Find the value of x3 + y3 + 15xy – 125 if x + y = 5

Question

The coefficient of three consecutive term in (1+x)n are in the ratio 1 : 7 : 42, then the value of n is

If I purchase a wood material and also prepared table and sale what is the entry gst ? both

Hello sir, I am Ranjit

Petrol Pump issued a bill and he mention his GST No. but not mention my company GST No.

so, Bill is correct or Incorrect

thank You....

If seller sale a material for the month November and Purchaser received materials same month but Purchaser received a bill for the month December.

so, when party entry in his own ledger and in which month party pay the Tax.

Dear sir,

Seller generate a bill for the month December but Purchaser not paid GST same month.

so, How party paid tax against this bill...

Thank You

in a paralellogram PQRS, A is the mid point of SP and B is the mid point of QR.show that ASBQ is a peralellogram.

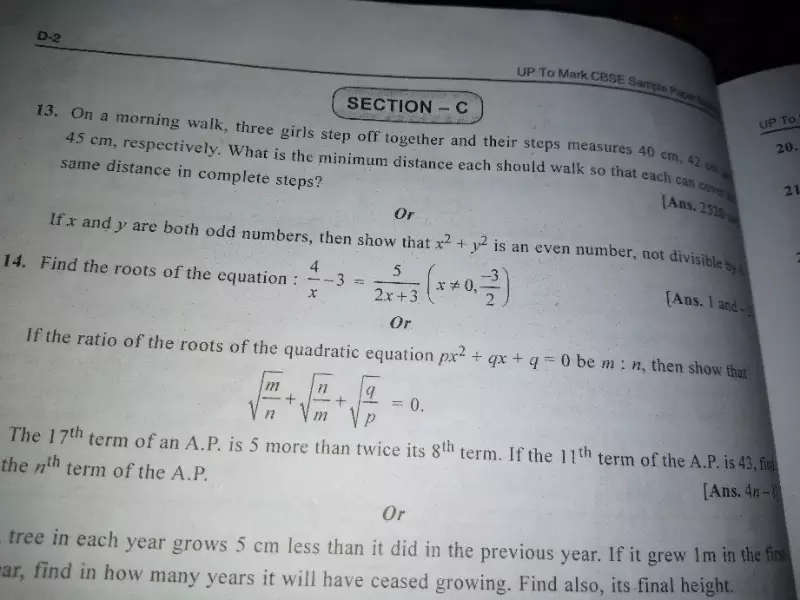

solve second part of question no 14

solve second part of question no 14