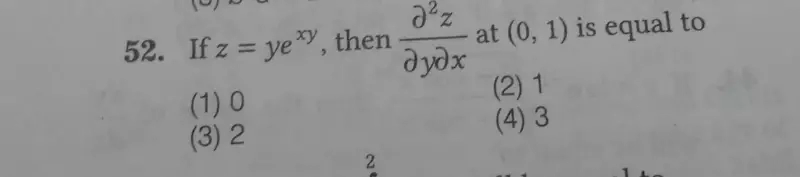

Question

Maths

Jan. 23, 2018, 12:34 p.m.

Answer

Jan. 23, 2018, 12:34 p.m.

Answer

Explain Theorem 11(the sum of either pair of opposite angles of a cyclic quadrilateral is 180)

Maths

Jan. 23, 2018, 12:19 p.m.

Answer

Jan. 23, 2018, 12:19 p.m.

Answer

find the area of the triangle whose vertices are (2,-2) , (4,3) , (1,2) using integration

Maths

Jan. 23, 2018, 12:17 p.m.

Answer

Jan. 23, 2018, 12:17 p.m.

Answer

prove that in two concetric circle chord of outer circle touches smaller circle always are equal

Pl. also provide me access to CBSE X Science and English lessons and exam papers

Sir. We will take "advances", how to pass the entry? And which under group take to "advances"?

Plz Answer me.

Plz Answer me.

Accounts Tax GST

Jan. 23, 2018, 11:11 a.m.

Answer

Jan. 23, 2018, 11:11 a.m.

Answer

We had received Input of Service Tax & some of amount has been utilised in excise duty return. Also we had filed service tax return half yearly & we have some credit in Service tax after return & same will be utilised in GST return.

Pls advice the accounting treatment for this.

Maths

Jan. 23, 2018, 11:09 a.m.

Answer

Jan. 23, 2018, 11:09 a.m.

Answer

Sir we throw a die twice than we should have 12 total outcomes why 36

Find the radius of the circle in which a central angle is 60° intersects on arc of length 37.4 cm.

Maths

Jan. 23, 2018, 8:11 a.m.

Answer

Jan. 23, 2018, 8:11 a.m.

Answer

A hemishpercal bowl is made of steel 0.25 cm thick. The inner radius of the bowl is 5 cm . Find the outer curved surface area of bowl