.ABC is a triangle in which D,E and F are the mid points of AB,AC and BC respectively.

AD=3cm ,AE=5cm ,BD=4cm ,CE=4cm ,CF=2cm ,BF= 2.5cm ,then find a pair of parallel lines and

hence their lengths.

Question

Maths

July 28, 2020, 5:51 p.m.

Answer

July 28, 2020, 5:51 p.m.

Answer

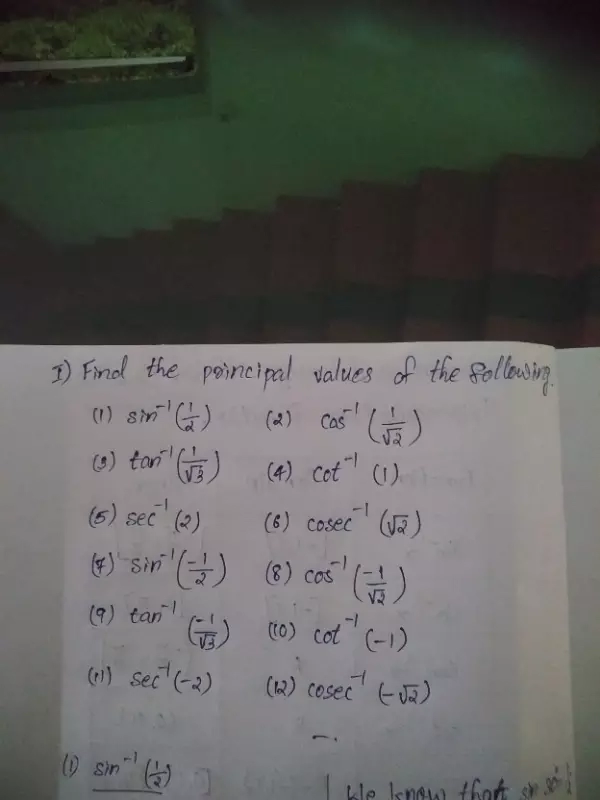

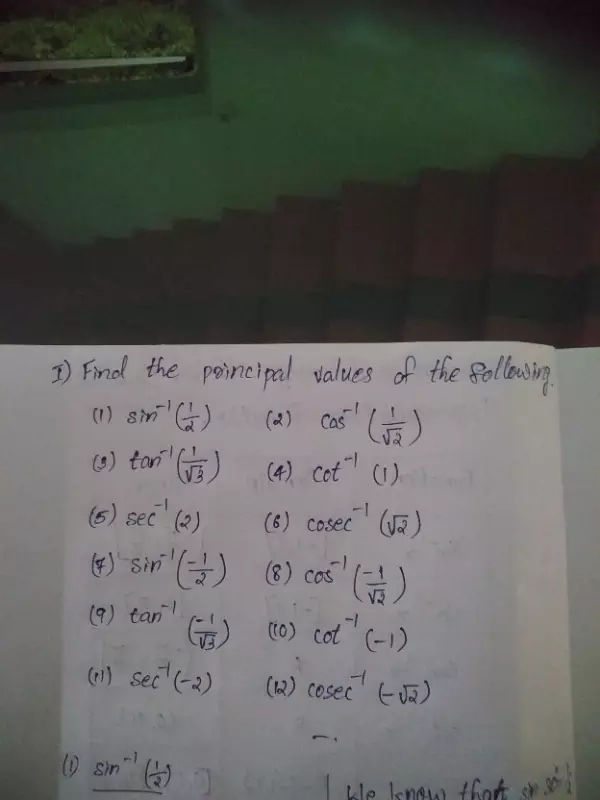

Maths

July 28, 2020, 12:09 p.m.

Answer

July 28, 2020, 12:09 p.m.

Answer

If a square paper of side 25 cm is rolled to form a cylinder then it's curved surface area is

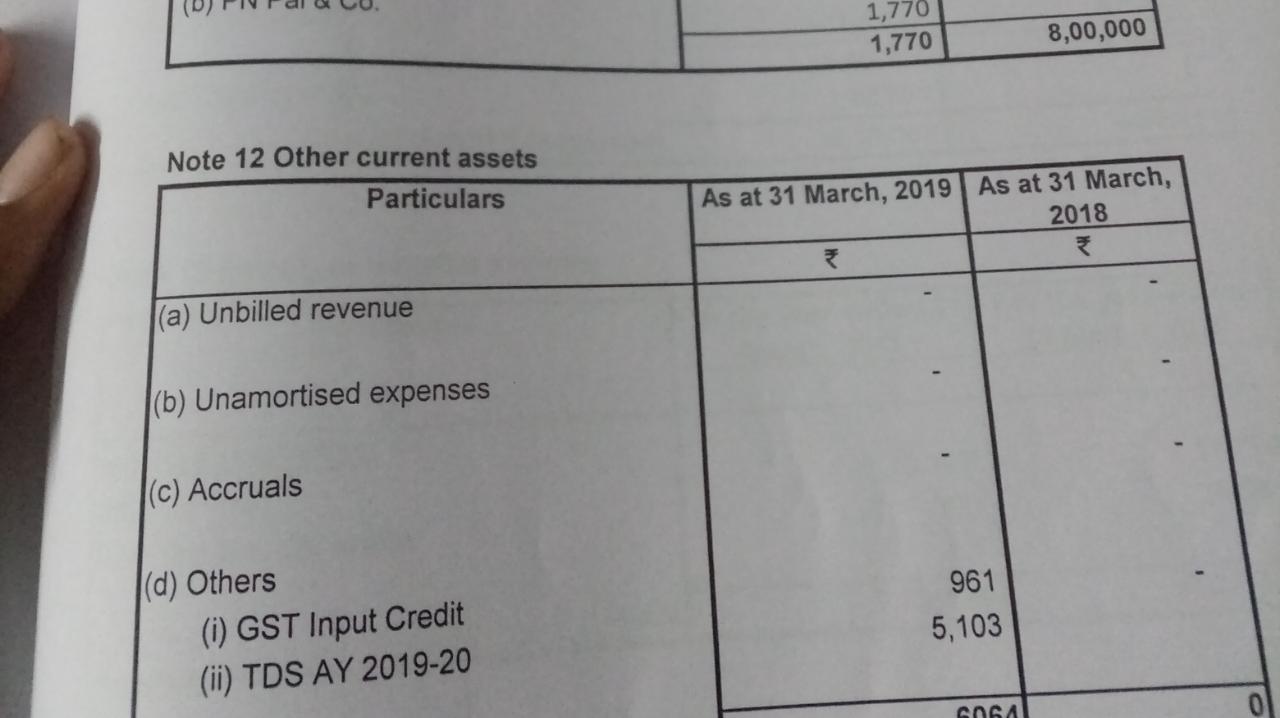

Accounts Tax GST

July 28, 2020, 11:04 a.m.

Answer

July 28, 2020, 11:04 a.m.

Answer

How to put GST input credit 31.03.2019 in tally ?

tell me the entry.....