Chapter 9 TDS Special Sections

Last updated at April 16, 2024 by Teachoo

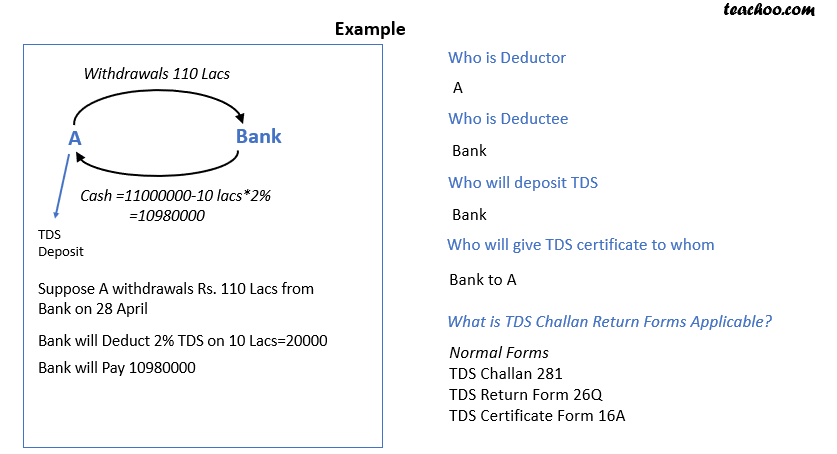

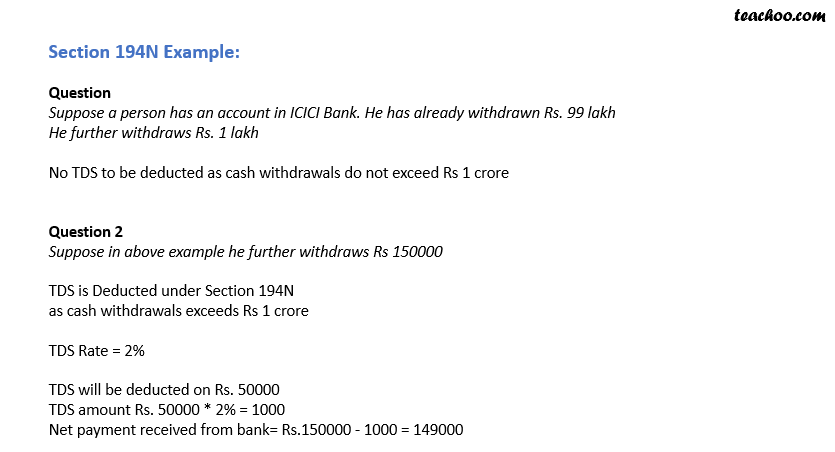

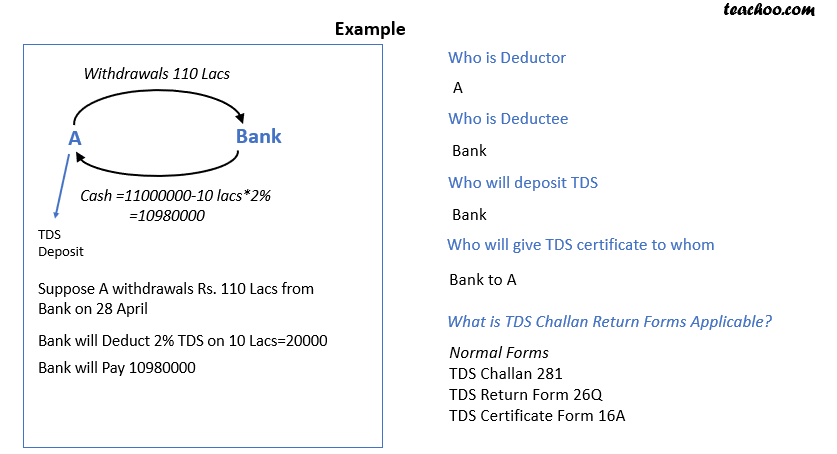

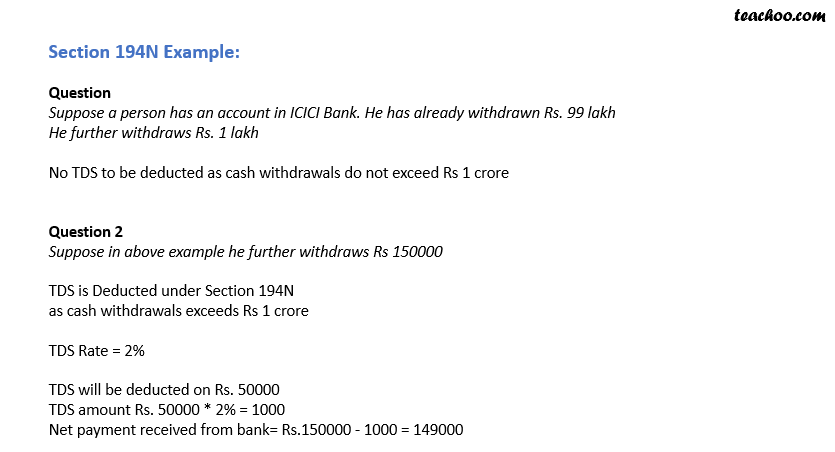

TDS ON CASH WITHDRAWALS Section no Description Cut off Normal Rate of TDS Reduced Rate From 14 May 2020 to 31 Mar 2021) 194 N TDS on cash withdrawals 1 Crore 2% No Change As Per Section 194N Examples: Payment TDS Applicable/No TDS 9800000 10000000 10050000 NO TDS NO TDS TDS Applicable In which amount 10050000 or 50000 If cash withdrawals exceeding Rs. 1 crore from Banking Company, Cooperative Society engaged in business of banking and Post office. TDS Deducted @ 2% on withdrawals TDS will be deducted on Rs. 50000 Rate not Reduced due to lockdown teachoo.com Example Who is Deductor A Who is Deductee Bank Who will deposit TDS Bank Who will give TDS certificate to whom Bank to A What is TDS Challan Return Forms Applicable? Normal Forms TDS Challan 281 TDS Return Form 26Q TDS Certificate Form 16A Suppose A withdrawals Rs. 110 Lacs from Bank on 28 April Bank will Deduct 2% TDS on 10 Lacs=20000 Bank will Pay 10980000 A Bank Withdrawals 110 Lacs Cash =11000000 10 lacs*2% =10980000 TDS Deposit Section 194N Earlier In All Cases ITR Filed for Any of Last 3 years Now (From 1 Jul 2020) TDS Deducted @ 2% if Amt withdrawn More than 1 Cr ITR Not filed for Any of Last 3 Years TDS Deducted @ 2% if Amt withdrawn More than 1 Cr TDS Deducted @ 5% if Amt withdrawn More than 1 Cr How will Bank Will Get to Know About whether Person has filed ITR? Bank Check Online at www.incometaxindiaefiling.gov.in ---->Verification of Applicability of 194N Section 194N Example: Question Suppose a person has an account in ICICI Bank. He has already withdrawn Rs. 99 lakh He further withdraws Rs. 1 lakh No TDS to be deducted as cash withdrawals do not exceed Rs 1 crore Question 2 Suppose in above example he further withdraws Rs 150000 TDS is Deducted under Section 194N as cash withdrawals exceeds Rs 1 crore TDS Rate = 2% TDS will be deducted on Rs. 50000 TDS amount Rs. 50000 * 2% = 1000 Net payment received from bank= Rs.150000 1000 = 149000 teachoo.com