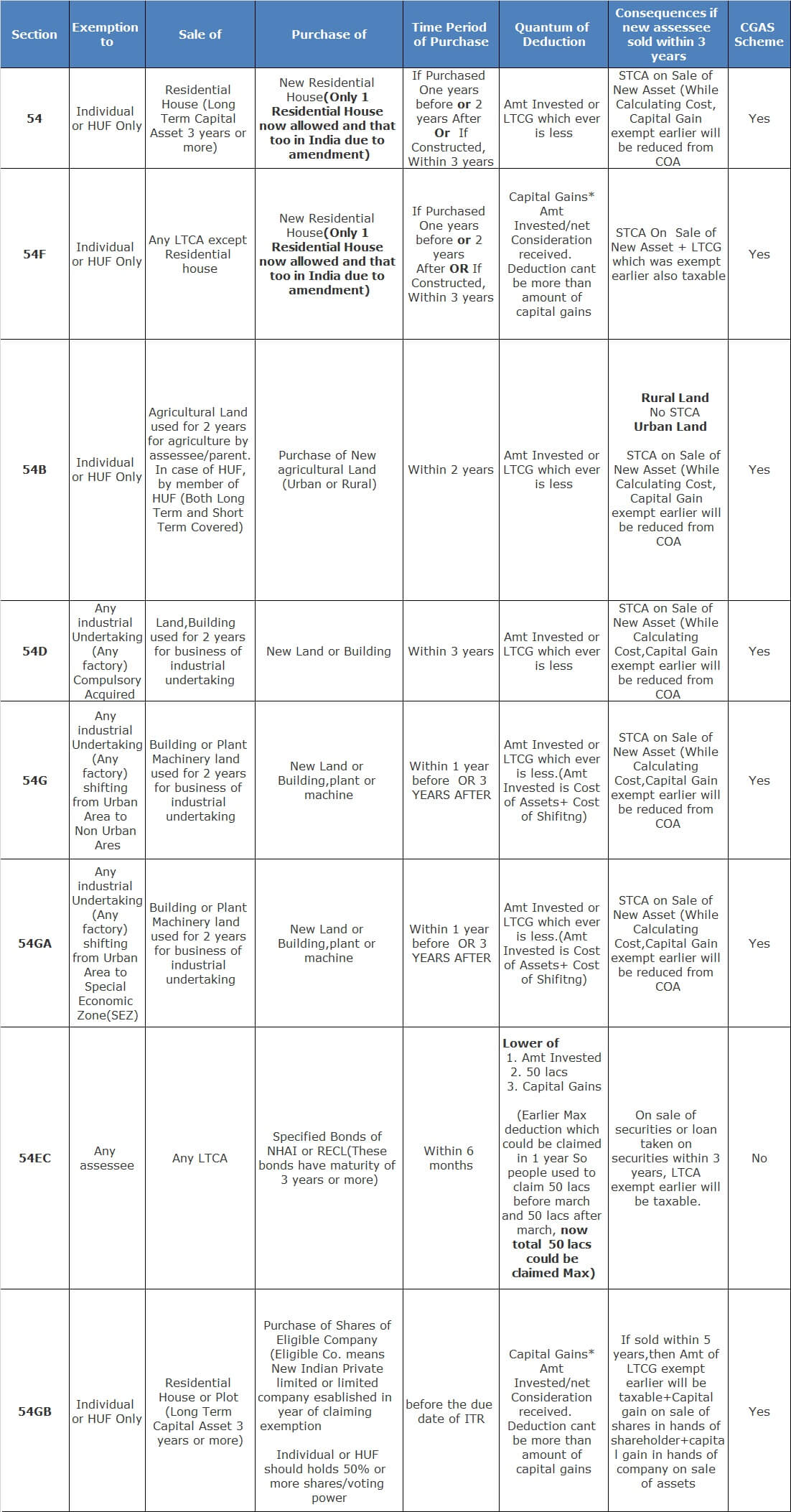

This is the Summary of Different Sections of Income Tax Act for Easier Understanding and Rememberance

Download chart in excel

SUMMARY

| Section | Exemption to | Sale of | Purchase of | Time Period of Purchase | Quantum of Deduction | Consequences if new assessee sold within 3 years | CGAS Scheme |

| 54 | Individual or HUF Only | Residential House (Long Term Capital Asset 3 years or more) | New Residential House (Only 1 Residential House now allowed and that too in India due to amendment) | If Purchased One years before or 2 years After Or If Constructed, Within 3 years | Amt Invested or LTCG which ever is less | STCA on Sale of New Asset (While Calculating Cost, Capital Gain exempt earlier will be reduced from COA | Yes |

| 54F | Individual or HUF Only | Any LTCA except Residential house | New Residential House (Only 1 Residential House now allowed and that too in India due to amendment) | If Purchased One years before or 2 years After OR If Constructed, Within 3 years | Capital Gains* Amt Invested/net Consideration received. Deduction cant be more than amount of capital gains | STCA On Sale of New Asset + LTCG which was exempt earlier also taxable | Yes |

| 54B | Individual or HUF Only |

Agricultural Land used for 2 years for agriculture by assessee/parent. In case of HUF, by member of HUF (Both Long Term and Short Term Covered) |

Purchase of New agricultural Land (Urban or Rural) |

Within 2 years | Amt Invested or LTCG which ever is less |

Rural Land No STCA Urban Land STCA on Sale of New Asset (While Calculating Cost, Capital Gain exempt earlier will be reduced from COA

|

Yes |

| 54D | Any industrial Undertaking(Any factory) Compulsory Acquired | Land,Building used for 2 years for business of industrial undertaking | New Land or Building | Within 3 years | Amt Invested or LTCG which ever is less | STCA on Sale of New Asset (While Calculating Cost,Capital Gain exempt earlier will be reduced from COA | Yes |

| 54G | Any industrial Undertaking(Any factory) shifting from Urban Area to Non Urban Ares | Building or Plant Machinery land used for 2 years for business of industrial undertaking | New Land or Building,plant or machine | Within 1 year before OR 3 YEARS AFTER | Amt Invested or LTCG which ever is less.(Amt Invested is Cost of Assets+ Cost of Shifitng) | STCA on Sale of New Asset (While Calculating Cost,Capital Gain exempt earlier will be reduced from COA | Yes |

| 54GA | Any industrial Undertaking(Any factory) shifting from Urban Area to Special Economic Zone(SEZ) | Building or Plant Machinery land used for 2 years for business of industrial undertaking | New Land or Building,plant or machine | Within 1 year before OR 3 YEARS AFTER | Amt Invested or LTCG which ever is less.(Amt Invested is Cost of Assets+ Cost of Shifitng) | STCA on Sale of New Asset (While Calculating Cost,Capital Gain exempt earlier will be reduced from COA | Yes |

| 54EC | Any assessee | Any LTCA | Specified Bonds of NHAI or RECL(These bonds have maturity of 3 years or more) | Within 6 months |

Lower of

|

On sale of securities or loan taken on securities within 3 years, LTCA exempt earlier will be taxable. | No |

| 54GB | Individual or HUF Only | Residential House or Plot (Long Term Capital Asset 3 years or more) |

Purchase of Shares of Eligible Company (Eligible Co. means New Indian Private limited or limited company esablished in year of claiming exemption Individual or HUF should holds 50% or more shares/voting power |

before the due date of ITR | Capital Gains* Amt Invested/net Consideration received. Deduction cant be more than amount of capital gains | If sold within 5 years,then Amt of LTCG exempt earlier will be taxable+Capital gain on sale of shares in hands of shareholder+capital gain in hands of company on sale of assets | Yes |

Download chart in excel