e-return of esic , pf, tds, gst, roc & I.Tax

Question

The edge of cube is 20 cm how many small cubes of 5 cm edge can be formed from this cube

Accounts Tax GST

Jan. 10, 2018, 12:33 p.m.

Answer

Jan. 10, 2018, 12:33 p.m.

Answer

In delivery note when we pass a sales entry. Tab ham central or sales tax lagate hai to us me kitna percent lagana h ki vo entry ho jaye..

A thief after committing a theft runs at a uniform speed of 50m-min.After 2min a policeman runs to catch him.He goes 60 min in first min and increses his speed by 5m-min every succeeding min.After how many min the policeman will catch the thief

Getting started

Getting started

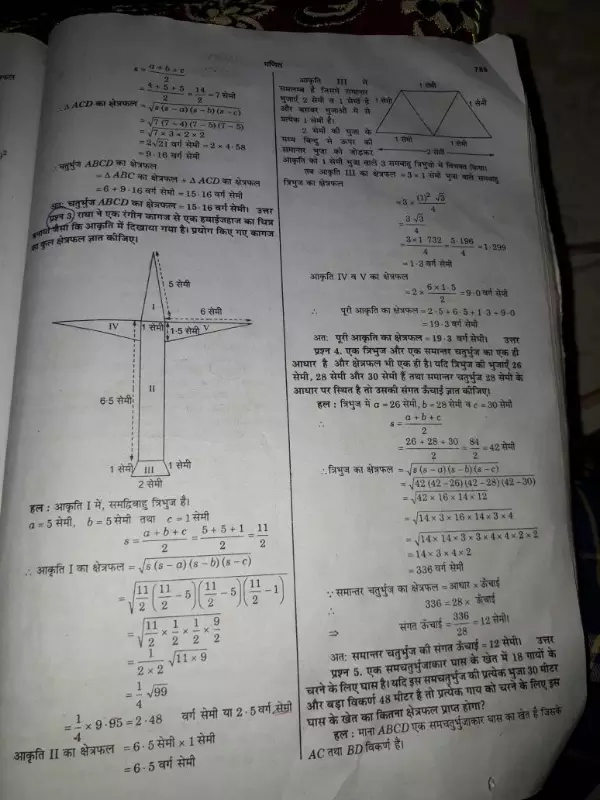

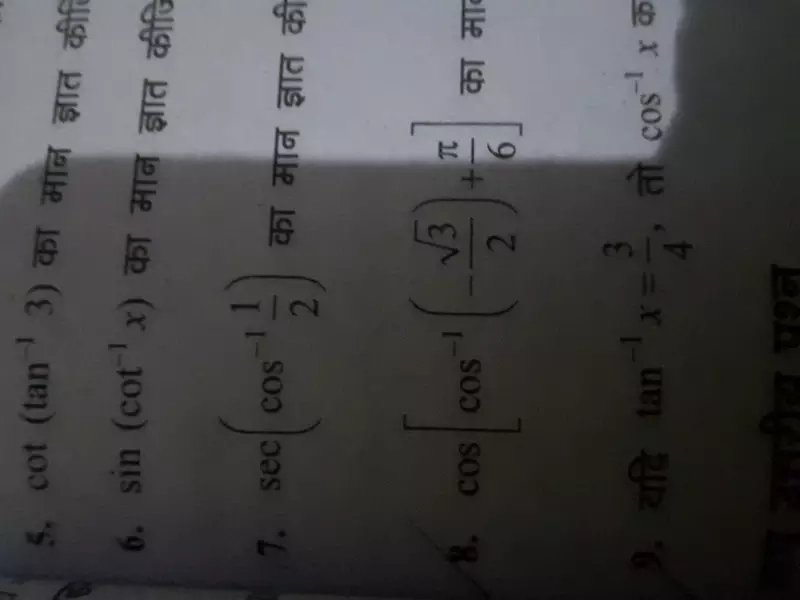

Maths

Jan. 10, 2018, 8:27 a.m.

Answer

Jan. 10, 2018, 8:27 a.m.

Answer

If in a room every person shakes hands with every other person and total shaken hands are 66 then find the number of persons in the room?

Two cubic defined as fx=x³ (a-3)x 2b,gx=3x³ x² 5ax 4b where a and b are constant. Find the value of a and b if both function have common factor x-2