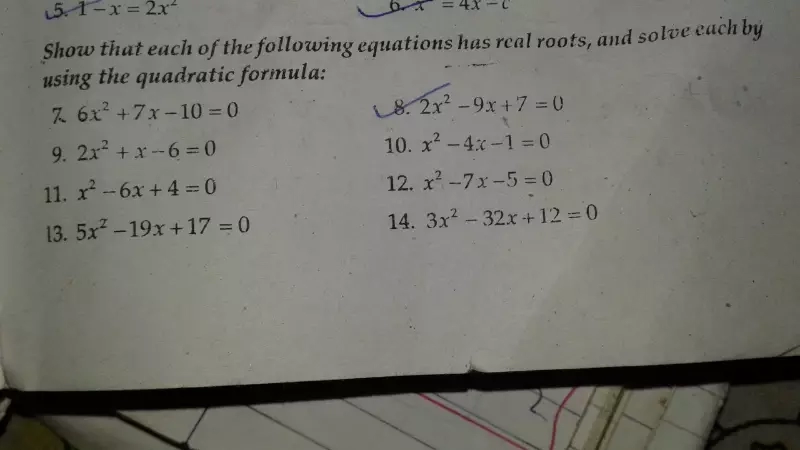

Class 8 problems

Question

Maths

Nov. 14, 2017, 6:37 a.m.

Answer

Nov. 14, 2017, 6:37 a.m.

Answer

Why there is a need of using only congruence property why not other property

Can you explain me question 4 of exercise 6.2 of Class 11 where you have said that 8 is greater or equal to 0.

Class 9

Nov. 13, 2017, 8:33 p.m.

Answer

Nov. 13, 2017, 8:33 p.m.

Answer

ABCD is parallelogram and P is a point on BC

Prove: ar(tringle ABP)+ar(tringle DPC)=ar(tringle APD)