Find the coefficient of xn in the expansion of (1+x)(1-x)n

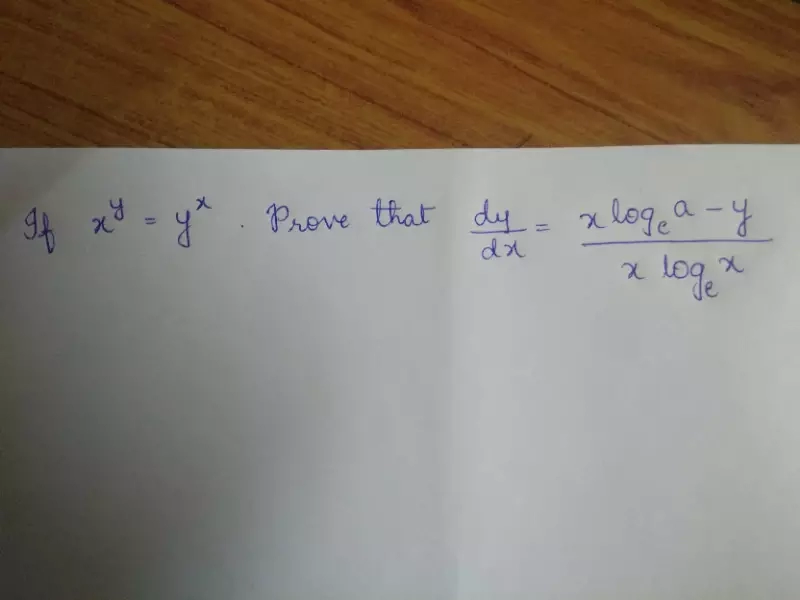

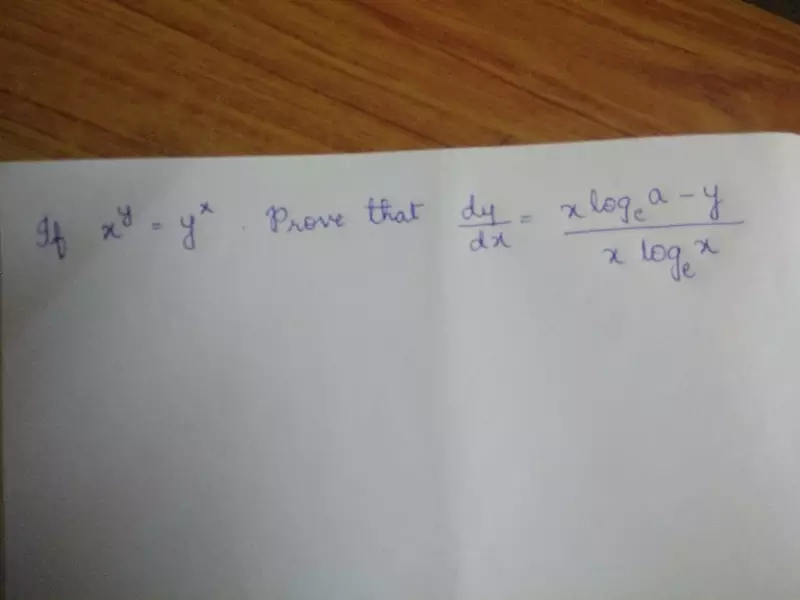

Question

Maths

Jan. 25, 2018, 9:26 a.m.

Answer

Jan. 25, 2018, 9:26 a.m.

Answer

Draw circle with the help of a circular bangle.Construct two tangents to this circle through a point in the exterior of the circle.

Maths

Jan. 25, 2018, 8:11 a.m.

Answer

Jan. 25, 2018, 8:11 a.m.

Answer

The value of a for which (8,-7,a), (5,2,4)and (6,-1,2) are collinear,

Use euclid divison lemma to show that the square of any positive integer is either of the form 3mor3; 1 for some integer m

plzz help me to solve this sir.....

plzz help me to solve this sir.....