Question

Plzz solve this:

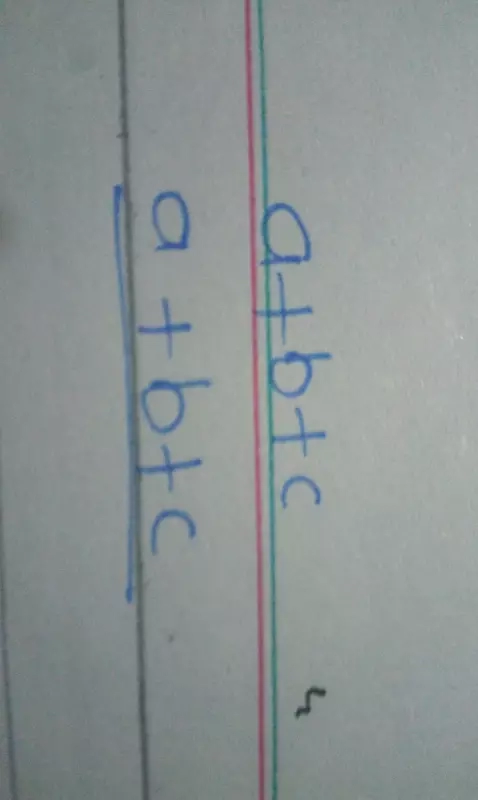

Prove that: tanA/1-cotA + cot/1-tanA =

1 + tanA + cotA

Maths

Sept. 26, 2017, 9:30 a.m.

Answer

Sept. 26, 2017, 9:30 a.m.

Answer

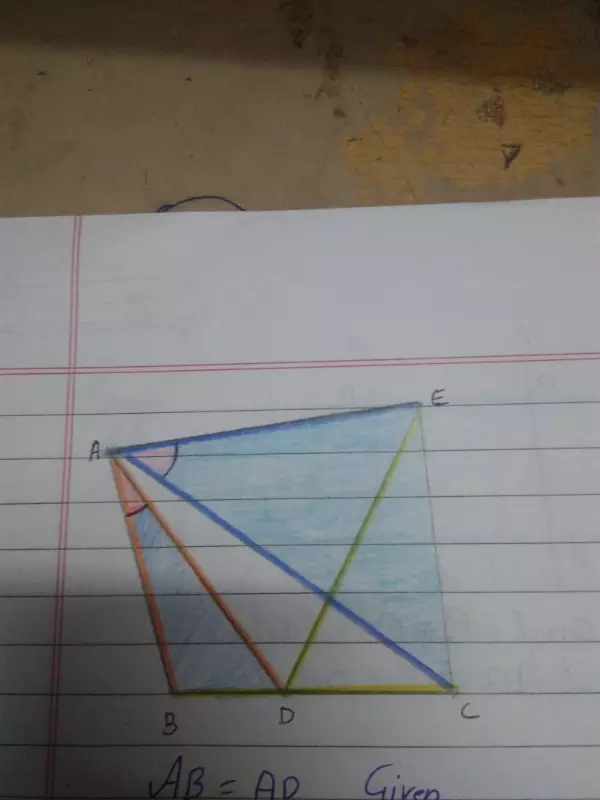

Mam, can we right angle EAD in question number 6 exercise 7.1 Triangle 9class please give me the answer fast . My FA2 is coming

how to find the solution:find the sum to n terms: 12+14+24+58+164+...

Not able to add APoB in GST as it's not enabled. When can it will be available?

Any alterternative available on online portal?

Any alterternative available on online portal?