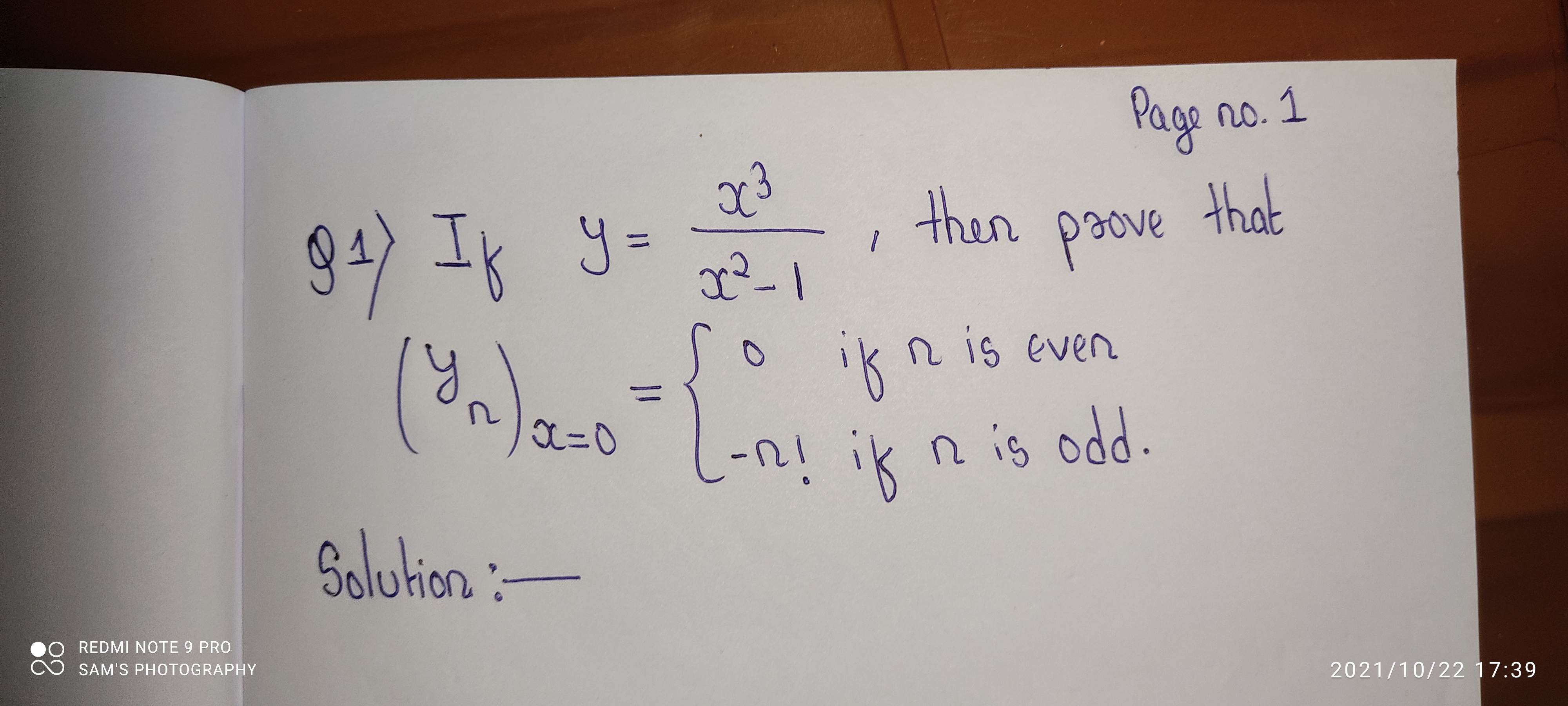

Question

Maths

Oct. 22, 2021, 6:11 p.m.

Answer

Oct. 22, 2021, 6:11 p.m.

Answer

a pendulam swings through a an angle of 30°and describes an arc 8.8 cm in length .find the length of pendulam

Maths

Oct. 22, 2021, 6:07 p.m.

Answer

Oct. 22, 2021, 6:07 p.m.

Answer

The hour hand of a clock is 6 cm long. The area swept by it between 11.20 am and 11.55 am is.