ' diagonal of a paralleogram divides it into two congruent triangles" ?

I meant to say :

1.Draw the diagonal

2.Based on given data, prove that 2 triangles are congruent.

3.Atlast say " as the diagonal divides the given figure into two congruent triangles it is a paralleogram."

Is my method correct??

I meant to say :

1.Draw the diagonal

2.Based on given data, prove that 2 triangles are congruent.

3.Atlast say " as the diagonal divides the given figure into two congruent triangles it is a paralleogram."

Is my method correct??

How to change units in tally as it is showing as ' not applicable ' in 'units ' head?