Uin holder??

Question

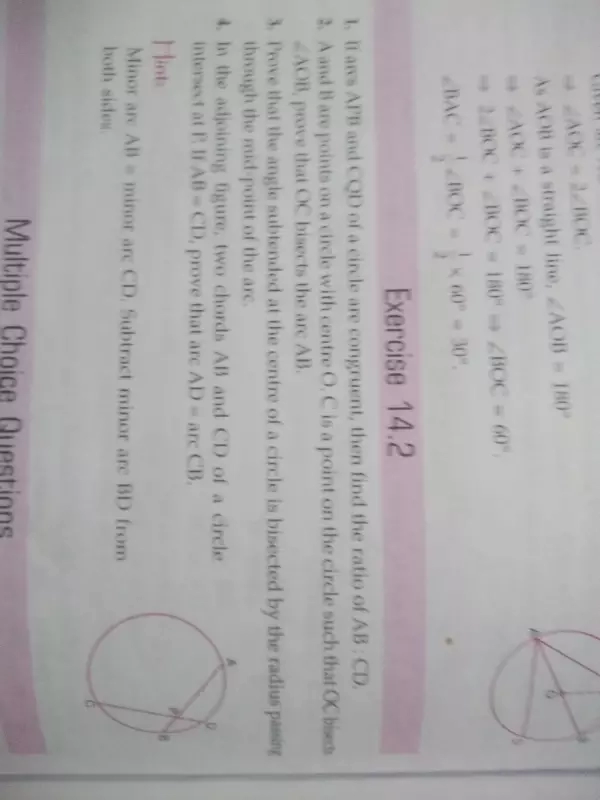

- Prove that the angle subtended at the centre of the circle is bisected by the radius passing through the mid point of the circle

Find the area of a quadrilateral ABCD in which AB = 3 cm, BC = 4 cm, CD = 4 cm, DA = 5 cm and AC = 5 cm. (a) 15 cm 2 (b) 15.4 cm 2 (c) 15.2 cm 2 (d) none of these

A rectangle is inscribed in a semicircle of radius r with one of its sides on the diameter of the semicircle .Find the dimensions of the rectangle so that its area is maximum.Also find the maximum area.

if 4 kurdish selected 6 dieferent kurdish and 3 english from 6 different english how many ways seven books .1)english and kurdish alternate

Find the value of 'a' when distance between the points (3,a) and (4,1) is √10

find the equation of the parabola, whose vertex is (0, 4) and focus is (0,2)

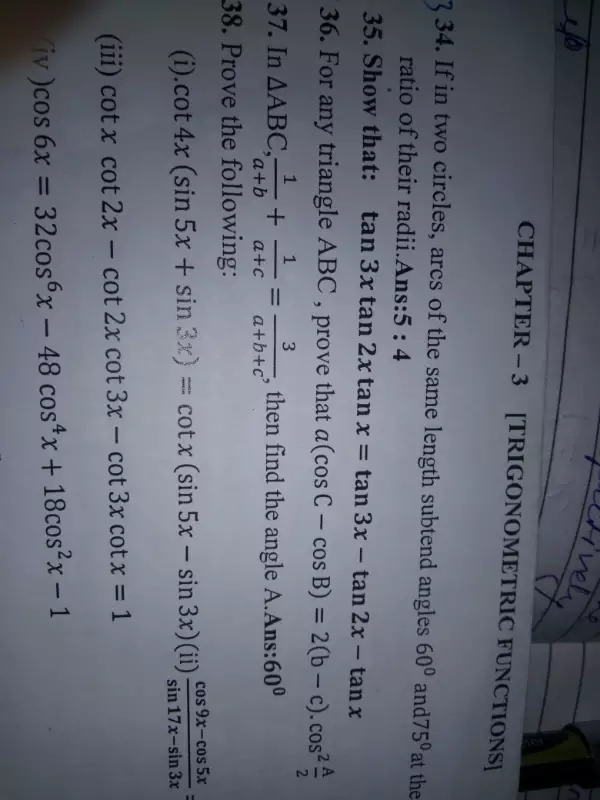

36 and 37

36 and 37