We know that Due date for TDS is 7th of next month

However for March,TDS Due date is 30 April

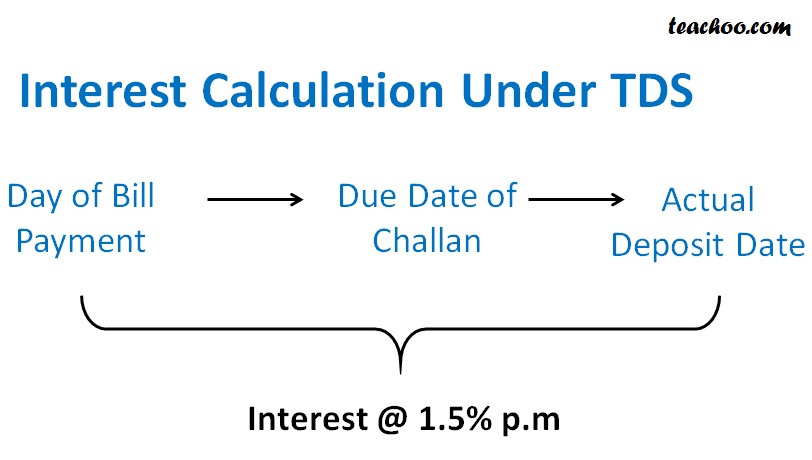

If deposited late,we have to pay interest @ 1.5%

If TDS is deposited late

Interest is payable from

Date of Deduction (and not Last Date of Challan)

to

Actual Date of Deposit

@ 1.5%

Changes in Interest Rate due to lockdown, If TDS Late Deposit

However,Due to Lockdown,Government has temporarily reduced Rate by 50%

| Current Rate | New Rate (Temporary) | |||||||

| Interest Rate on Late Deposit of TDS | 1.50% | 1.5%*50%=0.75% | ||||||

Due between 20 Mar 2020 to 29 June 2020,

if paid by 30 June 2020

Example 1

Bill of 20 October received of 50000 of Maintenance Charges

Payment made on 24 Oct of 49000(50000-2% tds)

What is Date of Deduction?

View AnswerDate of Deduction is

Earlier of

Bill -->20 Oct

or

Payment-->24 Oct

i..e 20 Oct

What is date of Deposit?

View AnswerDate of Deposit is 7th of Next month of Deduction

i.e. 7 November

Suppose TDS Actually deposited on 8 November

What is Interest to be paid?

View AnswerInterest is to be calculated from 20 Oct to 8 November

This will count as 2 months (October and November)

Interest Rate =1.5%

Interest Amount=1000*1.5%*2=Rs 30

Note

If TDS of March late deposited,then 3 Months Interest Payable

1.5%*3=4.5%

Example 2

Bill of 29 March received of 50000 of Maintenance Charges

Payment made on 30 March of 49000(50000-2% Tds)

What is Date of Deduction?

View AnswerDate of Deduction is

Earlier of

Bill -->29 March

or

Payment --->30 March

i.e 29 March

What is date of Deposit?

View AnswerDate of Deposit is 30 April for March TDS Non Salary

Suppose TDS Actually deposited on 1 May

What is Interest to be paid?

View AnswerInterest is to be calculated from 29 March to 1 May

This will count as 3 months (March,April and May)

Interest Rate =1.5%

Interest Amount=1000*1.5%*3=Rs 45