For make Sumary for GSTR1, GSTR3B and Tally Data, follow the steps

-

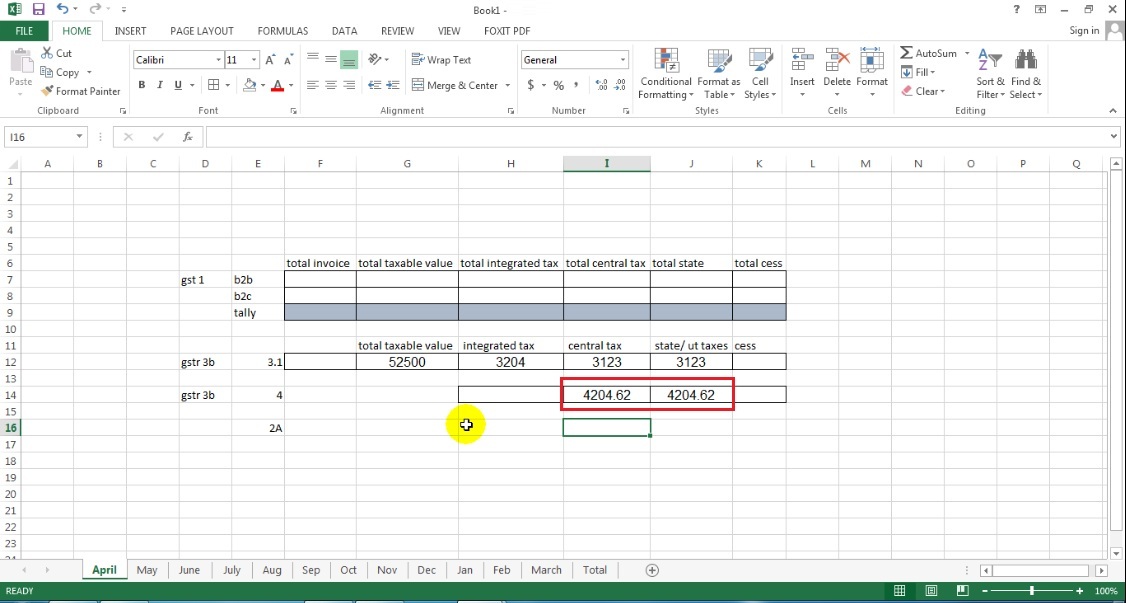

Make this type of data

-

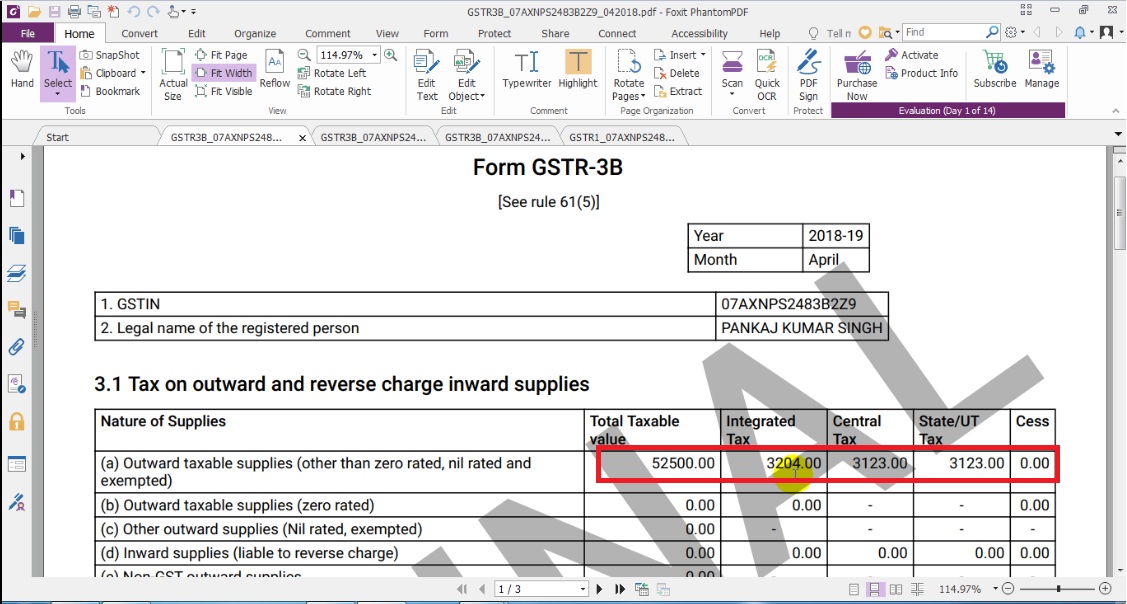

Open Form GSTR - 3B April

-

Copy values

-

Pasting on 3.1 row

-

Copy Eligible ITC values

-

Pasting on row 4

-

Again same procedure GSTR 3B with May

-

Again same procedure GSTR 3B with June month

-

GSTR 3B data April to June is filed in this format

-

Now we will open GSTR 1 (June) and Copy B2B and B2C Values

-and-copy-b2b-and-b2c-values.jpg)

-

We filed both row B2B and B2C

-

Now we will put formula

Press =

.jpg)

-

Go to April sheet and select 3.1 taxable value, then press

+ button

-

Go to May sheet and select 3.1 taxable value, then press plus button same with june then press

enter

-

Select row and press

control R

-

We will get value

-

Put tally values

-

Now Match the both rows