Form No for TDS Returns

| Type of TDS | TDS Due Dates |

| TDS Salary | Form 24Q |

| TDS Non Salary |

Form 26Q (if TDS Deducted of Residents) Form 27Q (if TDS Deducted of Non Residents) |

Due Date for TDS Returns

| Period | Due Date |

| April-June | 31 July |

| July-Sept | 31 October |

| Oct-Dec | 31 January |

| Jan-March | 31 May |

Same due dates for Form 24Q / 26Q /27Q

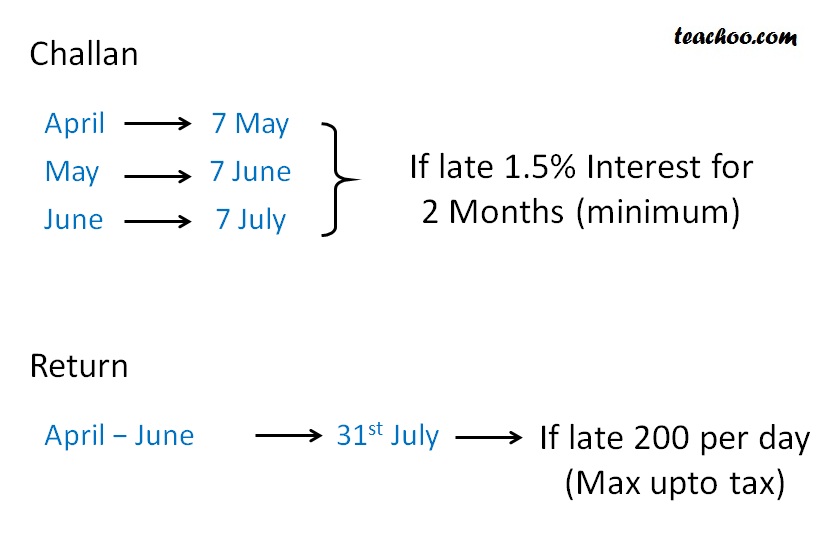

We know that TDS Return are to be filled as follows

| Period | Due Date |

| April-June | 31 July |

| July-Sept | 31 October |

| Oct-Dec | 31 January |

| Jan-March | 31 May |

Sometimes TDS Return is filed late

In this case Penalty of 200 per day is imposed

Penalty for TDS Return (April - June)

Penalty for TDS Return (July - Aug)

.jpg)

Penalty for TDS Return (Oct -Dec)

.jpg)

Penalty for TDS Return (Jan -Mar)

.jpg)

Note :-

This penalty cannot be more than tax involved

Written on Feb. 28, 2018, 12:03 p.m.