Question

Dear sir,

I want to that

How to calculation under sec.142 under GST. kindly help

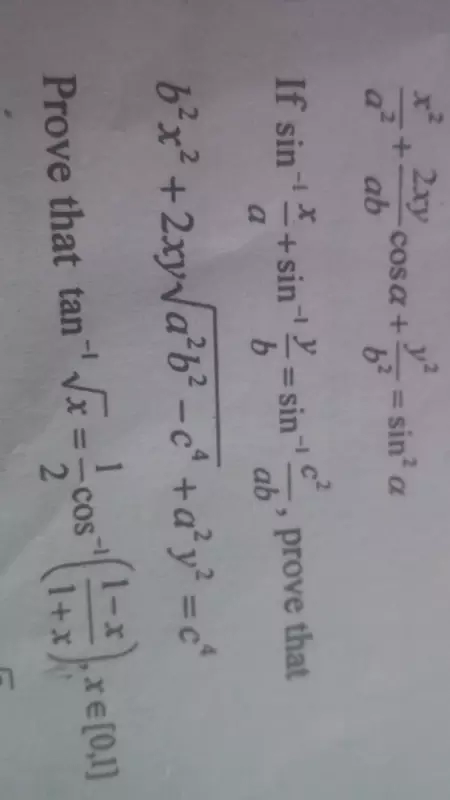

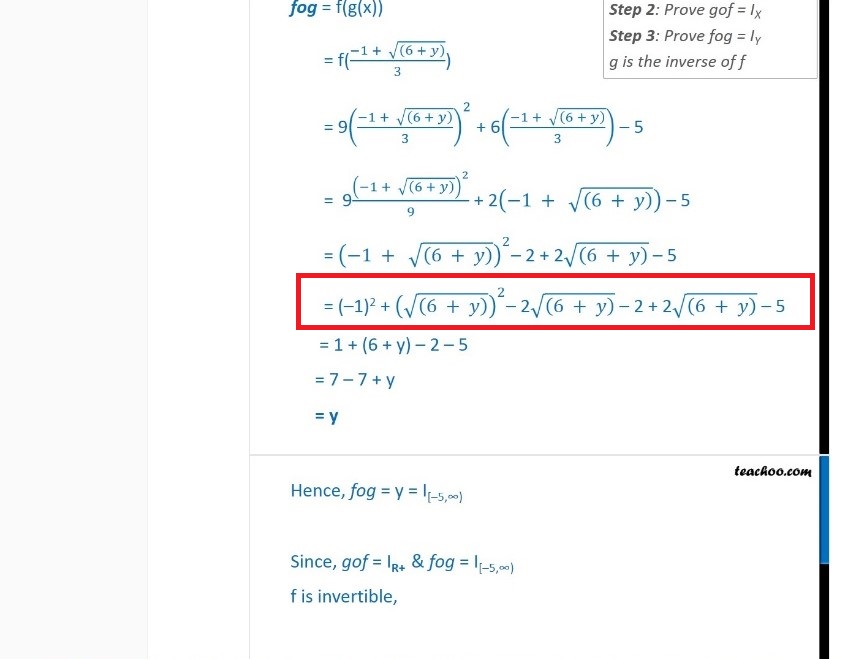

Maths

Sept. 4, 2017, 4:45 a.m.

Answer

Sept. 4, 2017, 4:45 a.m.

Answer

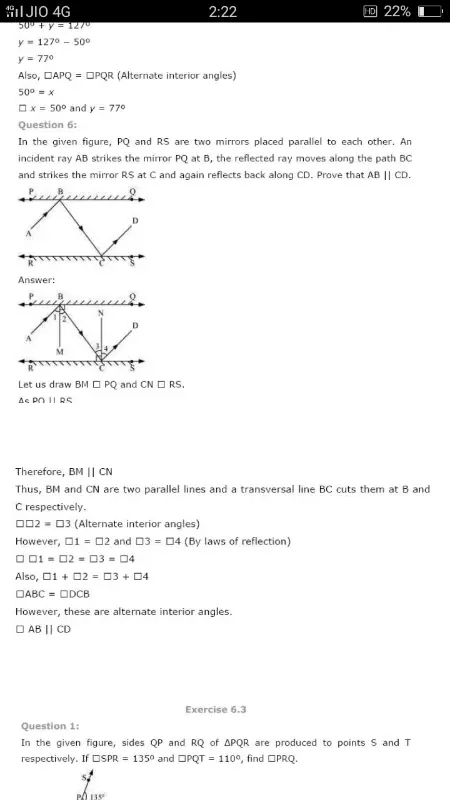

Op bisects angle AOC and oq bisects angle boc op is perpendicular to oq prove that a o b are collinear

Accounts Tax GST

Sept. 3, 2017, 10:38 p.m.

Answer

Sept. 3, 2017, 10:38 p.m.

Answer

.

.

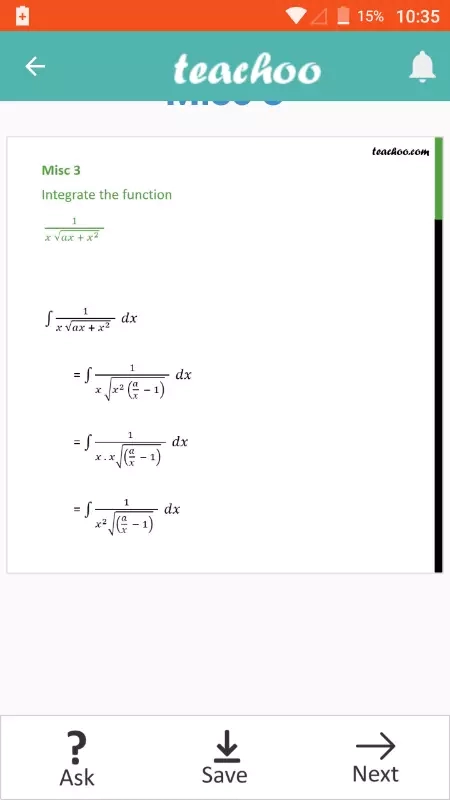

Sir I have dough in step 3 .. when we take common x^2 in root then ( a/x -1) . How ... I can't understand .

Can GSTR 3B return will be filed through off line performa as per GSTR1

Can't understand this step

Can't understand this step