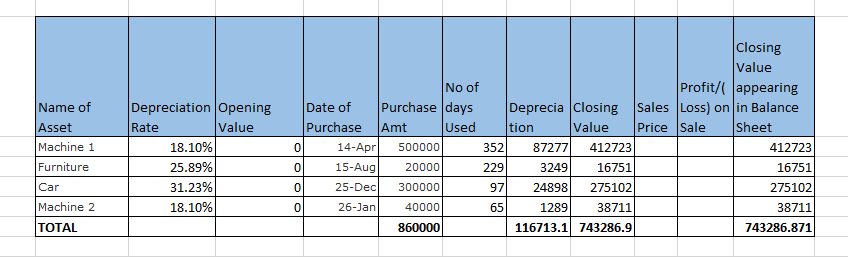

Example 1:-

In 2014-15 Company purchased the following assets

| Asset Name | Purchase Amt | Date of Purchase | Dep Rate |

| Machine 1 | 500000 | 14-Apr | 18.10% |

| Furniture | 20000 | 15-Aug | 25.89% |

| Car | 300000 | 25-Dec | 31.23% |

| Machine 2 | 40000 | 26-Jan | 18.10% |

Example 2:-

Continuing previous question,Suppose in 2015-16,Following Assets Were Purchased

| Name of Asset | Amount | Date of Purchase | Depreciation Rate |

| Furniture | 75000 | 20-Apr | 25.89% |

| Computer | 50000 | 15-Nov | 63.16% |

Compute Depreciation in 2015-16

Depreciation for year ended 31-03-2016

View Answer

Example 3:-

Continuing previous question,Suppose in 2016-17,Car and Machine 1 Sold for 200000 and 350000 respectively on 10 April and 30 April

View Answer