Question

Accounts Tax GST

June 27, 2018, 11:49 p.m.

Answer

June 27, 2018, 11:49 p.m.

Answer

I have received internet charges bill dated 20.04.2018 and the billing period for the same is 08.06.2018-08.07.2018 (June) , bill amount is Rs.1200 Inclusive of GST

Please advice what's the journal entry for this??

Please advice what's the journal entry for this??

Find out the following for the point(-3,8)

A.Absicca

B.ordinate

C.quadrant

D.normal distance from x axis

E.normal distance from y axis

A.Absicca

B.ordinate

C.quadrant

D.normal distance from x axis

E.normal distance from y axis

Accounts Tax GST

June 27, 2018, 4:44 p.m.

Answer

June 27, 2018, 4:44 p.m.

Answer

How to Prepare Eway bill in case of machinery transfer from one state to another for repairing work. Please provide detail procedure above issue

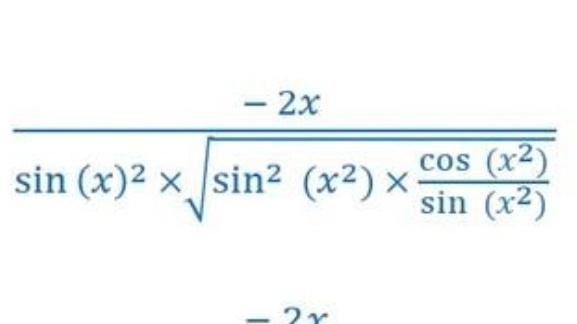

how sin. goes inside the root

how sin. goes inside the root