Question

In which voucher Drawing entry will be recorded in tally.journal or payment.

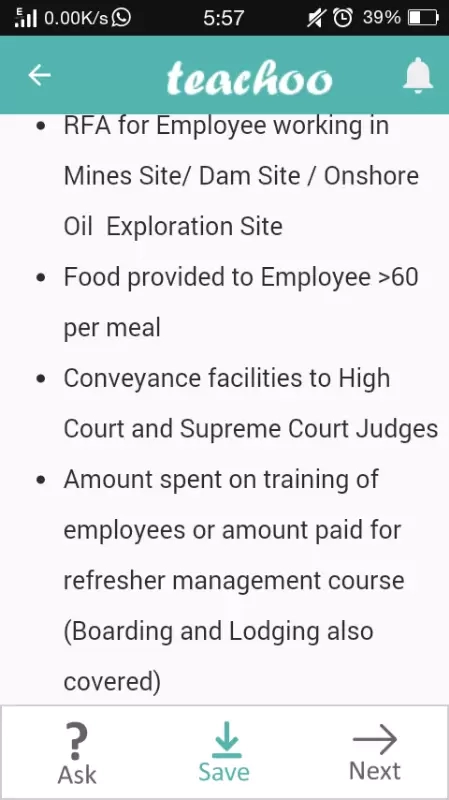

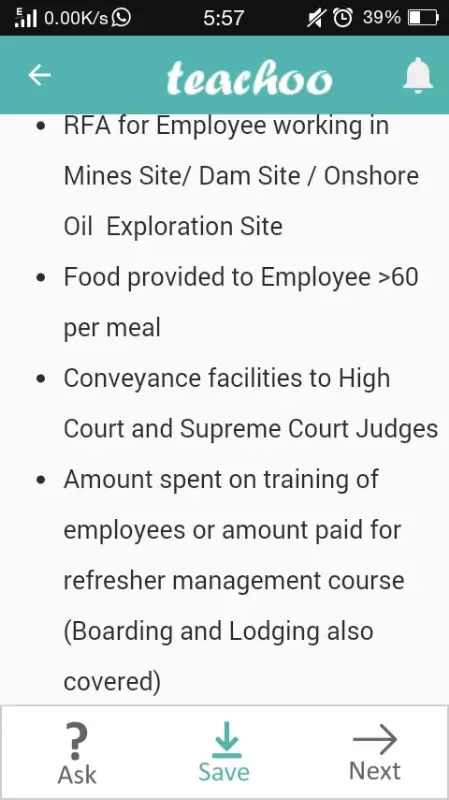

2nd point 'FOOD PROVIDED TO EMPLOYEES >60 per meal'

2nd point 'FOOD PROVIDED TO EMPLOYEES >60 per meal'

It is wrong .

It is 50 per meal

Rectify it

for traffic control a CCTV camera is fixed on a straight and vertical pole. the camera can see 113m distance straight line from the top.If the area visible by the camera around the pole is 39424 then find the height of the pole

TDS deducted @ 10% on consultancy charges paid to Mr. Ranjit Khurana of Rs. 60000 on 1.10.2016. TDS paid on 7.12.2016 along with interest. Pass entry for interest only.

Pass the entry with tds simplify both entry due and payment.

Pass the entry with tds simplify both entry due and payment.

Paid Rs. 45000 to M/S Menon associates for legal consultancy services provided to the company. Bill value was Rs. 60000 including reimbursement of expenses of Rs. 15000.

(Explain this question simplify and TDS 60000 pe charge hoga ya fir 45000 pe)

(Explain this question simplify and TDS 60000 pe charge hoga ya fir 45000 pe)

The circumference of the base of a cylindrical vessel is 132 cm and it's height is 25 cm. How many liters of water can it hold (1000cm3=1l)