![[Class 11 Accountancy] What are Outstanding Expense? - With Questions - Chapter 1 - Introduction to Accounting](https://cdn.teachoo.com/81e59311-2c9a-4e91-8da3-3ca211855dee/slide1-what-are-outstanding-expense.png)

Chapter 1 - Introduction to Accounting

Last updated at December 23, 2025 by Teachoo

![[Class 11 Accountancy] What are Outstanding Expense? - With Questions - Chapter 1 - Introduction to Accounting](https://cdn.teachoo.com/81e59311-2c9a-4e91-8da3-3ca211855dee/slide1-what-are-outstanding-expense.png)

Transcript

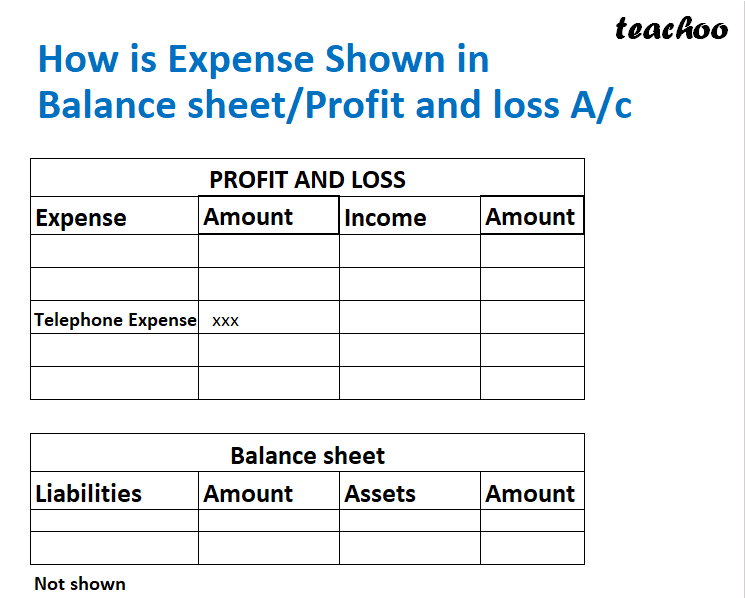

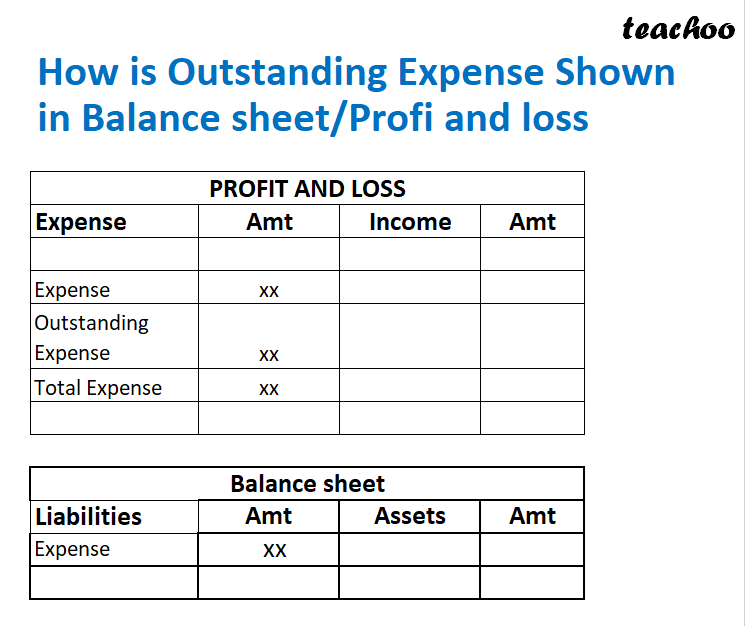

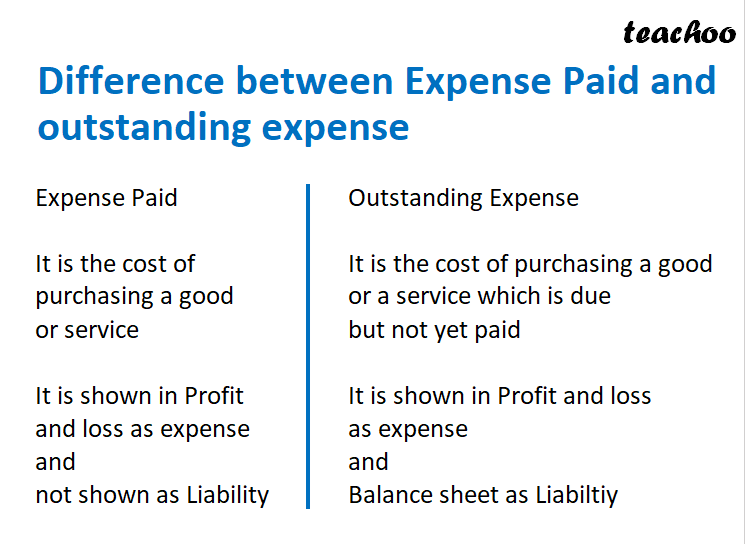

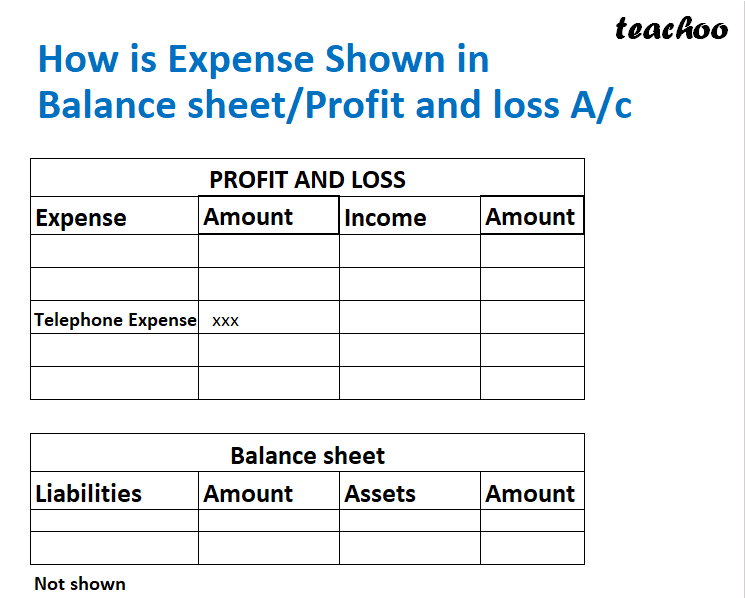

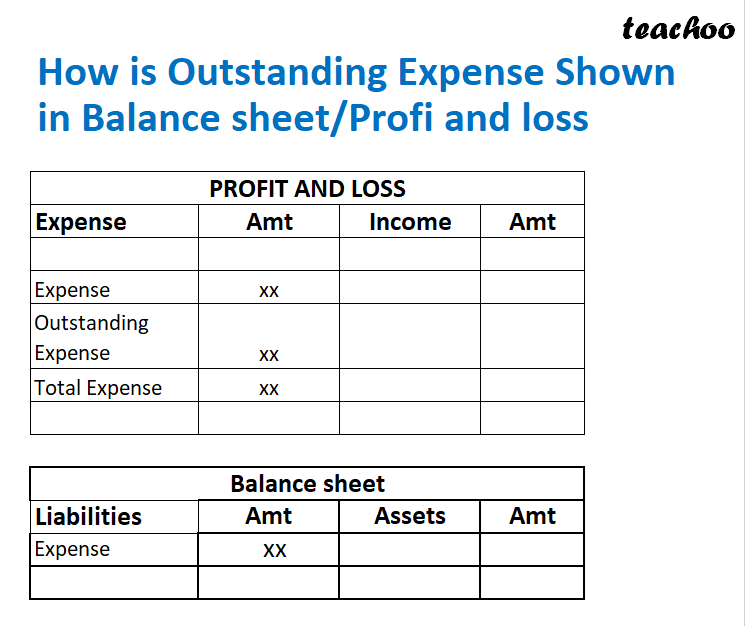

What are Outstanding Expense What is Expense? It is the cost of purchasing a good or a service It is the cost incurred for earning revenue(income) What is Outstanding Expense? It is an expense which has not been paid during the the accounting year Is Expense Part of Profit and Loss or Balance sheet? It is normally a part of Profit and loss But if it is not paid by us,it can be part of Balance sheet also.These are called outstanding expense Example 1 Telephone Bill of Airtel Received of Date 20 March If it is paid by 31 March,it is Normal Expense If it is not paid by 31 March,it is Outstanding expense as on 31 March Telephone Expense Telephone Expense Due, Paid Not yet Paid In Profit and loss In Profit and loss We show We show Telephone Exp Telephone Exp as expense as expense In In Balance sheet Balance sheet we don't show in We show Telephone Balance sheet Expense outstanding, It is not a liability as as liability as we have paid it we have to pay it in future Difference between Expense Paid and outstanding expense Expense Paid Outstanding Expense It is the cost of It is the cost of purchasing a good purchasing a good or a service which is due or service but not yet paid It is shown in Profit It is shown in Profit and loss and loss as expense as expense and and not shown as Liability Balance sheet as Liabiltiy How is Expense Shown in Balance sheet/Profit and loss A/c PROFIT AND LOSS Expense Amount Income Amount Telephone Expense xxx Balance sheet Liabilities Amount Assets Amount Not shown How is Outstanding Expense Shown in Balance sheet/Profi and loss PROFIT AND LOSS Expense Amt Income Amt Expense xx Add:- Outstanding Expense xx Total Expense xx Balance sheet Liabilities Amt Assets Amt Outstanding Expense xx