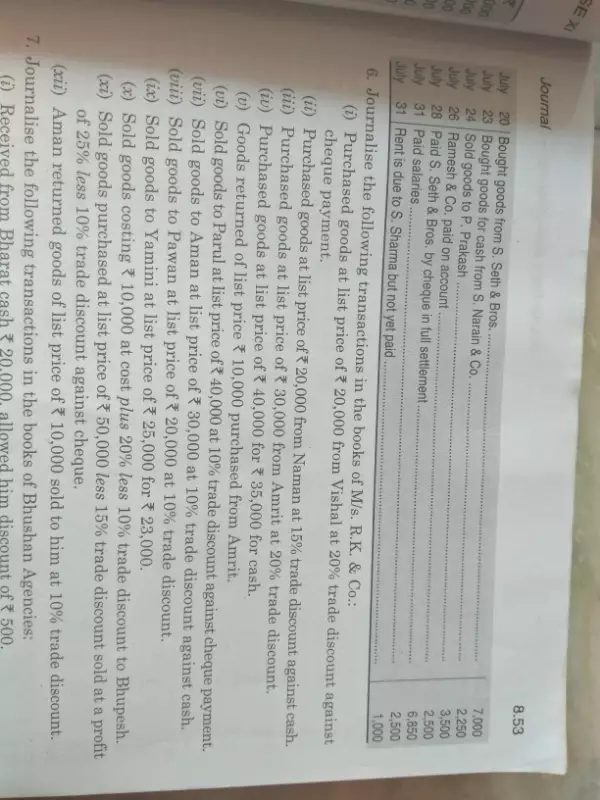

Question

Accounts Tax GST

Sept. 2, 2017, 8:49 p.m.

Answer

Sept. 2, 2017, 8:49 p.m.

Answer

In vector example 27 how I determine that I have to find cos© not sin©

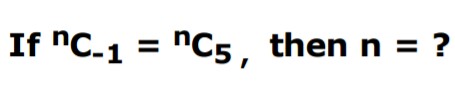

Maths

Sept. 2, 2017, 8:25 p.m.

Answer

Sept. 2, 2017, 8:25 p.m.

Answer

21students are to be divided into three groups forming an AP three groups are to be named ENERGY SAVING','PROTECTION OF NATURAL RESOURCE GROUP', and 'HEALTH AWARENESS GROUP '. if the sum of the square of number of students in each group is 155. Find the number of students in each group ? In which group you would like to be ?

Maths

Sept. 2, 2017, 6:36 p.m.

Answer

Sept. 2, 2017, 6:36 p.m.

Answer

5 questions, either true or false. No student answer correctly and no students given same sequence of answers. How many total students.

Dear sir,

we are registered gta under gst-

we have head office in delhi and branch at amritsar, our delhi head office is registered under gst act, but amritsar branch not, as we collect parcel from consigner at amritsar branch and deliver it to delhi branch we provide service only under reverse charge mechanism should we issue tax invoice or not to our client , or when.?

What should I do If I have filed My first return & Instead of choosing AY 17-18, chose AY 16-17???

Please guide to deduct TDS on Consultancy fees of Rs. 300000/-

Q1 - TDS 10% of income tax and 1% on GST both are applicable ??

Q2- May deducted 11% from the bill in the time of payment ??