What is Tan Number?

Tan number is Tax Deduction Account Number or Tax Collection Account Number.

- It is Registration Number for TDS

- It is Required in case of filing TDS-TCS Challan and Return

What is Difference Between Pan Number and Tan Number?

| PAN Number | TAN Number |

| Pan is Permanent Account Number | Tax Deduction and Collection Account Number |

| we get it in card format | it is not in card format, it is just an alphanumeric code |

| It is used at the time of preparation and submission of Income tax Return. | TAN is used at the time when a person responsible to deduct tax, tds challan payment, tds return,tcs return |

| Application form for PAN is 49A in case of Indians and 49AA in case of foreigners | Application form for TAN is 49B |

Why is Tan Number Required?

It is required when filling

TDS Returns ⟶ Form 24Q,26Q,27Q

TCS Return ⟶ 27EQ

TDS TCS Challan ⟶ Challan 281

In What Cases of TDS Tan Number Not Required?

-

TDS on property

Section 194IA-

TDS to be deducted @ 1% on purchase of immovable property more than Rs 50 lacs

-

TDS on personal rent

As per section 194IB-

Any person liable to pay TDS for more than Rs.50000 p.m. is liable to deduct TDS @ 5%

-

TDS on payment to contractors

As per section 194M- (From 1 Sep 2019)

TDS is to be deducted by Individual/HUF at 5% on payment made more than Rs 50 lacs to resident contractors and professionals.

What does the Different Digits of Tan Number?

It’s a 10 digits alphanumeric number,

First three alphabets of TAN represent the city name; forth alphabet represents the TAN holders name with the first letter of name.

Example:

TAN number allotted to Mr. Aditya of Bangalore may look like: BLR A 23456 M

How to Apply Tan Number Online?

First of all, we will fill the application form, pay.

Then we get an acknowledgment for the TAN application,

In which the signature / left thumb impression of the applicant has to be sent.

Then we get a tan number.

Detailed Procedure :-

-

First click on NSDL website ⟶ https://www.tin-nsdl.com/

-

IN heading ⟶ click on services ⟶ select TAN

-

In left side click on ⟶ apply online ⟶ new tan

-

Online Application for TAN (Form 49B) PAGE WILL OPEN

Read guidelines carefully

Go to ‘Apply for New TAN’

Select ⟶ CATEGORY OF DEDUCTORS- Central / State Government

- Statutory /Autonomous Bodies

- Company

- Branch/Division of a Company

- Individual / Hindu Undivided Family (Karta)

- Branch of Individual Business (Sole proprietorship concern) / Hindu Undivided Family (Karta)

- Firm / Association of Persons / Association of Persons (Trusts) / Body of Individuals / Artificial Juridical Person

-

Branch of Firm / Association of Persons / Association of Persons (Trusts) / Body of Individuals / Artificial Juridical Person

-

Form no. 49b will open

Click Here

Select AO code with first letter of your name

Select City

Select AO code

-

THEN FILL THE FOLLOWING DETAILS

Details Depend Upon Type OF Business

For Example-

A proprietorship will only fill part (e)

A Company will fill part (c)

A partnership will fill part (g)

-

Fill all Details

-

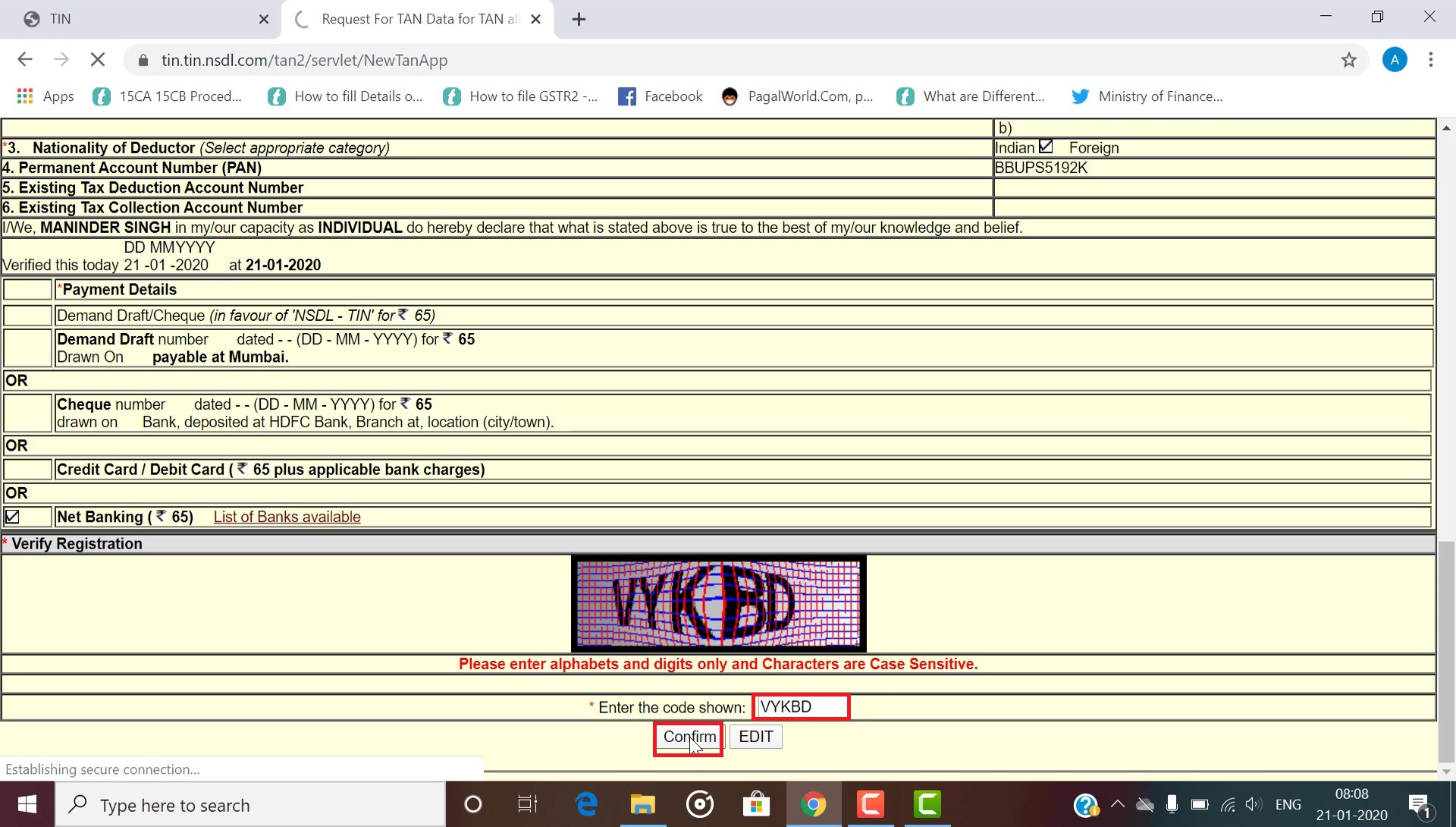

Payment Details (select appropriate mode of payment and fill relevant details)

Select Bank

-

Enter Code and Click Confirm

-

Make Payment

-

After payment we get 'Acknowledgment for TAN application'.

-

We have to send it to the office of National Securities Depository Limited, Pune along with the signature and a photo copy of PAN card.

NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune - 411016

Tel: 020 - 27218080; Fax: 020 - 27218081.

-

After this, when your application reaches there, you will receive this kind of mail

How to Apply Tan Number Offline

First, we will download and fill the application form 49B.

Then we will submit it to any TIN-Facilitation Centre near us.

Detailed Procedure:-

-

Download Application Form

Form 49b.pdf

-

Fill the form and submitted to any TIN-Facilitation Centres.

-

You can search TIN-Facilitation Centres from the following link

https://www.tin-nsdl.com/tin-facilities.html

-

GO TO "

Search for TIN-Facilitation Centres Cum PAN Centres near your location

"

- Choose a State/ Union Territory

- Choose a location

- Choose a near location from your destination and submit the form

What is the legal fees of Tan Number?

The processing fee for the New TAN is 65 (including Goods and Service Tax).

| Particular | Amount |

| Tan Fee | 55 |

| IGST 18% | 9.9 |

| Total | 65 |

Do we get Tan Card just like Pan Card?

No, we shall not get tan card like pan card. It is just a alphanumeric code issued by the Income-tax Department

What procedure we choose online or offline?

If we choose online method

We have to send 'Acknowledgment for TAN application' print out to the office of National Securities Depository Limited, Pune

We can send it through post, speed post or courier.

In this case, we have to Pay Tan Fees of + Courier Charges

So this process turns out to be expensive

In offline method

We should pay only 65 rupees application fees (same as online application)

In this case, we have to physically visit one of the Tin Facilitation Centres to deposit the form

But we save courier charges

Get list of nearest Facilitation centres here:

https://www.tin-nsdl.com/tin-facilities.html

So, Offline procedure is the best option for applying for tan number.

How is Tan Number Allotted?

We will not get it in physical, we get a mail like this

How to check status of Tan?

First click on NSDL website on https://www.tin-nsdl.com/

-

Click Services ⟶ Click TAN Number ⟶ Then click Know Status of Your Application

-

Put ⟶ Acknowledgment number ⟶ Enter the code show Then Submit