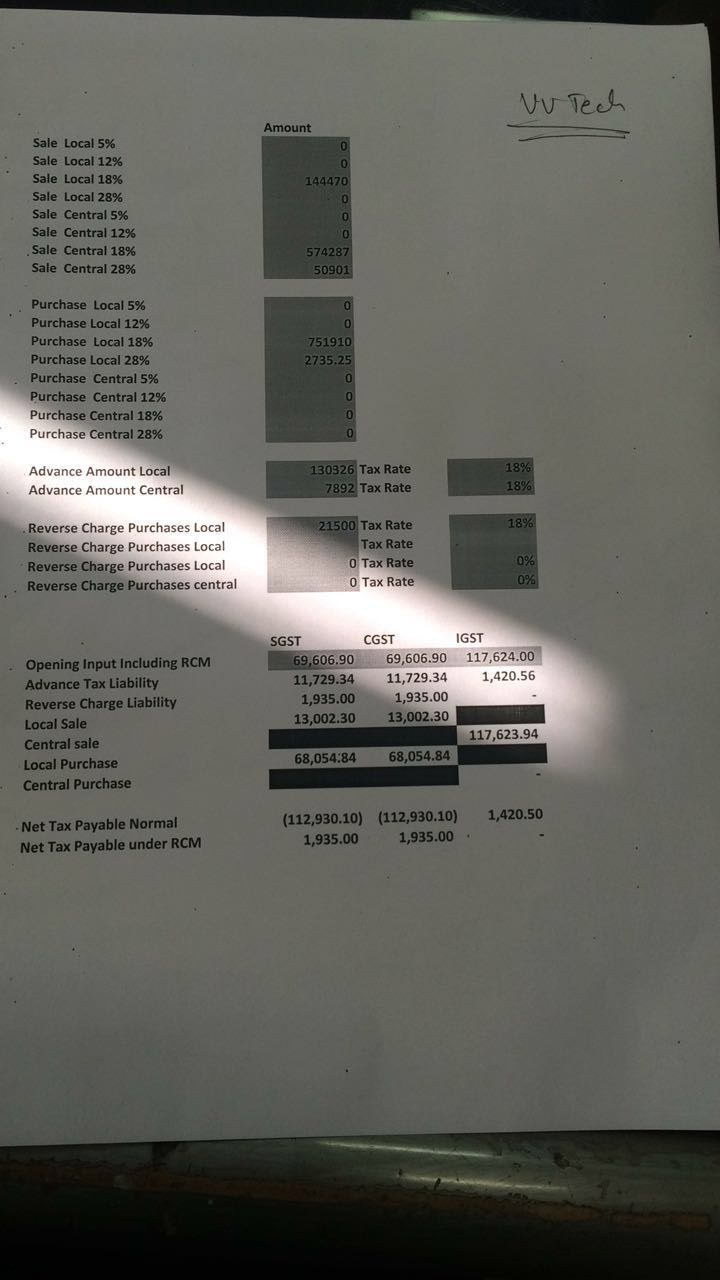

Sale Local 18% 144470 Sale Central 18% 574287 Sale Central 28% 50901 Purchase Local 18% 751910 Purchase Local 28% 2735.25 Advance Amount Local 130926 Tax Rate 18% Advance Amount Central 7892 Tax Rate 18% Reverse Charge Purchase Local 21500 Tax Rate 18% SGST CGST IGST Opening Input including RCM 69606.90 69606.90 117624 Advance Tax Liability 11729.34 11729.34 1420.56 Reverse Charge Liability 1935 1935 Local Sale 13002.30 13002.30 Central Sale Local Purchase 68054.84 68054.84 Central Purchase Net Tax Payable Normal (112930.10) (112930.10) 1420.50 Net Tax Payable under RCM 1935 1935 How Can I file this Entry return ka Data Hai August ka Sale Puri Ho Gayi Ha uske bad

Question

How to know? Suppose we have Cash A/c debited to capital A/c. Which one we have to entry under ledger?

Accounts Tax GST

Sept. 29, 2017, 12:47 a.m.

Answer

Sept. 29, 2017, 12:47 a.m.

Answer

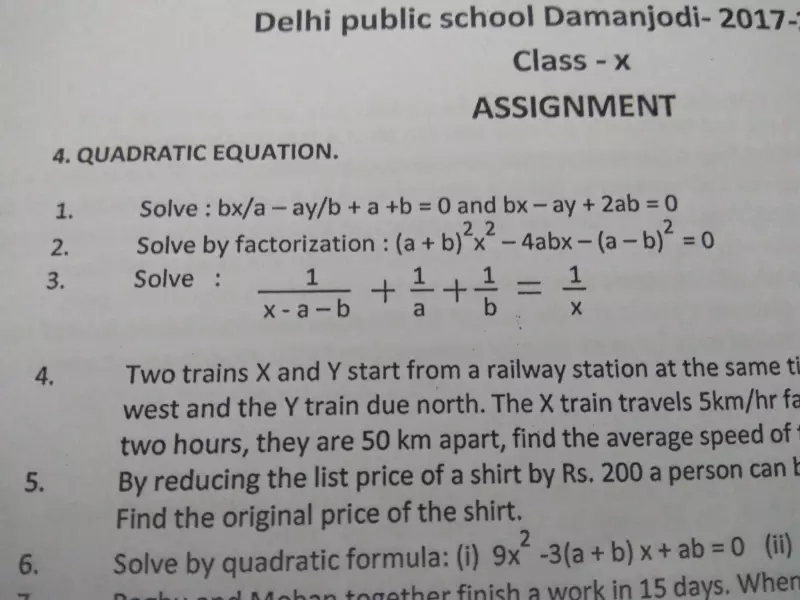

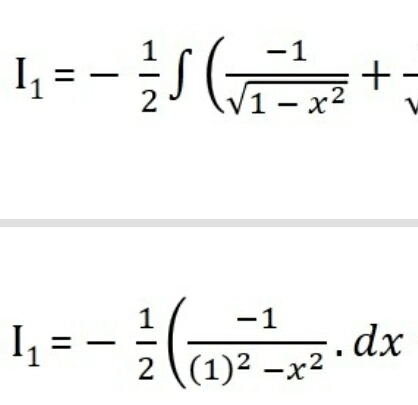

Please solve this question(7.6,9) by integration by parts (ILATE) it's urgent

Hi, i am having one doubt. In tally under which category we should maintain member welfare fund. Under liability side or income side?

Manufacturers, other than manufacturers of such goods as may be notified by the Government for which option is not available Suppliers making supplies referred to in clause (b) of paragraph 6 of Schedule II Any other supplier eligible for composition levy

Hii any one please tell me that vat excise and service tax we have to learn about it ?becoz it's showing in this app

by applying which formula or method you solve it?

by applying which formula or method you solve it?