Which ITR form for whom?

List of ITR Forms for Financial Year 2016-17 (AY 2017-18)

|

Form |

Used for |

|

ITR 1 |

Small Salaried or Interest or One House Property upto 50 lacs |

|

ITR 2 |

2 House Property or Capital Gain or Salary >50 lacs |

|

ITR 3 |

Large Proprietorship (Audit Case) |

|

ITR 4 |

Small Business Proprietorship/Partnership/Small Professionals |

|

ITR 5 |

Large Partnership (Audit Case) |

|

ITR 6 |

Companies (Private Limited) |

|

ITR 7 |

NGO/Trust/Temple/Hospital |

List of ITR Forms for Financial Year 2015-16 (AY 2016-17)

|

Form |

Used for |

|

ITR 1 |

Small Salaried or Interest or One House Property |

|

ITR 2A |

2 House Property or Capital Gain or Salary >50 lacs |

|

ITR 2 |

Capital Gain or Having Foreign Assets |

|

ITR 3 |

Partner having No Other Business |

|

ITR 4 |

Large Proprietorship (Audit Case) |

|

ITR 4S |

Small Business Proprietorship/Partnership/Small Professionals |

|

ITR 5 |

Large Partnership (Audit Case) |

|

ITR 6 |

Companies (Private Limited) |

|

ITR 7 |

NGO/Trust/Temple/Hospital |

Important Changes in ITR Forms

|

PARTICULARS |

FINANCIAL YEAR 2015-16 (AY 2016-17) |

FINANCIAL YEAR 2016-17 (AY 2017-18) |

|

44AD/44AE Scheme |

ITR 4S |

ITR 4 |

|

44ADA Scheme for Professionals |

N/A |

ITR 4 |

|

Proprietorship Audit |

ITR 4 |

ITR 3 |

|

2 House Property |

ITR 2A |

ITR 2 |

|

Partner having No Other Business |

ITR 3 |

ITR 2 |

|

Partner having Other Business |

ITR 4 |

ITR 3 |

EXPLANATION

Different ITR Form List for Financial Year 2016-17(AY 2017-18)

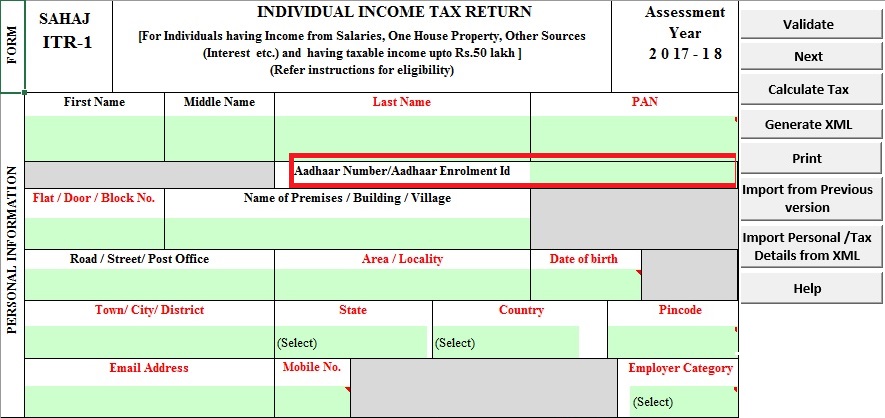

ITR 1 Form (ITR 1 Sahaj Form)

It is to be filled by Salaried Person having Salary Income/Interest Income/Income from One House Property

However, this ITR Form can only be filled if Gross Total Income is upto 50 lacs

ITR 2 Form

Those Salaried Individual Income who cannot file ITR 1 have to file ITR 2

Examples

- Having Income from More than One House property

- Having Capital Gain Income

- Having Total income more than 50 lacs

Note:-

Last Year in FY 2015-16(AY 2016-17), there were 2 separate returns

ITR2A – If Income from 2 property but not having Capital Gain or Foreign Asset

ITR 2 If having foreign asset or Capital Gain

Now ITR2A has been abolished

ITR 4 Form for Small Business (ITR 4 Sugam)

For Small business like Proprietorship and Partnership, there is no need to Maintain Books of Accounts

If turnover is upto 2 Crores, then fixed 8% of turnover is treated as Income directly under 44AD

Similarly there is 50% Scheme for Professionals if turnover upto 50 lacs under 44ADA

Similarly for those in truck business, there is 7500 pm Scheme under 44AE

Such schemes are called Presumptive taxation Scheme

These business have to file ITR 4

Note:-

Last Year in FY 2015-16(AY 2016-17) ,

These business had to use ITR 4S Forms, Now they have to use ITR 4 in this year

Also last year, Professionals like CA/Doctor could not opt for such presumptive taxation scheme

ITR 4S Form

This form was used for FY 2015-16(AY 2016-17) , in case of 44AD, 44AE business.

Now this form has been replaced by ITR 4 Form for FY 2016-17(AY 2017-18) .

ITR 3 Form

This is for those proprietorship/partnership who are not claiming 44AD/44AE/44ADA Scheme

Example

- Showing Profit less than 8% or Showing loss

- Having Turnover more than 2 Crore (50 lacs for professionals)

Note:-

They have to get compulsory audit from CA and file ITR 3

Last Year in FY 2015-16(AY 2016-17) , ITR 4 was applicable for such business

ITR 5

This is to be filed by Partnership not claiming 44AD/44ADA/44AE Scheme

In this case. They have to get compulsory audit from CA

Last Year in FY 2015-16(AY 2016-17) also same form ITR 5 was applicable

ITR 6

This form is for Companies (Private Limited and Public Limited Companies)

In this case, 44AD, 44ADA, 44AE Scheme is not applicable

There is compulsory audit from CA and ITR 5 is applicable

Last Year in FY 2015-16(AY 2016-17) also same form ITR 6 was applicable

ITR 7

This is filed by persons normally having exempt income like

- Trust

- NGO

- Political Parties

- Temples/mosques

ITR Form is same as last year

ITR Forms for Partners of Partnership Firm

If they have some other business, they have to file ITR 3

If they do not have any other business, they file ITR 2

Note:-

Last Year in FY 2015-16(AY 2016-17)

If they have some other business, they have to file ITR 4

If they do not have any other business, they file ITR 3

Other Notable changes in new ITR Forms for Financial year 2016-17(AY 2017-18)

1. Adhar Card is Now Made Compulsory from 1 July 2017

.jpg)

2.Details of Cash Deposit during Demonetization to be Mentioned