Question

Is it possible to enter the data for gstrn1 for September and save it now and file it whenever the time would be mentioned? Can we edit it later after saving it?

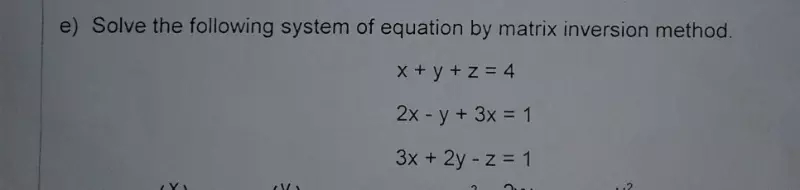

Find the equation of the straight line that passes through (-3,4) and cuts off positive intercepts on the co-ordinate axes whose sum is 7.

prove that equal chords of a circle subtend equal angles at the centre

If a b c and B D E are the two equilateral triangle such that D is the midpoint of the BC then prove that area of triangle BD equal to one by fourth of the area of triangle ABC

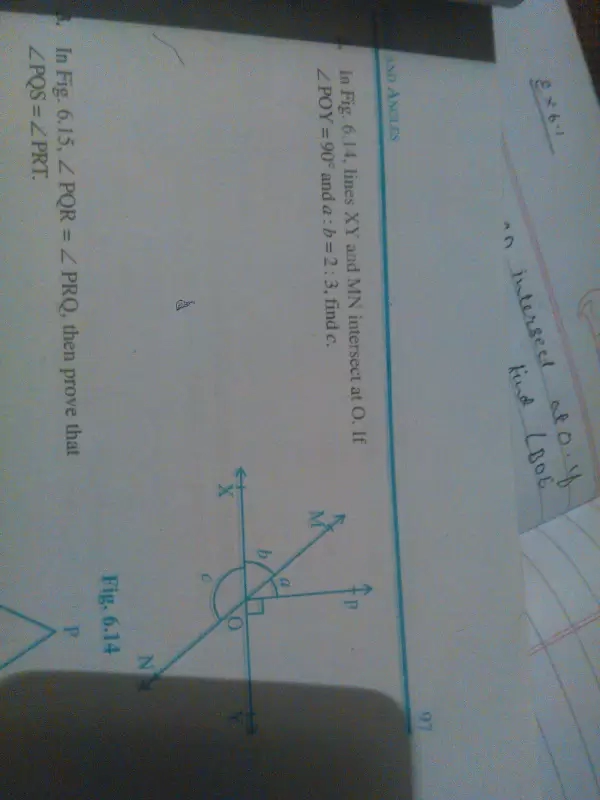

Class 9

Nov. 15, 2017, 5:22 p.m.

Answer

Nov. 15, 2017, 5:22 p.m.

Answer

Can u plz give me sample question papers of Mathematics NCERT of class ninth