Normally, Seller Collects GST from Buyer and Pays to Government

However, in some cases, Buyer Pays GST Directly to Government

This is called Reverse Charge in GST

What is Normal Charge and Reverse Charge Mechanism (RCM) in GST

Normal Charge

Normally, Seller Collects GST from Buyer and Pays to Government This is called Normal Charge

Example

Suppose A provides Service to B of 100000 + GST 18000

In this case, B will pay A Rs 118000 ,A will deposit 18000 GST to Government

Reverse Charge

Seller gives Buyer bill without GST

In this case, Buyer Pays only bill amt to seller and deposit GST Directly to Government

This is called Reverse Charge in GST

Example

A will provide Service to B of 100000 (without tax)

In this case, B will pay A Rs 100000 and deposit GST of 18000 directly to Government

GST in Case of Goods

Earlier Reverse Charge was applicable in Case of Services only (in Service Tax)

It was not applicable in case of Goods (There was no reverse charge concept in Vat)

However, now in GST, it is applicable in Goods Also

Example

X Sold Goods to B of Rs 100000 Suppose GST Rate is 5%, X will sell goods to Y for Rs 100000 + GST 5% = 105000

Y will pay X Rs 105000 and X will pay 5000 to Government

However , If X is Unregistered in GST, then X cannot charge GST on it Then Reverse Charge will also be applicable on it

Y will pay X 100000 and deposit 5000 Directly to Government

When is Reverse Charge Applicable?

It is applicable as per Section 9(3) and Section 9(4)

- Section 9(4) - Purchases from Unregistered Dealer were covered here Local Purchases upto 5000 per day were exempt.

- Section 9(3) - Certain Goods and Services notified by Government were covered like Goods Transport Agency, Freight etc.

As per decision in GST Council Meeting Section 9(4) has been stopped by Government However, Section 9(3) is still applicable. Hence GST is still applicable on following services

Reverse Charge List

| NAME OF SERVICE | SERVICE PROVIDER | SERVICE RECEIVER |

| Advocate Service | Any Lawyer/Law firm | Any Business Entity |

| Manpower Service(From 1 Jan 2019) | Any Unregistered Person | Registered Person |

| Import of Service (Service provided from Non-Taxable Territory) | Foreign Party | Indian Co |

| Transport of Goods by Road(GTA) | Goods Transport Agency | Any person Registered Under CGST, UTGST, SGST |

| Any Factory, | ||

| Any Society/Cooperative Society Registered in India | ||

| Any body corporate(Company) | ||

| Any Partnership Firm | ||

| Sponsorship Service | Any Person | Any body corporate(Company) or Partnership |

| Service by Director | Director | Any body corporate(Company) |

| Insurance Agent Service | Insurance Agent | Insurance Co |

| Recovery Agent Service | Recovery Agent | Bank or Financial Institutions |

| Ocean Freight(Transport of Goods by Vessel from place outside India to customs clearance in India) | Foreign Party(Person located in Non-Taxable Territory) | Importer |

| Copyright Service related to literary, dramatic, musical, artistic work | Author, music composer, photographer, artist | Publisher, Music Composer, Producer |

| Radio Taxi Service | Taxi Driver | E Commerce Company |

| All Service by Government except | Govt | Business Entity |

| Renting of Immovable Property | ||

| Service by Department of Posts | ||

| Service in Relation to Aircraft or vessel | ||

| Service of Transport of Goods or Passengers |

Reverse Charge on Goods

| Description of supply of goods | Supplier of goods | Recipient of goods |

| Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| Bidi wrapper leaves (tendu) | Agriculturist | Any registered person |

| Tobacco leaves | Agriculturist | Any registered person |

| Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent |

| Silk yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any registered person |

Whether we get input of Reverse Charge?

On Certain Items, No Input will be available like Food, Catering, etc

On Other Items, Input Available Next Month

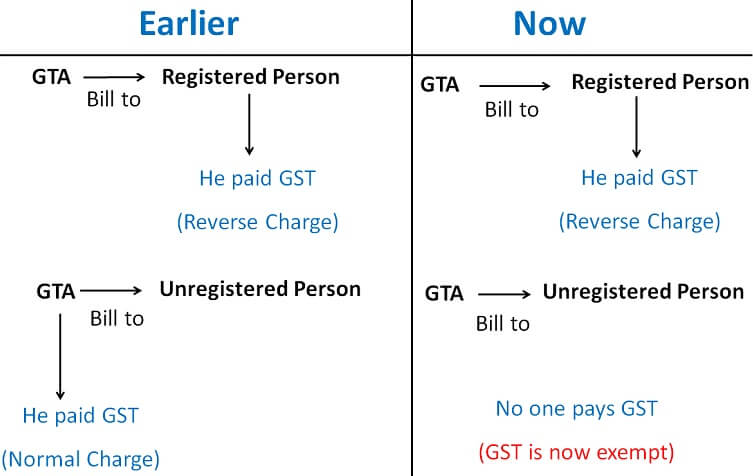

GTA(Goods Transport Agency) Service To Unregistered Person Exempted

Earlier If Goods Transport Agency (GTA) provided services to Unregistered Persons, they had to pay GST

Because of this GTA were not willing to supply services to Unregistered persons.

Now,

This service has been exempted.

What will be entry of Reverse Charge?

It depends upon whether we get Input of

|

Ajay Transport |

|

|

Bill to My Co. |

A LTD |

|

Freight Charges |

100000 |

|

TOTAL |

100000 |

Suppose GST Rate is 5% (2.5% CGST, 2.5% SGST)

Entry

Case 1

Bill Received on 10 April

Payment made on 29 April

View Answer| No Input of Reverse Charge | Input Available of Reverse Charge |

|

10 April Freight Exp Dr. 100000 To Ajay Transport 100000 29 April Ajay Transport 100000 To Bank 100000

30 April Reverse Charge Exp Dr. 5000 To Output CGST 2500

To Output SGST 2500

After paying GST Output CGST Dr. 2500 Output SGST Dr. 2500 To Bank 5000 |

10 April Freight Exp Dr. 100000 To Ajay Transport 100000 29 April Ajay Transport 100000 To Bank 100000

30 April Input CGST (Deff) Dr. 2500 Input SGST (Deff) Dr. 2500 To Output CGST 2500 To Output SGST 2500

After paying GST Output CGST Dr. 2500 Output SGST Dr. 2500 To Bank 5000

Input CGST Dr. 2500 Input SGST Dr. 2500 To Input CGST (Deff) 2500 To Input SGST (Deff) 2500 |

Case 2

Bill Received on 10 April

Payment not made within 61 Days

View Answer| No Input of Reverse Charge | Input Available of Reverse Charge |

|

10 April Freight Exp Dr. 100000 To Ajay Transport 100000 30 June Reverse Charge Exp Dr. 5000 To Output CGST 2500

To Output SGST 2500

After paying GST Output CGST Dr. 2500 Output SGST Dr. 2500 To Bank 5000 |

10 April Freight Exp Dr. 100000 To Ajay Transport 100000 30 June Input CGST (Deff) Dr. 2500 Input SGST (Deff) Dr. 2500 To Output CGST 2500 To Output SGST 2500

After paying GST Output CGST Dr. 2500 Output SGST Dr. 2500 To Bank 5000

Input CGST Dr. 2500 Input SGST Dr. 2500 To Input CGST (Deff) 2500 To Input SGST (Deff) 2500 |

Case 3

First Payment in Advance on 25 April then Bill Received later on 18 june

View Answer| No Input of Reverse Charge | Input Available of Reverse Charge |

|

25 April Ajay Transport 100000 To Bank 100000 30 April Reverse Charge Exp Dr. 5000 To Output CGST 2500

To Output SGST 2500

After paying GST Output CGST Dr. 2500 Output SGST Dr. 2500 To Bank 5000

18 June Freight Exp Dr. 100000 To Ajay Transport 100000 |

25 April Ajay Transport 100000 To Bank 100000 30 April Input CGST (Deff) Dr. 2500 Input SGST (Deff) Dr. 2500 To Output CGST 2500 To Output SGST 2500

After paying GST Output CGST Dr. 2500 Output SGST Dr. 2500 To Bank 5000

Input CGST Dr. 2500 Input SGST Dr. 2500 To Input CGST (Deff) 2500 To Input SGST (Deff) 2500

18 June Freight Exp Dr. 100000 To Ajay Transport 100000 |

When is Output GST Payable, on Bill or Payment?

It depends upon Time of Supply of Goods and Services

| Time of Supply Reverse Charge of Goods | Time of Supply Reverse Charge of Services |

|

We have to consider earlier of

|

We have to consider earlier of

|

Whether Input can be used to Pay Reverse Charge Liability

No we have to deposit GST Reverse charge Liability from cash Ledger

We cannot reduce it from Input Tax Credit available to us

Example

Output GST on Sales 100

Output GST on Reverse Charge 30

Total Output 130

Input GST 110

In this case,

We have to Pay GST on Reverse Charge of 30

We can adjust input of 100 against our Output

Remaining 10 we can carry forward

Summary

Download in PDF

Registration Threshold Limit under Reverse Charge in GST

There is Compulsory Registration in GST In case of Reverse Charge

Buyer cannot say that his Invoice amount is less, so need to pay GST

In this case, he has to compulsorily get himself registered in GST and pay tax

Comparison of Normal Charge and Reverse Charge

|

NORMAL CHARGE |

REVERSE CHARGE |

|

Registration Limit If Aggregate Turnover is greater than 40 lacs (for goods) and 20 lacs(for services), then Compulsory Registration (Limit is 20 lacs(for goods) and 10 lacs (for services) for North Eastern States)

Aggregate turnover includes all types of Sales like

(Amount of taxes not to be included)

However Compulsory Registration Required for MAKING

|

Reverse Charge There is Compulsory Registration No Limit of 40 lacs /20 lacs here |