This Scheme is for Small Business who cannot maintain detailed books of accounts and records.

Why GST Composition Scheme is introduced

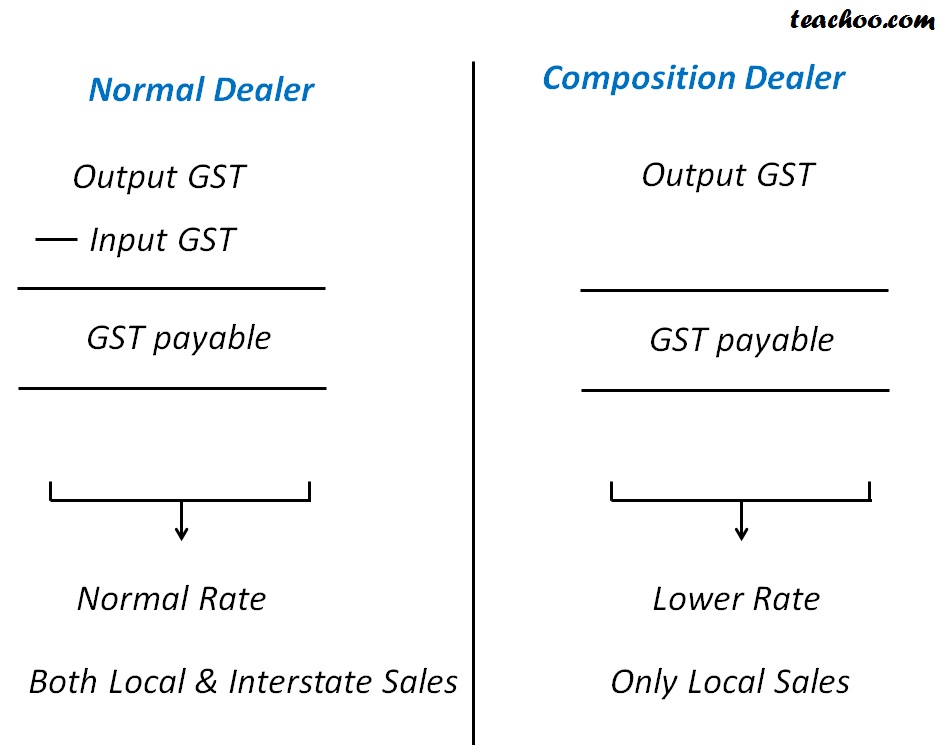

Normally, an assesse under GST has to maintain proper records of Output and Input and pay Monthly Returns every month+ One Annual Return

This is not possible for small business.

For such business, Government has introduced composition scheme under GST.

As per this Scheme, No Input is available to Composition Dealer. However, he has to pay Output at less Rate

Also Instead of monthly 3 returns, he can file Quarterly One Return annually plus one Annual Return and pay tax quaterly

Hence, this scheme is for easy compliance of GST Law of small business

Turnover Limit for composition scheme

If turnover upto 100 lacs, then Composition Scheme can be availed

This to be shown in increase to 150 lacs from 1st April 2019

For north eastern state and uttarakhand limit has been increased from 50 lac to 75 lac

Summary of Rates for composition scheme

|

Type of Business |

TILL 31 DEC 2017 |

FROM 1 JAN 2018 |

FROM 1 APRIL 2019 |

|

Trader |

1% |

1% |

1% |

|

Manufacturer |

2% |

2% 1% |

2% 1% |

|

Restaurant |

5% |

5% |

5% |

|

Other services |

N/A |

N/A | 6% |

Government has changed GST Rates for Manufacturers from 2% to 1% Notification 1/2018

Hence, now GST Rates are similar for Traders and Manufacturers

New Amendment from 1 April 2019

- In case of service provider (except restaurant)

- If turnover is upto 50 lac, then 6% Rate of tax for composition scheme

- Till 31st March 2019, composition scheme was not available to such service provider

Can Composition Dealer Provide Service?

Composition scheme is applicable to

- Traders

- Manufacturers

- Restaurant Business, (It is not available to other services Like CA, Consultancy Service etc)

From 1 Feb 2019, Composition dealers in goods allowed to supply services for a value not exceeding – Higher of 10% turnover or Rs 5 lacs, whichever is higher.

New Amendment from 1 April 2019

- In case of service provider (except restaurant)

- If turnover is upto 50 lac, then 6% Rate of tax for composition scheme

Return and Due Date for Composition Scheme

- It is normally 18th of next Quarter

- However Due date of Return for July-September has been extended to 24 Dec 2017

- Gstr-4 has to be filed for Composition Dealer

| Period | Due Date |

| July-Sep 2017 | 24 Dec 2017 |

| Oct-Dec 2017 | 18-Jan-18 |

| Jan-March 2018 | 18-Apr-18 |

| April-June 2018 | 18-Jul-18 |

| July-Sep 2018 | 18-Oct-2018 |

| Oct-Dec 2018 | 18-Jan-2019 |

| Jan-March 2019 | 18-Apr-2019 |

New amendment from 1 April 2019

Composition dealer needs to pay tax quarterly by 18 th of next quarter in form CMP-08

And file return annually GSTR 4

|

PERIOD |

DUE DATE |

RETURN/PAYMENT FORM NAME |

|

APRIL-JUNE |

18 JULY 2019 31 August 2019 |

CMP-08(PAYMENT FORM) |

|

JULY-SEPTEMBER |

18 OCTOBER 2019 |

CMP-08(PAYMENT FORM) |

|

OCTOBER-DECEMBER |

18 JANUARY 2020 |

CMP-08(PAYMENT FORM) |

|

JANUARY-MARCH |

18 APRIL 2020 |

CMP-08(PAYMENT FORM) |

|

APRIL 2019-MARCH 2020 |

30 APRIL 2020 |

GSTR -4 (RETURN) |

|

APRIL 2019-MARCH 2020 |

31 DECEMBER 2020 |

GSTR 9A (ANNUAL RETURN) |

Option to Avail Composition Scheme

Person can change from Normal Scheme to Composition Scheme

Suppose scheme opted in one month will be effective from Next Month

Example

Normal Dealer opts for Composition Scheme by 20 Nov 2018

He will file Composition Dealer Return and Tax starting from 1 Dec 2018