GEAR UP FOR FIRST GST RETURN (GSTR-3B)

BACKGROUND :

After filing of Income tax return by August 05, 2017 now comes in the period of GST Return for the very first time, Anything for the first time creates a chaos due to limited knowledge among various businessmen over how to file the returns and hence this article is being shaped to try to make GST return filing easier than filing any return.

Ever since India’s Biggest Indirect tax reform, Normal Tax Payers have to file their first Return for July-2017.

Taxpayers were required to file:

| GSTR-1 | 10 th August,2017 |

| GSTR-2 | 15 th August,2017 |

| GSTR-3 | 20 th August,2017 |

However due to difficulties faced by taxpayers, it was decided to delay the filing of returns and single return was announced for the month of July & August.

RETURN:

Return can be filed via

ONLINE MODE: Log in to your GST Portal- Services Tab-Returns & then click on Returns Dashboard, you need to select the Month as July and after which all the details should be entered as explained in this article after clicking on Monthly return GSTR 3B-Prepare Online(As shown in the diagram).

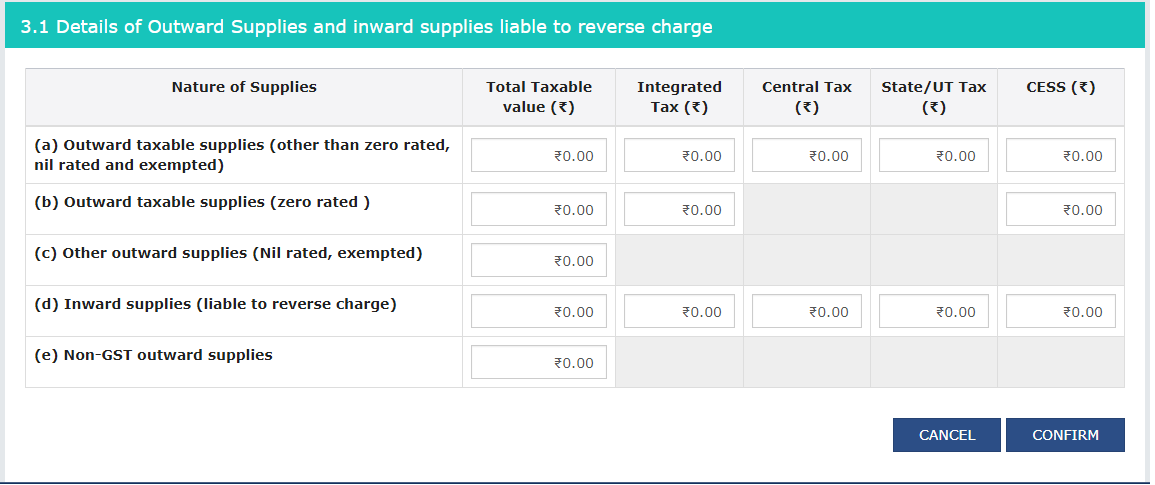

The very first table consists of Details of Outward supplies and inward supplies liable to reverse charge. following details are to be provided in respective column:

3.1(a) – The dealer is required to provide details of the supplies (in simple words “sales”) details on which tax has been charged in aggregate , he need not segregate rate wise or product wise or bill wise he just needs to put in the consolidated figure, (Do remember detail wise you would be required to provide in GSTR-1 which is to be filed by 05/09/2017).

3.1(b)-In case taxpayer has engaged himself into exports during the month of July, he is required to provide the details in this column. Here the column IGST has to be filled only if you have exported by taking an option of payment of tax on export and claiming refund later, in case if you have exported without tax then you only need to enter the taxable value.

3.1(c) – If taxpayer has supplied any goods on which rate of GST is NIL or on which GST is exempted, they are required to provide complete details of the same in 3 rd row.

3.1(d) – Taxpayers are required to pay GST on Reverse charge basis on certain notified goods and services, purchase from Unregistered Dealer subject to exemption provided and various services such as GTA, Legal service etc, even though this being an expense for the businessmen, the taxpayer is required to pay GST on reverse charge basis and he is also allowed to take Input credit on it. Hence it is advisable to before filing the return to check the Profit & Loss A/c and consult your GST Professional for the advice.

3.1(e) – If Taxpayer has supplied items such as Alcohol, crude oil, petroleum etc on which GST is not yet levied, he is required to display the same in this column.

Note: Kindly, do ensure you fill the correct amount of tax collected on supply in Return.

After filling 3.1, completely click on 3.2 tab only if you have supplied to the following explained taxable persons (The details to be mentioned here should have been already included in 3.1 table, this is just an additional disclosure)

A. INTER-STATE Supplies made to Unregistered Person: Details have to be filled in this tab only if taxpayer has supplied the goods or services or both in other state & the person to whom it is provided is unregistered

- Logic: In Gst, in case if you have done interstate supply, you would have to pay IGST which the government would have to share with the state where the supply has been consumed (Since being destination based tax) & hence the details of place of Supply has to be provided & details of the total tax of that particular state (Again you need not provide bill wise, rate wise & tax wise details).

- Supplies made to Composition Taxable Persons: In case, the taxpayer has supplied to dealers who are registered under Composition scheme, details of the same are to be provided.

- Supplies made to UIN Holders – Any supplies made to Foreign Diplomatic missions & Embassies are to be disclosed here.

NOTE: The details provided here is just additional disclosure, ensure that the details mentioned in this table are already included in 3.1 tables.

Fourth Table speaks about Input Tax Credit, following points are required to be known while filling up this column

1. ITC Available – In this sub table, we are required to fill the details according to fields mentioned therein, the tax amount which is to be taken as INPUT credit.

2. Import of Goods –Integrated Tax paid on import of goods along with Basic custom duty is allowed to be taken as Input tax credit, in case a trader has imported any goods on which he has Paid IGST he can claim credit of such tax paid by mentioning the amount of tax paid in this column (Tax means IGST).

3.Import of Services- Integrated Tax paid on import of services along with Basic custom duty is allowed to be taken as Input tax credit, in case a trader has imported any services on which he has Paid IGST he can claim credit of such tax paid by mentioning the amount of tax paid in this column (Tax means IGST).

4. Inward Supplies liable to reverse charge – Under Column 3.1(d) we were required to pay tax on expenses which were liable to reverse charge, hence we can take credit of the same by filling in the details of tax amount paid in this column, Ensure that the tax paid shown in 3.1 table is similar to input tax credit claimed in this column.

5.Inward Supplies from ISD – This is applicable for those units, which has various branches and input credit has been apportioned from a head branch.

6.All other ITC – Any input tax credit to be claimed other than mentioned above needs to be filled in this column, eg: Interstate Purchases, Intrastate Purchases, and Regular Expenses on which GST can be claimed.

B. ITC REVERSED

1. As per Rule 42 & 43 of CGST Rule :

In simple interpretation, It means in case any expense which has been used partly for business and partly for private, the input tax credit claimed on private use portion has to be reversed(Reverse needs to be done only after claiming full in Part A)

2. Ineligible ITC

i. As per Section 17(5) – Tax payer will not be eligible to take credit of goods or services acquired which are mentioned in Section 17(5) (Such as motor vehicles, works contract service subject to conditions mentioned therein). Taxpayer is required to mention such details as well (Intention is to have a track of the same).

ii. Others – Any other Input credit which is not eligible for business has to be shown here (Consult your GST professional to have an understanding of the same).

NOTE: In INPUT TAX CREDIT TABLE YOU NEED NOT MENTION THE VALUE OF GOODS OR SERVICES OR BOTH, YOU ONLY NEED TO MENTION THE VALUE OF TAX PAID FOR ACQUISITION OF SUCH GOODS OR SERVICES OR BOTH.

Value of inward supplies (similar to “Purchases”) on which GST has not been applied has to be provided here.

1. After submission of details of Outward Supplies (Sales) & Inward Supplies (Purchases), Tax Payable would be calculated and you would be required to make the payment of the same.

2. Payment can be made via two modes

i. Utilizing Input credit paid (As mentioned in Table 4)

ii. Tax/Cess Paid in Cash (option of which is available as you log in to GST Portal)

3. Ensure that CGST & SGST are not cross utilized(The form would anyway not allow for the same)

4. TDS/TCS provisions are not yet effective hence as of now it is not required to be explained.

FAQ:

1. I am a composition dealer; do I need to file GSTR-3b?

Ans: GSTR-3B is for those taxpayers, who were required to file GSTR-1, 2 & 3.For composition dealer, you would be required to File GSTR-4 on quarterly basis and hence GSTR-3B is not applicable to you.

2. Once I File GSTR-3B, is the GST Filing for July month done with?

Ans: No, GSTR-1, 2, 3 has to be filed by 5, 10, 15 of September respectively and same applies for the month of August. Where Bill wise details are to be submitted on 20, 25 and 30 th of September.

SUGGESTION:

1. It is advisable to ensure that your First GST Return is filed before Due Date.

2. Before filing the return, ensure that all your expenses are recorded along with CGST, SGST & IGST Component for which you can claim Input credit.

3. Being First return, Consult Chartered Accountants, GST Advisors, Tax advisors for being on safety Side.