Here we will learn complete details about PF like what is PF, What are Different Rates of PF like EPF, EPS, Difference, PF Admin Charges, EDLI Admin Charges etc)

What is Provident Fund

It is a scheme for the benefit of employees,

In this scheme,

- Certain amount is deducted from employee salary.

- Some amount is also contributed by Employer(Company)

- Both Employer and Employee Contribution is invested

- Every year Interest is earned on amount Contributed.

- Whole Amt (Employer+ Employee + Interest) is received later on retirement etc

What are the rates of PF?

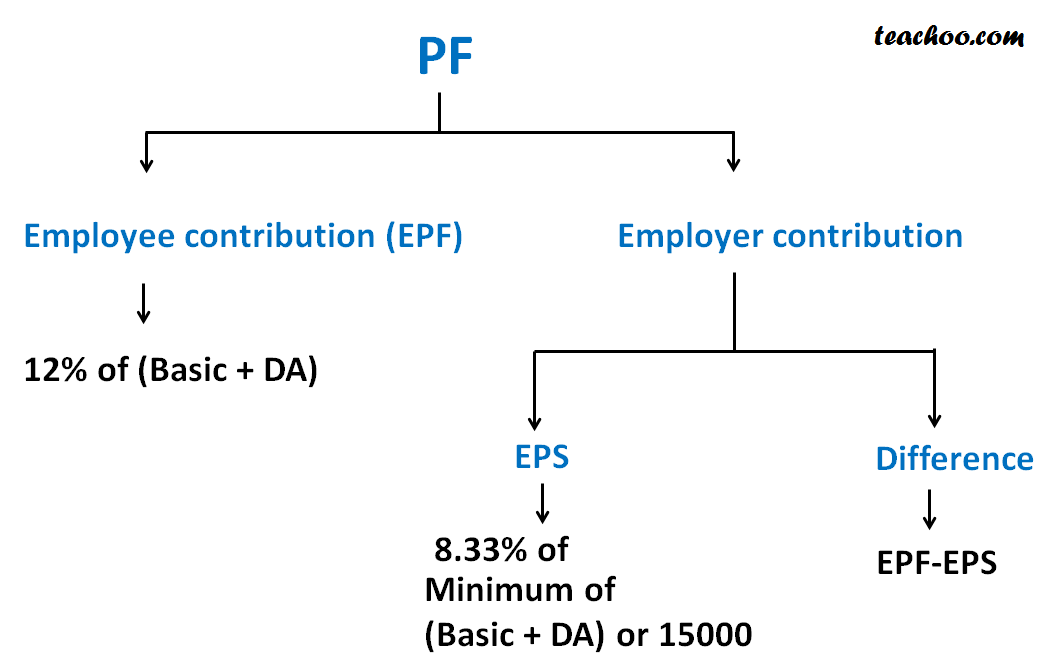

Both Employer and Employee Contribute towards PF

Employee Contribution to PF

12% of (Basic Salary+ DA)

Note:- In case of Private Companies,there is no DA (Dearness Allowance) ,hence it is 12% of Basic

Employer Contribution

Employer (Company) also contribute 12%

but it goes in 2 heads

- Employee Pension Scheme (EPS) 8.33%

- Difference

Why Employer share is in 2 Parts, EPS and Difference?

EPS Amount

View AnswerEPS means Employee Pension Scheme

This amount is received as pension on retirement of person

This cannot be more than 1250 pm for employee (15000*8.33%)

Difference Amount

View AnswerThis amount is added to PF amount and is received on retirement of a person

It is difference of EPF and EPS

Suppose Employee pays PF of 4000

Employer also has to pay PF of 4000

Out of this 1250 is deposited as EPS

Balance Amount of 4000-1250=2750 is called Difference

Example 1

Suppose Basic Salary is 10000

DA is 2000

EPS=8.33% OF 12000=1000

Example 2

Suppose Basic Salary is 100000

DA is 2000

EPS=8.33% OF 15000=1250

Important Points

EXAMPLE 1

If Basic + DA is upto 10000, Calculate Employee and Employer Contribution?

View AnswerEmployee Contribution

EPF=12% *10000=1200

Employer Contribution

EPS=8,33%*10000=833

Difference=1200-833=367

Total Employer=833+367=1200

EXAMPLE 2

If Basic + DA is 2000, Calculate Employee and Employer Contribution?

View Answerin Many Companies, Employee and Employer are Paying PF on higher amount of 20000

Employee Contribution

EPF=12% *20000=2400

Employer Contribution

EPS=8,33%*15000=1250

Difference=2400-1250=1150

Total Employer PF=1250+1150=2400

Note-

Even if PF is calculated at higher amount, For EPS, we will take 15000 limit only

Remaining amount wil go to Difference

Question 1

| Particulars | Case 1 | Case 2 |

| Basic | 5000 | 50000 |

| DA | 1000 | 10000 |

| Special Pay | 4000 | 40000 |

| Total | 10000 | 100000 |

Calculate the following

| Particulars | Case 1 | Case 2 |

| Gross Salary | ||

| EPF | ||

| EPS | ||

| Difference | ||

| Total ER contribution | ||

| Net Salary | ||

| EPF Wages | ||

| EPS wages |

| Particulars | Case 1 | Case 2 |

| Gross Salary | 10,000 | 100000 |

| EPF | 720 | 7200 |

| EPS | 499.8 | 1249.5 |

| Difference | 220.2 | 5950.5 |

| Total ER contribution | 720 | 7200 |

| Net Salary | 9280 | 92800 |

| EPF Wages | 6000 | 60000 |

| EPS wages | 6000 | 15000 |

Question 2

What is EPF Wages?

View AnswerEPF wages mean amount on which EPF is to be calculated i.e. Basic + DA

Question 3

What is EPS Wages?

View Answer

EPS wages means amount on which EPS is to be calculated i.e. (Basic+DA) or 15000 whichever is Minimum

Other Charges Paid by Employer

Note:-Total here means total of all employees

What are PF Admin Charges?

View AnswerNormally whole share of Employee and Employer PF (EPF, EPS and Difference) is deposited with PF Department in Employee A/c

Whole amount is recovered on retirement of Employee or as pension

To cover salary and office expenses of PF Department, PF Admin Charges are also recovered from the employer

It is 0.5%*EPF WAGES

(There is no limit of 15000)

Minimum PF Admin Charges are 500 per month for all employees

It is to be paid only by Employer and not Employee

What are EDLI Charges and EDLI Admin Charges?

View AnswerEDLI means Employee Deposited Linked Insurance

It is a kind of life insurance scheme in which on death of employee, beneficiary gets a lumsome amount

Employer has to Pay EDLI Charges @ 0.5% of EPS Wages

(Note-EPS Wages =basic+da or 15000 which is minimum)

EDLI Admin Charges

Earlier Employer also had to pay EDLI Admin Charges @ 0.01% of EPS Wages (Min 200),now these are totally exempted from 1/4/2017

Minimum PF

Note- Some Companies Pay Minimum PF on 15000 only

If Basic + Da is 20000(more than 15000), do Employee and Employer have to pay PF on 15000 or 20000?

View AnswerLegally, Employee and Employer are liable to Pay PF on Max 15000 only

Employee Contribution

EPF=12% *15000=1800

Employer Contribution

EPS=8,33%*15000=1250

Difference=1800-1250=550

Total Employer=1800

However, in Many Companies, Employee and Employer are Paying PF on higher amount of 20000

View AnswerEmployee Contribution

EPF=12% *20000=2400

Employer Contribution

EPS=8,33%*15000=1250

Difference=2400-1250=1150

Total Employer PF=1250+1150=2400

Note-

Even if PF is calculated at higher amount, For EPS, we will take 15000 limit only

Remaining amount wil go to Difference

Is EPF Rate Always 12%?

View AnswerNo

EPF Rate is 10% in following cases

- If there less than 20 employees

- In case of Jute/Bedi/Brick/Coir/Guar gum Factories

- Sick Industrial Company

- Loss Making Company(Total Losses are more than Net Worth of Company

What are the rules of PF for Workers Employed abrading Foreign Countries?

View AnswerIn PF, he is called international worker

PF is to be deposited for international workers also

However, max limit of 15000 is not available,

Example

Suppose Employee has Salary of 20000, both Employee and Employer has to pay PF on 20000

They cannot pay PF on lower limit of 15000

In what cases EPS is not applicable

View AnswerEPS is not applicable in case

Person is more than 58 years of age and in job

Person was receiving pension, later he re-joins company

In this case, whole amount is deposited in Difference Head