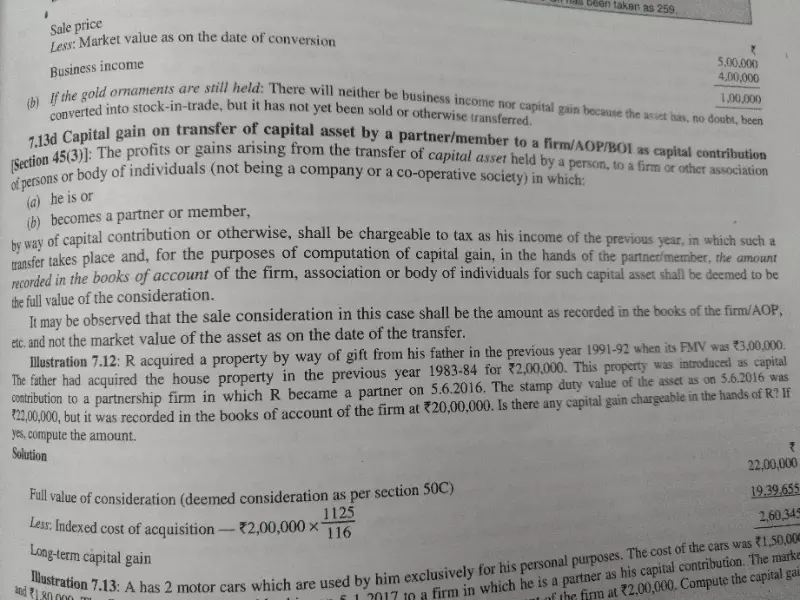

It is given in the special case of chapter capital gain that if a partner transfers his capital assets to the firm then the amount recorded in the book is taken as the full value of consideration and not the actual market value on the day of transfer but in this question the stamp duty value is taken as the full value of consideration andnot the amount recorded in the books of firm. Why?