(a b)2

Question

Gst ledger registraion process

Input tax credit

Rcm

E way bill

Compogination schme

Input tax credit

Rcm

E way bill

Compogination schme

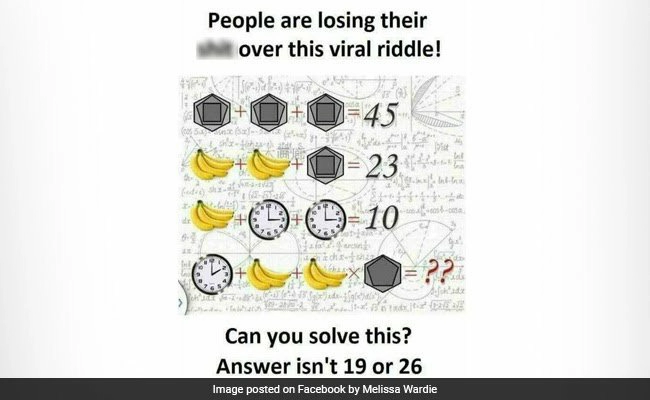

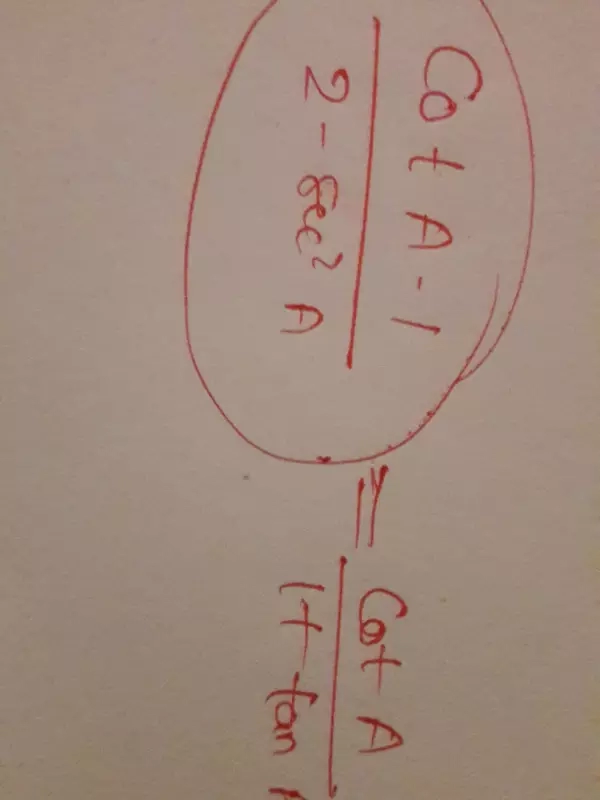

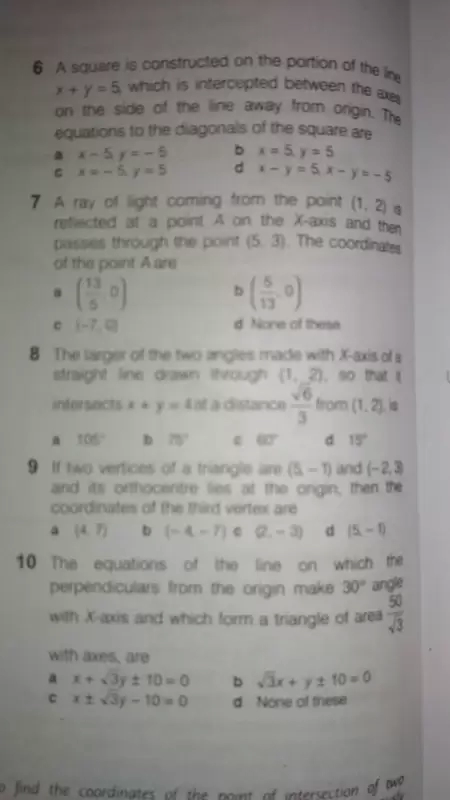

Maths

Oct. 31, 2017, 10:27 p.m.

Answer

Oct. 31, 2017, 10:27 p.m.

Answer

It is given that the length of a tangent from point A is 5cm from the centre of their circle is 4 cm .... So how come AB is 4 cm and OA is 5cm .

Dear sir,

Thanks for giving the chance for the free online tranning course. My main concern is that your asseinment are are not opened.with the downloading of the file...

Thanks for giving the chance for the free online tranning course. My main concern is that your asseinment are are not opened.with the downloading of the file...

500 male and female live in a village.Male person 11%and what is the percentage of female in a villages?

Prove that the sum of the squares of the diagonals of parallelogram is equal to the sum of squares of its sides.

find the probability of getting 5 exactly in 7 throws of a dieIf vector a = 2i +j - k, vector b = 4i - 7j + k, find a vector c suchthat axc =b and a.c = 6

find the probability of getting 5 exactly twice in 7 throws of a die

RESPECTED SIR/MADAM,

I HAVE UPLOADED GSTR-1 FOR JULY 2017 BY 10TH OCT 2017 BUT COULD NOT FILE ON OR BEFORE 10TH OCT , MY QUESTION IS CAN I FILE GSTR-1 FOR JULY 2017 AFTER 31ST OCT 2017. I NEED YOUR ADVICE / SUGGESTION