Latest economics question paper pattern for cbse class 12

Question

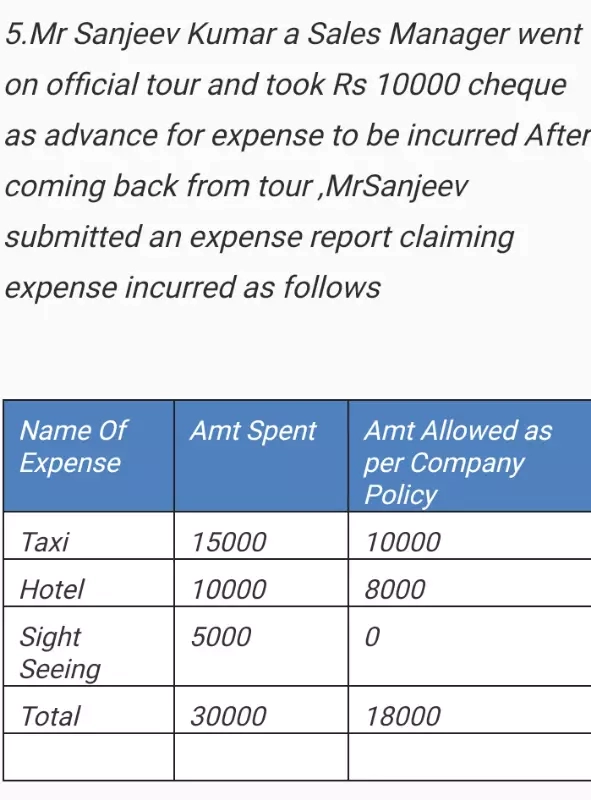

If my client is not deducting my tds properly so I'm receiving extra money more than the money what i should get now how can I pass the entries in tally

Accounts Tax GST

April 24, 2017, 2:57 p.m.

Answer

April 24, 2017, 2:57 p.m.

Answer

I could not understand the 2nd and 3rd journal Entries. Please Help

I could not understand the 2nd and 3rd journal Entries. Please Help

In excel and MIS, you provide info only for excel not for MIS. Can you provide info about MIS?

Design seven mechanisms that can be used to reduce the government expenditure in developing countries like Tanzania

prove that in an isosceles right triangle the median drawn to the hypotenuse is half the hypotenuse

prove that in an isosceles right triangle the median drawn to the hypotenuse is half the hypotenuse

Accounts Tax GST

April 21, 2017, 10:05 p.m.

Answer

April 21, 2017, 10:05 p.m.

Answer

Write a 2 by 2 matrix which is both symmetric and skew symmetric ?

three layer concrete cylindrical structure was build in a school for erecting the flag post the ground layer is of diameter 154 cm and height 25 cm, the middle layer is of diameter 98 cm and height 25 cm and the top layer is of diameter 42 cm and height 25 cm find the total surface area of whole structure

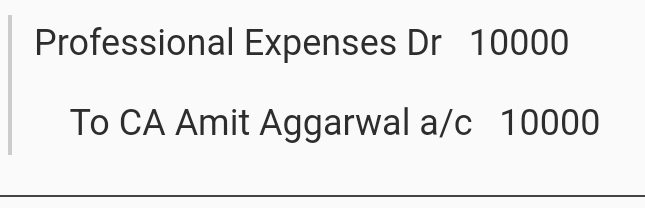

why a/c not written after Proffessuinal Expenses ?

why a/c not written after Proffessuinal Expenses ?