TDS means Tax Deducted at Source.

It is a tax which is to be deducted on some expenses and payments

As per Income Tax Act, persons responsible for making payments are required to deduct TDS at different rates.

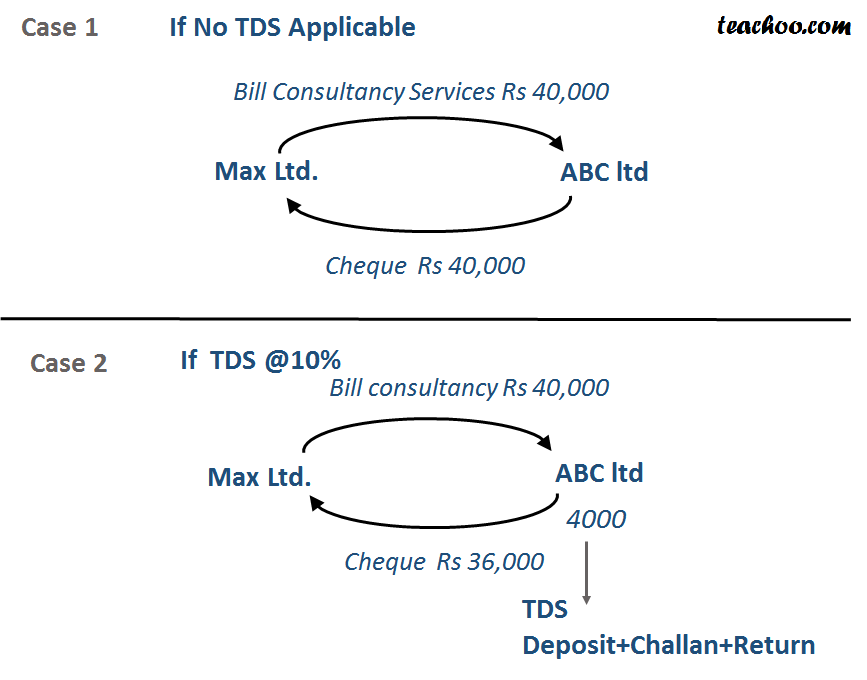

Example

Suppose Max Ltd provided Consultancy Service to ABC Ltd for 40000

In this case,ABC will pay Max Rs 40000.

However,if in this cases,TDS @ 10% is to be deducted, then ABC will deduct 4000,and pay Max only 36000

ABC will deposit this 4000 TDS with Government

Why this tax called Tax Deducted at Source?

Source of Income of Max is Amount to be received by ABC

Tax has been deducted at this source by ABC

Who is Deductor and Deductee ?

- Deductor is the person who deducts tax at source (ABC)

- Deductee is the person whose tax was deducted.(Max)

Duties of Deductor

- Deduct TDS

- Deposit TDS

- File TDS Return

- Issue TDS Certificate

Duties of Deductee

- Issue Bill

- Collect payment

- Collect TDS Certificate

- Check TDS Deducted Online

- Adjust TDS with his Income Tax Liability while filing ITR

Difference between Income Tax and TDS

|

Income Tax |

TDS |

|

When we deposit our own Tax, it is called Income Tax |

When we deduct some other person tax and deposit it, it is called TDS |

Written on Feb. 15, 2018, 11:47 a.m.