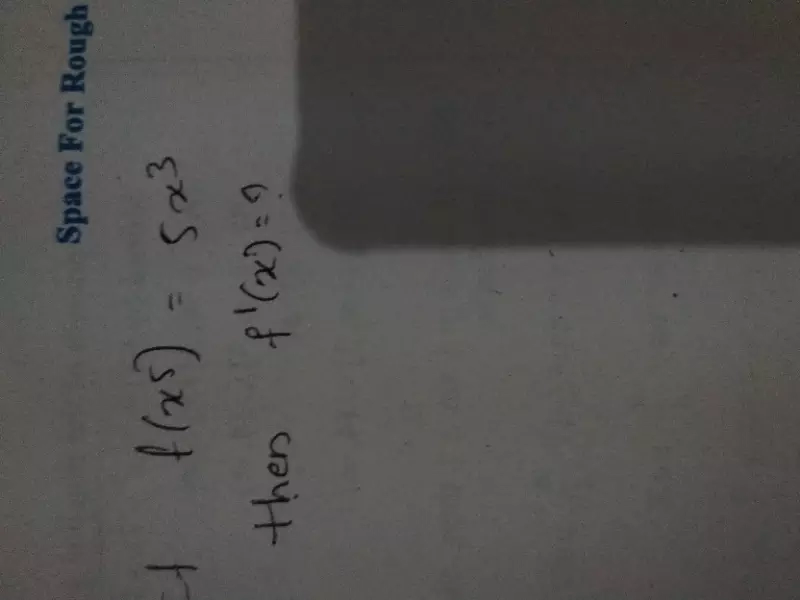

Question

Maths

May 27, 2019, 3:11 p.m.

Answer

May 27, 2019, 3:11 p.m.

Answer

The fifth term of a geometric sequence is 81/32 and the ratio of 3rd and 4th is 2/3 , write the geometric sequence and its 8th term.

Maths

May 27, 2019, 11:22 a.m.

Answer

May 27, 2019, 11:22 a.m.

Answer

For what values of p the pair of equations have unique solutions px=2y and 2x-y 5=0