Question

Sir if I want to learn accounts , taxation , bal sheet finalisation, mis reporting then shall I need to take tally and Excel separate or automatic it will cover in above topics.

Sir if I want to learn accounts , taxation , bal sheet finalisation, mis reporting then shall I need to take tally and Excel separate or automatic it will cover in above topics.

Find the differential equations of family of parabolas having vertex at y-axis and axis of parabola is parallel to the x-axis

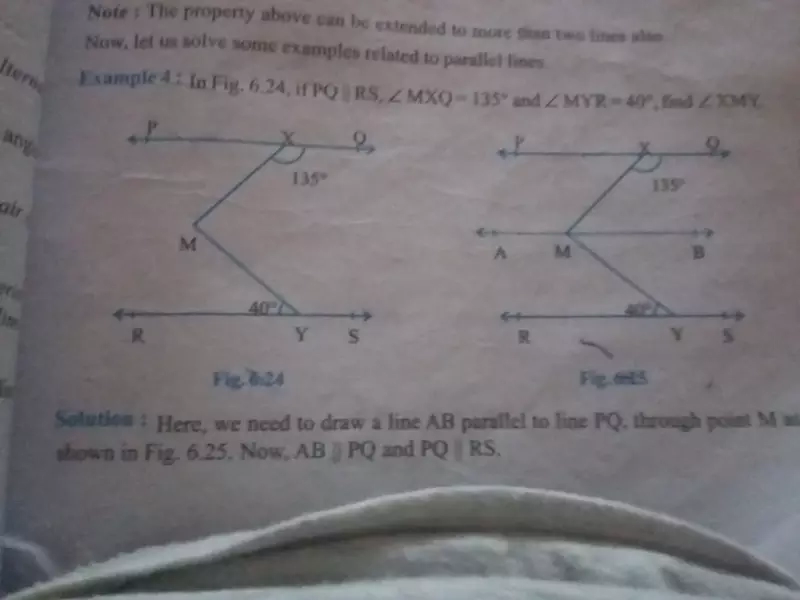

EXAM QUESTION

Mr. Ramesh gifted a sum of Rs 5 lacs to his brothers minor son on 16-4-2015. On 18-4-2015, his brother gifted debentures worth Rs 6 lacs to Mrs. Ramesh.

Son of Mr. Rameshs brother invested the amount in fixed deposit with Bank of India @ 9% p.a. interest

and Mrs. Ramesh received interest of Rs 45,000 on debentures received by her.

Discuss the implications under the provisions of the Income-tax Act, 1961.

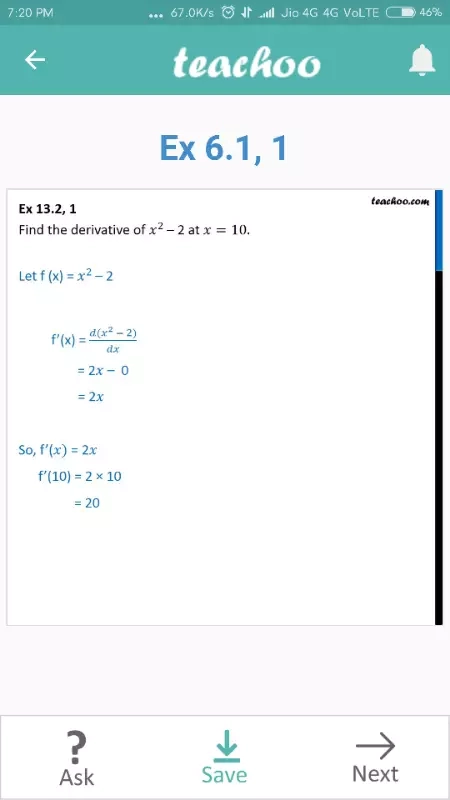

- Find the zeroes of the quadratic polynomial √3x^2-8x 4√3

- For what value of 'k', -4 is a zero of polynomial x^2-x-2k 2

Find the differential equations of family of parabolas having vertex at y-axis and axis of parabola is parallel to the x-axis

Dear Sir,

In Kerala, there was Reverse Charge in VAT also, but the name was Purchase u/s 6(2) especially in case of Natural Rubber, where the buyer purchases the Natural Rubber Sheet from the unregistered dealers and pays the tax on the closing stock held. The same is adjusted in the next month automatically in the VAT return as Special Rebate.

Thanking you,

Regards,

Sajit Kumar

Dear sir,

We have a business of various food products, which we supply to supermarkets etc. of which few are exempted from GST and few has GST rates. So which invoice format should we use?

Awaiting your reply soon.

Thank you.

How to send goods on consignment and what all documents required to attached with? Whether GST is applicable or not? What is the value to be declared?

There's a bug.

There's a bug.