Question

Maths

Jan. 20, 2018, 11:25 a.m.

Answer

Jan. 20, 2018, 11:25 a.m.

Answer

Sir , I want to ask form you if Mohit painted the outside of a box of length 2.5 m , breadth 2m and height 1m . How much surface area did he cover . If he painted all except the bottom of the box . Please help me in this sum . I am not getting correct answer when I solve it in my NB .

Maths

Jan. 20, 2018, 10:42 a.m.

Answer

Jan. 20, 2018, 10:42 a.m.

Answer

Find the area of quadrilateral ABCD whose sides are 9cm; 40cm;28cm and 15cm respectively; in consecutive order; and angle between first two sides is 90 degree.

Sir kindly say me that how the equation of line can be described and what was it's mean information

Accounts Tax GST

Jan. 19, 2018, 10 p.m.

Answer

Jan. 19, 2018, 10 p.m.

Answer

Compulsory invoice number series are maintained in gst if not maintained then what is the process

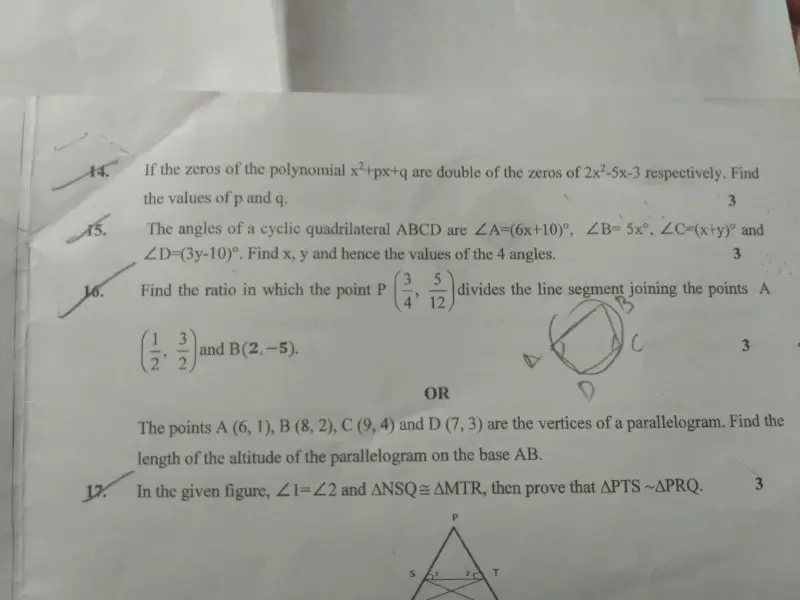

question no. 15

question no. 15

14 number

14 number